Inside

|

Rahim Quazi and Munir Quddus compare Bangladesh's foreign investment levels with other countries in South Asia

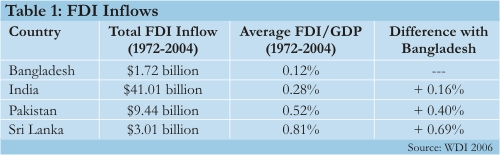

The annual foreign-direct investment (FDI) inflows to developing countries have jumped from $23 billion (0.7% of their combined GDP) in 1990 to about $211 billion (2.6% of GDP) in 2004. The South Asian countries, led by India, have also witnessed a massive rise in their FDI inflows from $0.55 billion (0.1% of GDP) in 1990 to $7.15 billion (0.8% of GDP) in 2004 (Source: World Development Indicators 2006, World Bank). There are four countries in South Asia (Bangladesh, India, Pakistan and Sri Lanka) that have benefited from high FDI inflows over the last several decades. But the figures reported in Table 1 below show that Bangladesh has lagged behind the other three countries in attracting FDI funds both in absolute level and as a share of GDP. A recent study by Unctad (World Investment Report 2005) published a ranking of 140 countries based on their potential and actual performance in attracting FDI. This study suggests that while Bangladesh has generally ranked below the other three countries in FDI performance, in terms of FDI potential Bangladesh has consistently ranked higher than Pakistan and Sri Lanka since 2000. It appears that Bangladesh faces some significant hurdles to achieving its FDI potential. This article estimates the determinants of inward FDI for these four countries, and attempts to identify, from the perspective of foreign firms, factors that can explain why Bangladesh lags behind the neighbouring countries as a destination of FDI. Investment Climate: Foreign Perspectives

Compared with foreign firms located in the three rival countries, foreign firms located in Bangladesh have to rely more on electricity generated from their own generators, face more delays in obtaining electrical connections (except Sri Lanka), and face more delays in obtaining mainline telephone connections. Furthermore, the percent of foreign firms identifying electricity and transportation as major business constraints is much higher in Bangladesh. These figures suggest that foreign firms perceive poor infrastructure to be a major hurdle for doing business in Bangladesh, which is consistent with results found in the econometric model that infrastructure is a significant determinant of FDI. A staggering 83% of foreign firms located in Bangladesh identified corruption as a major constraint (nearly three times as high compared with the rival countries). This is not surprising given that Bangladesh does hold the dubious distinction of one of the most corrupt countries in the world. Foreign firms located in Bangladesh also identified crime and lack of law and order as major business constraints. This negative image of Bangladesh as a corruption- and crime-riddled country is evidently taking a toll on its FDI inflow.

To finance investment and working capital, foreign firms in Bangladesh generally have to rely more on their internal resources and less on the financial markets (banks, stock market, etc). Foreign firms in Bangladesh also face problems in the forms of higher percentages of loans requiring collateral and higher value of collateral needed for loans. Furthermore, a higher percentage of foreign firms in Bangladesh (except in India where the percentage is somewhat higher) identified access/cost of finance as a major business constraint. Finally, a higher percentage of foreign firms located in Bangladesh generally identified tax rates and administration, business licensing and permits, customs and trade regulations, and labor skill level as major business constraints. These perceptions are consistent with results found in the econometric model that human capital (a part of which is labor skill) is a determinant (albeit marginally significant) of FDI. Despite the presence of several factors identified above that are not conducive to attracting FDI, Bangladesh does possess some factors that are favourable to FDI. Foreign firms in Bangladesh generally spend a smaller share of senior management time in dealing with requirements of government regulation, attend fewer meetings with tax officials, utilise modern technology (web and e-mail) more extensively to communicate with clients/suppliers and do not view labour regulations as a major constraint. The results found form the ES dataset discussed above are generally consistent with the findings of the Global Competitiveness Report 2008 published by the World Economic Forum. This report ranks 131 countries on a broad range of competitiveness indicators and shows that Bangladesh is generally ranked lower than its three rival countries (India, Pakistan and Sri Lanka) in terms of the overall index, infrastructure, financial market sophistication, training and health, and education. Therefore, findings from independent sources indicate that the locational disadvantage for Bangladesh in attracting FDI vis-à-vis other countries in the region can be largely explained by poor infrastructure, underdeveloped financial markets, and inadequate human capital. Recommendations and Conclusions

In a democracy, there are always elements in the political spectrum adamantly opposed to rapid liberalisation of the investment climate for foreign investors. The analysis in this paper shows that foreign investors are sophisticated and look for markets that are friendly for the long run security of their investments. The risk elements -- political instability and conflict must be controlled. An educated and skilled labour force is the key to success for attracting foreign investors. Therefore, adequate investment in education should become high priority. Private universities have done well to create some competition for the public institutions that have been hopelessly mired in politics. These educational institutions must be provided security and to the extent possible, protected from the forces of violence and instability. Bangladesh can learn a valuable lesson from India and China where an important source of FDI has been their expatriate nationals. The numbers for India are also impressive, but not nearly as large as for China given that the Indian policymakers until 2002 were not welcoming of their expatriate citizens. The lesson for Bangladeshi policymakers is to welcome the non-resident Bangladeshi (NRB) citizens, especially those interested in investment and business opportunities. It is clear, therefore, that there are many factors that drive the global flows of FDI. This information is important for policymakers and central banks to devise strategies to promote foreign investment and economic development. Given the intense global competition for these investment funds, there is much at stake not only for Bangladesh and South Asia, but also for developing countries as a whole. Rahim Quazi and Munir Quddus write from the College of Business, Prairie View A&M University, Prairie View, Texas.

|