|

Cover Story

The Duty of Giving

When Islam was introduced in the Arab deserts thousands of years ago, it created quite a revolution. In

Islam has to be studied and interpreted properly. |

fact, it was the younger generation rather than the senior citizens that were more accepting of Islam. The religion brought forth a new set of universal values that would guide the believers on how to lead their lives, a way of life that would lead to peace and harmony in society. Over the centuries these dictates have been distorted by individuals trying to gain some advantage - political or personal, some have even killed thousands of innocents and continue to do so in the name of protecting the religion. Perhaps the most attractive aspect of Islam is the emphasis on being humane and giving towards fellow beings, something that most religions consider important. Zakat, considered one of the five pillars of Islam, incorporates the act of sharing wealth and giving and makes it an obligation of every believer. But misinterpretation and distortions have lead to confusion and sometimes-incorrect application of the rules of Zakat.

Elita Karim

Photo: Zahedul I Khan

In a nutshell, Zakat is an obligatory contribution which every wealthy Muslim is required to pay and / or distribute amongst the poor. It is said to be a practice of sharing one's wealth and a token of one's success with his or her neighbours and fellow human beings who are poor and needy. Sharing one's wealth, knowledge or skill with the poor and the needy has been an idea preached in almost all religions. In Islam this sharing has been made obligatory for a Muslim, in terms of Zakat, referring to purification or increment. Dr Shamsher Ali, the current Vice Chancellor of Southeast University and a religious scholar explains that the more you give to the people around you, the more you gain; “maybe not in tangible terms, but spiritually one gains a whole lot more,” he says.

Dr Ali quotes from Surah Tawbah (9:60) the eight categories of people who are eligible to receive Zakat the poor, the needy, people who have converted to Islam from other religions and do not have support in the society, those in debt, those who fight for the cause of Islam and Allah, the wayfarers, those who administer the giving of Zakat and prisoners. It is of course, how one interprets the categories, which is to be done properly and after careful investigation. For instance, those who, in the name of religion have caused mayhem in the country and murdered innocents clearly do not fall in the category of receiving Zakat. “There is no free lunch,” says Dr Ali. “Which is why those who have been hired to administer and manage the distribution of your Zakat are also eligible to receive Zakat.” In the case of giving Zakat to prisoners, he explains with an instance from the time of Prophet Muhammad (PBUH), when Belal was being tortured in the heat with a stone on his chest. Abu Bakr saw this and went to the authorities and offered to pay for Belal's freedom. “This is also considered a form of Zakat,” says Dr Ali. In fact Dr Ali also adds that non Muslims who are poor and in need are eligible to get Zakat. “If there are people in your neighbourhood, who stay hungry and deprived, all your nafal prayers will be of no avail,” explains Dr Ali, referring to the prayers which are not mandatory but are prayed all the same by Muslims. “When we define a neighbourhood, we also include our non-Muslim neighbours or fellow non-Muslims who are in need. Hence, one can pay one's Zakat to non-Muslims as well.”

Saris and lungis of cheap quality piled up in shops for Zakat.

Musammat Hanifa Begum, a mother of three children, had lost her husband as a young wife. She raised her two daughters and one son with the help from her family members and neighbours. After years, as her grown up children were being married off, she bought three pairs of gold earrings, a simple gold chain-necklace and a gold bangle for each of her child with the money that she had been saving up over the years. She assembled each piece of jewellery into a set and gave one set each to her daughters and her son's wife. For Hanifa, marrying her children off was probably not the end of her endeavours and worries. Her extended family members and neighbours pounced on her and demanded that she follow the Islamic law of paying a Zakat for the gold jewellery that she had bought. She didn't have anything left, explained Hanifa. She had spent the little bit of money that she had saved up for her children's marriage and now she had nothing to give. She herself was a person in great need, where would she come up with Zakat? Eventually, not being able to stand the regular bouts of verbal abuse from her in-laws, she sold the little possession that she had and gave it off as Zakat.

This is a regular story in Bangladesh and hundreds of others like Hanifa Begum are taken advantage of in the name of following an Islamic ritual or fulfilling one of the pillars of Islam. This blind acceptance of an idea, which is considered Islamic, without understanding the actual concept or significance behind it, has been causing meaningless conflicts and disputes between the so-called wise local religious leaders and people from all walks of life. Some local religious preachers, out of sheer ignorance, give a distorted concept of Zakat. On the one hand, the poor and low wage earners are forced to pay Zakat that they can barely afford, while on the other hand, many wealthy individuals pay much less than the stipulated amount or nothing at all.

According to the Holy Quran, an individual is bound to give Zakat, only if he has enough saved after fulfilling his daily obligations towards himself or herself and his or her family. “The individual will have to pay 2.5 per cent of his wealth,” explains Dr Ali. “That is, if an individual has a saving of Tk 10 lakhs, he or she will have to pay a sum total of Tk 25,000. An individual with a saving of Tk 10 crores, will have to pay a Zakat of Tk 2, 50,000.”

Paying Zakat in the right way will eventually eradicate poverty.

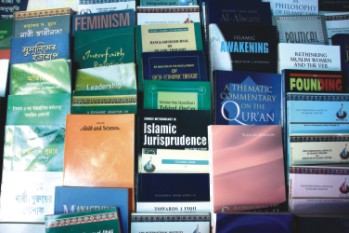

Paying Zakat is not really the issue, explains Dr Ali. There are plenty of rich and well-off families in our society who pay Zakat. “However, it is not paid in the right method,” he says. Many get muddled up with the calculations or according to him, do not bother about the significance of Zakat and give out cheap quality clothes and products to the poor.

Zakat paying is actually done with plenty of pomp and show. Affluent households in towns and villages invite the poor and the needy in and around their vicinities and give out saris, lungis and other forms of Zakat. In fact, in many of the shopping complexes and even in several shops selling apparels in New Market, a pile of saris and lungis are kept in one corner for customers to purchase for Zakat. These clothes are usually cheap and of low quality and are bought by many for domestic workers working in their respective homes. “This is absolutely wrong,” says Dr Ali. “We have to make sure that the food and clothes that we give our domestic workers are of the same kind and quality that we ourselves consume.” Not only does Islam obligate Muslims to do this, but it is a humanitarian step that one has to take using his or her common sense.

Dr Shamsher Ali |

Zakat, according to Dr Ali, needs to be viewed as a financial institution. The promises made by the leaders of this country to eradicate poverty are something of a fantasy now, or so thinks Dr Ali. “If we take the independence of India as a marker in history or the liberation of Bangladesh, we can see that all the developments in the country have not done anything to decrease poverty in the country for the last 30-60 years,” he says. “Still today, at least 50 per cent of our people live below the poverty line.” The gap between the rich and the poor, therefore, is increasing every day. “Mahatma Gandhi had rightly put it when he said that there is enough for everyone's needs, but not for everyone's greed,” says Dr Ali. “The Holy Quran preaches the same idea, to work honestly and take what one needs but greed simply destroys everything.”

According to Shamsher Ali, paying Zakat in a proper way can actually help in poverty alleviation in Bangladesh. “Of course, poverty simply cannot disappear in a matter of a year,” he explains. “It will take a little time, maybe a few years. However, it is a definite solution to eventually eradicate poverty from the country.” Dr Ali mentions the building of a Zakat fund which can be operated to help establish people in need. “At one time, there were only a handful of individuals and families who could be identified as earning in crores. But today, there are thousands of businesspeople in Bangladesh who earn crores on an average every year. Forming a Zakat fund for these businesspeople is not a difficult task. Moreover, this will also ensure the proper utilisation of Zakat.”

“There is a Chinese proverb which says that give a man a fish who wants to eat one, teach one to use the fishing rod if he wants to eat fish every day,” says Dr Ali. “Instead of giving out the low quality clothes to the poor and the needy, why not sponsor skill development programmes for them and buy them machinery or other tools to help them earn an honest living?” he poses the question. For instance, he says that in the form of Zakat, one might help a person in need to construct and establish a small grocery store, or buy someone a sewing machine. “The zakat can be arranged and paid in such way that eventually the person earning a living with the help of a sewing machine will be able to hire more people around and start some kind of a cottage industry,” he says. “This guarantees employment and is not very difficult for the rich to do if they are willing to. If each of the well off families in the country decide to help one such person in need of skill development, training, raw materials and tools every year, very soon, poverty will be alleviated in Bangladesh.”

The act of giving, helping the needy and sharing one's wealth are universal values encouraged by many religions. The idea of sharing one's wealth with the poor and needy to decrease the ever-growing gap between the rich and poor is attuned to the Marxist ideal of equality.

The infamous announcement of 'Zakater sari and lungi' in front of shopping complexes.

Zakat is the Islamic way of telling people that it is the moral responsibility of the wealthy and privileged to take care of fellow beings in society, thus making this a duty rather than the voluntary act of charity which is also encouraged but not made mandatory as with Zakat. Dr Shamsher Ali says that we as a nation have to explore new technology and an easy way to survive with confidence and dignity. He mentions an instance stated in a hadith, where a poor man had gone to the Prophet (PBUH) and asked for alms. The Prophet (PBUH) asked the man about his possessions. The man replied that all he had were a few clothes. The Prophet (PBUH) asked the man to sell the clothes and buy an axe. He could then use the axe to cut wood and earn money. “Here the axe signifies technology,” interprets Dr Ali. “Similarly, we have to use our resources to explore new technology and stand as an independent and dignified nation in front of the whole world.” Shamsher Ali further says that if Zakat is administered and paid in a proper way, in no time will our country be able to fend for itself. “We will not need the IMF or the World Bank to lend us money,” he says. “We will be able to live with dignity by building a strong platform for ourselves.”

Copyright

(R) thedailystar.net 2009

|