Inside

|

Macro Context of the Budget Ahsan Mansur and Bazlul H. Khondker evaluate how various sectors will be affected by this year's budget The budget for the next fiscal year (FY10) has been announced. This is the first budget of the new government reflecting their election promises. This is also the first budget prepared against the backdrop of the global financial and economic crisis. These two issues make this budget a special one, and any assessment of the budget therefore must take these factors into account. Our focus here will be on the macro-economic setting; and the appropriateness of the policy stance of the budget. This article argues that while the expansionary stance is appropriate under the current sluggish macro-economic environment, major challenges lie in implementing the large investment programs envisaged under the Annual Development Plan (ADP) and the new initiative under public private partnership (PPP) arrangement. The possibility of crowding out of the private sector may also undermine the government's intended fiscal stance.

Macro-economic setting Projections suggest that overall economic growth during first half and second half of FY10 will be around 5% and 6%, respectively, leading to an average annual growth of 5.5 percent. During the last fiscal year agriculture grew at 4.6% -- which is almost 1 percentage point higher than its historical average of 3.6%. Following three consecutive bumper rice crops, agricultural growth is also likely to return to its historical average in the next fiscal year. Farmers not getting the right price for their most recent rice crop may also act as a negative incentive for higher agriculture output. Manufacturing sector performance is significantly dependent on export sector developments and thus indirectly on the health of the global economy. It is projected that the world economy would continue to struggle/shrink in the first half of FY10 before moving to a recovery phase. At this stage, both domestic and foreign demand for Bangladeshi products will be subdued due to slower growth in remittance inflows and lower demand for exports leading to a slower manufacturing growth (5 percent) in this half. The world economy is expected to enter into a recovery phase in the second half of FY10, which will contribute to a rise in overall demand (through higher exports and remittances) and a consequent rebound in manufacturing sector growth to 7 percent. A review of the growth projections of some neighbouring and emerging economies also supports government's cautious growth outlook for the Bangladesh economy. In particular, growth projections for FY10 compared to the pre-financial crisis period (i.e. FY08) are respectively 2 and 2.5 percentage points lower for India and Pakistan. The corresponding projections for China and Vietnam are respectively 4.5 and 2 percentage points lower. In this context, the projected slowdown in Bangladesh by 0.7 percentage point in FY10 compared to the pre-crisis year may even appear optimistic, essentially reflecting Bangladesh's better performance relative to others during the global meltdown. Expansionary fiscal stance may be undermined by implementation By setting the fiscal deficit at 5% of GDP, the budget aims to inject additional stimulus amounting to about one percent of GDP into the economy. This stimulus would largely result from the planned ADP and PPP spending. These two items in the budget together, if implemented fully, would amount to a 44% increase in government capital spending. From a demand management perspective, such a boost in spending growth would be most desirable since it would be easily reversible when the economy rebounds. In addition to boosting domestic activity, the planned spending (if executed effectively) will also help reduce the infrastructure gap and contribute to future growth potential.

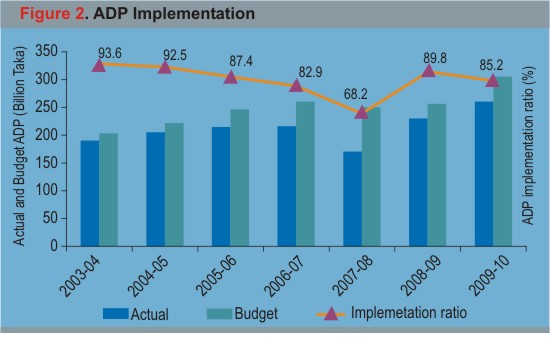

The challenge lies in effective implementation. In recent years, ADP implementation has always been much lower than its target. The size of ADP has declined by half in relation to GDP over the years. A review of the last five fiscal years' actual-against-targets suggests an average 15 percent shortfall in ADP implementation. The key factors contributing to the unsatisfactory implementation of the ADP are: (i) complex procurement policy; (ii) inadequate capacity of the implementing agencies; and (iii) a lack of proper monitoring of the agencies implementing the ADP. Because of these constraining factors, ADP utilisation has always fallen short of the target, and failed to grow in line with the growing needs of the economy. Certainly, this trend cannot be allowed to continue, and things must change on the implementation side. The government would need to re-examine the procurement policies and rationalise them as appropriate without compromising on the necessary safeguards. Efficiency of the government implementation ministries and agencies must be enhanced by strengthening their administrative capacity and accountability. Finally, close monitoring of the agencies implementing the ambitious ADP program would be needed for the program to reach its target level. Otherwise, actual ADP implementation would only be limited to around Tk 260 billion at the end of Fy10. Public Private Partnerships Recognising the limitations of traditional ADP-based approach for delivery of power and other infrastructure, the government has rightly embarked on the new PPP initiative. The initial allocation for this purpose is respectable at Tk 2,500 crore (about $350 million) and the government is committed to add more if needed. By leveraging private sector investment under various modes of PPP operations and risk sharing, if effectively executed, the program should be able to catalyse more than one billion in new investment. Effective and prompt launching of the program however would be extremely challenging. The major tasks would include: putting in place the proper regulatory framework either by revising the current Private Sector Investment Guideline (PSIG) of 2004 or enacting a new PPP Law; establishing the PPP Cell with proper institutional framework, manpower support, and resource base; and putting in place an appropriate tax incentive regime and viability gap funding mechanisms to attract private sector investment in the infrastructure sector.

Only after these initial steps are in place, the government would be able to attract private sector investment by addressing other important issues like: ensuring competitiveness and transparency in the bidding process, investment pricing and financing aspects, and careful matching between asset and liability and cash flow. The government has to develop technical capacity for reviewing the financial and economic viability of PPP projects because success will depend largely on aspects relating to costing, pricing and risk sharing. The legal framework would lay down the obligations of the private sector partners, allow provisions for cost recovery, and address compensation and redress mechanisms. Success will ultimately depend on establishing comprehensive policies and regulatory frameworks for competitive and transparent bidding, appropriate risk sharing and rewards, and dispute settlement mechanisms. Other challenges

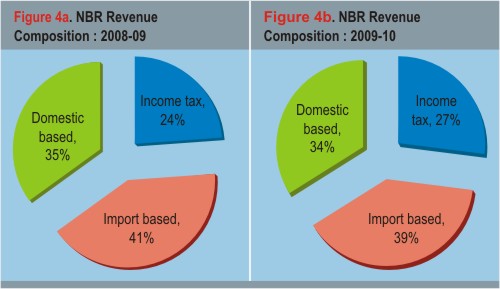

private sector borrowing. How realistic is the revenue target? In the coming fiscal year when the government needs the most revenue to cover its ambitious spending plans, revenue potential will be constrained by two factors: (i) growth in NBR taxes would be subdued due to lower import prices and the effect of slower economic growth, as it has already happened in FY09; and (ii) a lower non-tax base after adjusting for the one-time factors like a large transfer from the Bangladesh Telecom Regulatory Authority. Furthermore, domestic demand would also be less buoyant because of slower growth in remittance inflows. Accordingly, revenue growth should not be more than 10-12 percent, even with some measures to increase revenue. The budget aims to realise a higher proportion of tax revenue from domestic based taxes (i.e. income tax and domestic VAT), and that is appropriate from both short-term macroeconomic perspective and longer-term fiscal strategy. Accordingly, the budget expects to increase the share of income tax by 3 percentage points to 27%. This shift in emphasis would need to be sustained over a very long time, since at 73% the share of indirect taxes in Bangladesh is high, pointing to a regressive structure of the tax system. The budget, however, targets a 15% increase in NBR revenue. Although this may appear significantly lower than the growth rates set in the last five budgets, this target is ambitious under the prevailing macro-economic environment. In recent budgets, growth in NBR revenue was set between 17 and 19 percent and in almost every year (except FY08 due to special factors) growth in tax revenues fell well short of their targets by significant margins. Although the 15% growth rate set for the FY10 does not appear ambitious, it would be difficult to achieve due to falling import values in the first half of the fiscal year. Other factors like slower economic growth and the potential incentive for evading/hiding taxes to take advantage the 10% tax on undeclared/illegal income instead of paying taxes at much higher legal rates would also contribute to slower revenue growth.

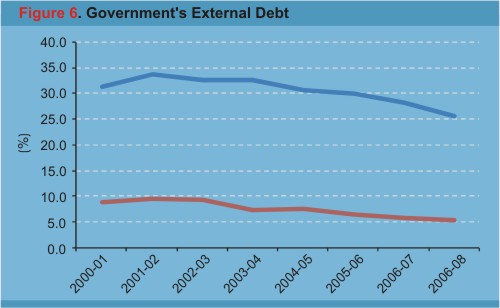

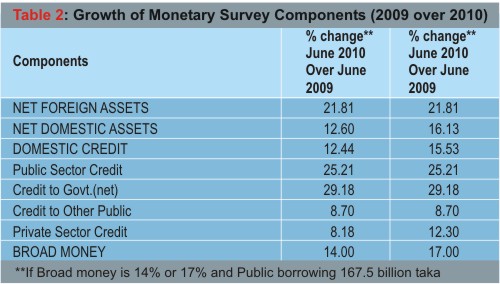

Crowding-out of the private sector Ambitious spending plans combined with an optimistic revenue target have accentuated the risk for the budget deficit to exceed the 5% of GDP target leading to a correspondingly higher borrowing requirement. A significant part of the budget deficit is expected to be financed from external sources, requiring the government to borrow $2.6 billion. In the historical context this external borrowing target is very high and any shortfall in realising this would also lead to a further higher borrowing requirement from the domestic banking system. Scenarios based on projections for monetary aggregates (Table 2) demonstrate that the large deficit financing from the banking system as envisaged in the budget would seriously limit the availability of credit for the private sector. Estimates based on 17% expansion in money supply (i.e. broad money M2), and allowing for government borrowing of Tk. 167.5 billion bank borrowing, would limit private sector credit growth to only 12.3 percent in FY10. This scenario essentially rules out Bangladesh Bank's ability to contain monetary expansion below this level in the event inflationary pressures accentuate.

It does not require much imagination for one to conclude that, in the event of a significant shortfall in external financing, the government would be forced to cut its spending plan. The key problems in mobilising the targeted external financing may be the government's plan to modify the current procurement rules/process, the increased degree of effective protection in the budget through regulatory and supplementary duties imposed on imports, and the privatisation policy.

We certainly would like to see the government successfully and effectively implementing the large spending plan envisaged in the budget. A repeat unfolding of the typical budget scenario/outturn should be avoided at all cost. A typical Bangladesh budget outcome is characterised as: setting a high revenue target, a high ADP target, and a fiscal deficit in the range of 3.5-5 percent of GDP. In the event, a large revenue shortfall is generally offset by lower ADP implementation, thereby achieving the target for overall budget deficit. Citizens of the country surely want to see Bangladesh shift from this vicious cycle of "unsatisfactory performance in ADP utilisation and tax revenue collection" to its emergence as a star performer in both domains in order to embark on a double digit growth path over the medium- and long-run. The government must do everything in its capacity to execute effectively the ADP and PPP plans and realise its revenue and external borrowing targets. Ahsan H. Mansur, Executive Director, Policy Research Institute. |

Possible policy reversals in the area of privatisation of public entities and the increased incidence of protection in the budget certainly run against the long-term interest of the country. The procurement policy, however, would need to be looked at with an open mind from all sides so that implementation of ADP improves while not compromising on the quality of spending. We hope that the government will be able to reach reasonable understanding with the donors on these important economic policy issues so that its external resource mobilisation target is not undermined.

Possible policy reversals in the area of privatisation of public entities and the increased incidence of protection in the budget certainly run against the long-term interest of the country. The procurement policy, however, would need to be looked at with an open mind from all sides so that implementation of ADP improves while not compromising on the quality of spending. We hope that the government will be able to reach reasonable understanding with the donors on these important economic policy issues so that its external resource mobilisation target is not undermined.