| Home - Back Issues - The Team - Contact Us |

|

| Volume 11 |Issue 24| June 15, 2012 | |

|

|

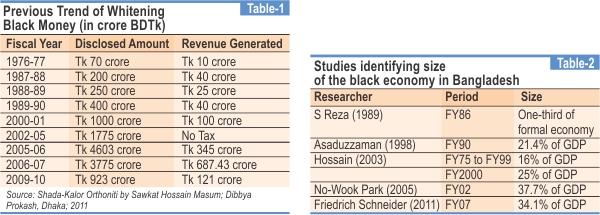

Economy White Money: Black Money Asjadul Kibria Ignoring all urges and arguments, finance minister AMA Muhit makes the provision to legalise undisclosed incomes more flexible. The budget for the next fiscal year (FY13) provides an opportunity to bring almost all previous undisclosed incomes under the tax net. The provision is popularly dubbed as whitening the black money. Interestingly, in his 150 plus pages budget speech, Muhit doesn't mention even a single word regarding the provision but skillfully keeps it in the finance bill. So, at first it is not possible for anyone to understand that such a tax scheme is there. And as the finance bill is written in legal-technical term, it is also very difficult for most people to understand the meaning of any provision. In brief, the provision provides a scope to legalise previously undisclosed income by allowing a person to pay applicable income taxes along with a 10 percent penalty. The rate of penalty is 10 percent of tax proportionate to such income. For instance, if somebody wants to legalise Tk 15 lakh he earned five years back, but didn't show in his income tax return, first the applicable income tax for that income has to be determined. Then a 10 percent penalty will be imposed on the tax. In this case, if the person's income tax, according to tax-slabs, is Tk 3 lakh, he has to pay an additional Tk 30,000 as penalty. The actual calculation is, however, more complicated. Whatever the method of calculation may be, the main question is necessity and rationale for such room to legalise the undisclosed money. The arguments placed by finance minister as well as the government to justify the measure are highly misleading and ill-conceived. Moreover, if the finance minister believes that such a measure is right and valid, why does he skip it in his budget speech?

In his post-budget press briefing, the finance minister claims that such a measure would bring investment and prevent cash from going out of the country. He also states that the amount of undisclosed money in the economy is something between 41 and 82 percent of the country's gross domestic product (GDP). In his language, ‘We have given scope to bring the undisclosed money to the market because we want the undisclosed money invested in the economy. We want to utilise the money.' Such claims actually reflect an inadequate understanding of the nature of black money. The mentioned estimate of black money in the country is also very misguiding. The huge range from 41 to 82 percent itself is enough to illustrate that the figure is untrustworthy. How can a responsible finance minister depend on such a figure? No doubt that estimating the amount of black money is very difficult. But, before doing so, one has to have a clear conception of black money and the nature of its holding. To be precise, black money is actually earnings that evade applicable tax no matter whether the earnings are legal or illegal. Actually, incomes that originate from illegal activities (i.e. smuggling) and practices of corruption (i.e. bribe) have no valid reason to come under the tax net. Such incomes are by nature meant to dodge tax. On the other hand, incomes from approved activities are subject to tax. When anyone keeps any such income undisclosed to tax authority, it becomes undisclosed or black. For instance, when a physician doesn't show his/her full earnings, originated from private practices, in his/her income tax return, the said amount actually turns into black money. Such income is not illegal as he/she has government approval for private practice. So, despite having a legal source of income, any one can make his/her income undisclosed or black by evading due taxes.

Now the question is, where are all these black money held. As M A Taslim and Ahsan H Mansur explain: 'Black money may be held in the form of (a) financial or real assets in the country and/or (b) financial or real assets overseas.' (Black Money & Investment-Unpleasant Economics by M A Taslim; p.66; Jagriti Prokashani, Dhaka; 2010.) Thus black money is not kept in cash in a secret vault in a house, drawer or under the pillow. It is already invested in the economy in several forms. The money holders purchase land, apartments or gold; or invest in bond and shares or stocks; or deposit with banks; or even purchase dollars. The difference between the actual purchase value and the deed value of a land is a clear example of holding black money as a form of real assets. Thus, a big portion of the country's black money is already invested in different forms. One should also keep in mind that income has two components – consumption and savings. It is almost impossible to keep savings idle without investing it in any form. It is the basic economics identity (Y=C+S=C+I). Surely rest of the portion has transferred to other countries in different legal and illegal ways. Now, it is usually transferred to those countries where it is safe to keep. For example, Malaysia and Dubai have legal safeguards for such illegal or undisclosed funds. These funds are also invested in overseas real or financial assets. According to the Global Financial Integrity report, illicit financial flows from Bangladesh are some US$13,976 million during 2000-2009 period. So, the argument of our finance minister that he wants to bring all or at least a good portion of black money into mainstream economy through investment is not valid. Almost all the black or undisclosed money is already invested in the national economy or overseas. By allowing the legalisation of the undisclosed money, the mode of investment may be changed. One may invest into stocks or bonds by selling gold, for instance. Actually, huge amounts of black money is already accumulated by different quarters closely allied with the incumbent government. Now they need some legal protection of their illegal and undisclosed incomes. The finance minister is giving that protection. And definitely a good amount of black money will be invested to set up new approved commercial banks. But such a practice actually goes against both economic rationale and moral standards. It will be very disappointing for regular and honest tax payers. Previous record shows that a very small amount of black money is actually whitened by using tax amnesty allowed by several governments. Another gray area is the amount of black money in Bangladesh. The finance minister's estimate is vague indeed. Several studies, conducted by both local and international economists during the last two decades, revealed that the size of the underground economy ranged between 21 to 38 percent of Bangladesh's GDP. An underground economy is the reflection of generation, flow and activities of black money. Friedrich Schneider, Professor of Johannes Kepler University of Linz in Austria, is one of the few economists around the world at the forefront of efforts to measure the underground economy. His latest study reveals that around 36 percent of the Bangladesh's economy consists of underground activities. In the last month, Indian finance minister Pranab Mukherjee has tabled a 97-pages white paper on the country's black money in the national parliament. Although the paper did not mention any names or provide an estimate of such funds within and outside the country, it pointed out where the money is parked and suggested some legal measures to detect existing black money and also curb the future flow of black money. A M A Muhit should follow such an initiative before allowing a wholesale opportunity to legalise undisclosed income or whiten the black money. The writer is the business page editor of Prothom Alo and can be reached asjadulk@gmail.com

|

||||

Copyright

(R) thedailystar.net 2012 |