| Home - Back Issues - The Team - Contact Us |

|

| Volume 11 |Issue 37| September 21, 2012 | |

|

|

Cover Story A Question of Public Trust The Hall-Mark loan scam raises questions about the efficiency and accountability of state-owned bank and whether any policy changes are required to retain public trust in the country's banking sector Md Fazlur Rahman and Tamanna Khan

Banking scams are not new, especially not in Bangladesh where corruption and a default culture are rampant. Yet we squirm in our seats when we hear Tk 36 billion being siphoned out from the largest bank in the country, Sonali Bank Limited, a brand name symbolising trust because of its full government ownership. Loans were given out to little known entities from the Ruposhi Bangla branch of the Bank, defying all lending procedures and norms. Although irregularities came to the notice of the bank's audit team in 2007, no action was taken by the bank manager. A number of attempts to inspect the branch activities were also stalled by the top management of the bank. The scam became public when other commercial banks complained to the central bank about Sonali Bank's failure to pay its dues to other banks. In view of the situation, Bangladesh Bank recommended reconstituting the Sonali Bank's board of directors, comprising of eleven members, all appointed by the government. However, the board refused to take responsibility for the loan scam. On the other hand, economists and civil society members opine that the board cannot shy away from taking responsibility. Dr Salehuddin Ahmed, former governor of Bangladesh Bank, says “In ordinary companies, the board of directors and management do not meet very frequently. But financial institution's board of directors meet with management almost every week.” Major loan approval, rescheduling, findings of audit reports, all are discussed by the board. He adds that since commercial banks also have an audit committee comprising of board members, plus an asset and liability committee (ALCO), such irregularities could not have surpassed the board's notice. He says, “I have a hunch that they [the board of directors of Sonali Bnak Limited] knew it. They tried to conceal it.” The possible involvement of political figures in the scam came up in the Anti-Corruption Commission's probe. Regarding political influence in state-owned banks and its board of directors, Dr Ahmed says, “In all the state-owned commercial banks there should not be any people who are directly involved in politics.” He adds that individuals may subscribe to a certain political philosophy but that should not be reflected in their professional functions. However, in our country positions in the state-owned commercial banks are mostly given on political consideration. “These people come with a political agenda and they try to influence banking functions to do some favours. These people also have political masters or seniors. Those people on the board have political ambition to climb up. They gradually become a MP. So they like to please their political masters who are outside,” he says, adding that it becomes difficult for management to work with integrity and independence under such political pressure. Section 46 of the Banking Companies Act has limited Bangladesh Bank's (BB) power with respect to state-owned banks. BB cannot dissolve or reconstitute the board of directors of state-owned banks, remove the chairman or the managing director, although BB has the power to do so to private banks. Dr Ahmed believes that such a limiting clause should not exist. Khandker Ibrahim Khaled, Chairman of Krishi Bank of Bangladesh, says, “The government should amend the Banking Companies Act to delegate the same power to the central bank with respect to both state-owned banks and private banks." He adds, "No two laws could prevail in a country.” Dr Iftekharuzzaman, Executive Director of Transparency International Bangladesh, also agrees with this view. Criticism about the existence of the banking division in the Ministry of Finance (MoF) has also surfaced. Giving examples of other countries Dr Ahmed says that he does not know of the existence of any such parallel bodies in the banking sector anywhere in the world. Khaled too says that the banking division of the MoF should be disbanded. An advisory council could be formed, comprising of noted banker, economists and professors of the country. This team will give advice and will not be involved in the day to day affairs.

A small wing of the finance ministry will own the banks, he suggests. Professionals should be given charge of the banks and they should be allowed to work independently. At the same time, they should be liable for their actions. Renowned economist, A B Mirza Azizul Islam, former adviser to the caretaker government, says that when the banking division was first created he was opposed to the idea. “I said it is unnecessary. I still maintain the position because the responsibility of the banking sector should rest entirely with the central bank.” He says, as a caretaker government adviser, he took the initiative to corporatise the state-run banks. “Still, the government can manage the banks as if they are corporatised banks, where the management will work independently and professionally. If this can be ensured then the chances of irregularities will go down.” He adds that the government might think of divesting minority shares of up to 49 percent and can hold the remaining 51 percent to establish internal checks and balances in the banks. “Then the board will have directors elected by private shareholders also. Then there will be another check and balance in the system.” Besides, bringing the state-run banks under the supervision of Bangladesh Bank, Dr Ahmed calls for full autonomy of the central bank, as it is enjoyed in other countries of the world. Giving example of the United Kingdom, he says, “In Bank of England, the governor is appointed by the government. He is not answerable to the Ministry of Exchequer, which is UK's finance ministry. He is answerable to the parliament directly. That is how he is free from any kind of political bias or pressure.” He suggests that in Bangladesh too, “Appointment of governor should be free from political pressure. It should be guided through constitutional process.” However, as an immediate measure to prevent such scams from happening again, all the four experts emphasise on the need to first bring the perpetrators to justice. Khaled points out that no case has been filed yet against any of the perpetrators. “We have learnt that the Anti Corruption Commission is investigating the issue. As no case is yet to be filed so it seems that neither the bank nor the ACC has completed the process to identify people responsible for the scam to sue them. Even if they have done that they are probably still confused because there might be some influential figures behind the scam.” Khaled, who led the stock market probe team that unearthed irregularities in the sector, observes that a lot of public money has been swindled. As a result, people's trust is involved here. “Through the scam criminal offences have been committed and the perpetrators have to be punished. We have seen in the past that nobody has been punished for small or large criminal offences in the banking sector. They got away with the crime. As a result, people get encouragement to get involved in this type of scam. As a result, the incidents of scam in the banking sector are increasing.” He suggests that the elite force Rapid Action Battalion and other intelligence agencies should be given responsibilities to take these people to remand and unearth the real story behind the scam. In a similar note, Dr Iftekharuzzaman says that though realisation of the money is important, investigation should be initiated to find out the role of other regulatory bodies in it. He asks whether or not the National Board of Revenue should have checked the tax returns of Tanvir Mahmud, director of Hallmark, one of the five fraudulent companies that amassed a huge amount of wealth in a very short period. Even the land authority should have probed allegations of illegal grabbing of khas land by the company. Dr Iftekharuzzaman believes that departmental actions against Sonali Bank officials involved in the scam is not enough rather criminal procedures should be brought against them. Regarding the top management, he says, “Even if it has taken place without the connivance of top management that also indicates the failure of management. You are supposed to ensure that this kind of large transaction takes place with the knowledge of the top management and even the board.” He expected the board of directors to take responsibility for the scam and step down voluntarily on ethical grounds. “They should have created a situation that they could be investigated in due process without being influenced by any quarter,” he adds. For the longer term perspective, Dr Iftekharuzzaman suggests, “Government should constitute a high-powered independent commission to investigate into the whole issue of the functioning of the state-owned commercial banks, their efficiency, their standards and principle of operations and particularly creating sufficient checks and balances to prevent this kind of situation in the banking sector.” He however notes that the members of the commission should not come from the ministry of finance or any of the state-owned banks or neither from Bangladesh Bank. Tk 36 billion is proportionately small when one considers Tk 4 trillion total lending portfolio of the country's banking system. However, Islam points out, “It is a significant part of Sonali Bank's lending portfolio. It is a significant part of the overall classified loans of the banking system.” He says that events like this can cause erosion of trust in the banking system. “If that happens it would be dangerous because that would impede the flow of deposits into the banking system, which in turn would reduce the capacity of the bank to lend and would have a negative impact on investment, growth and employment.

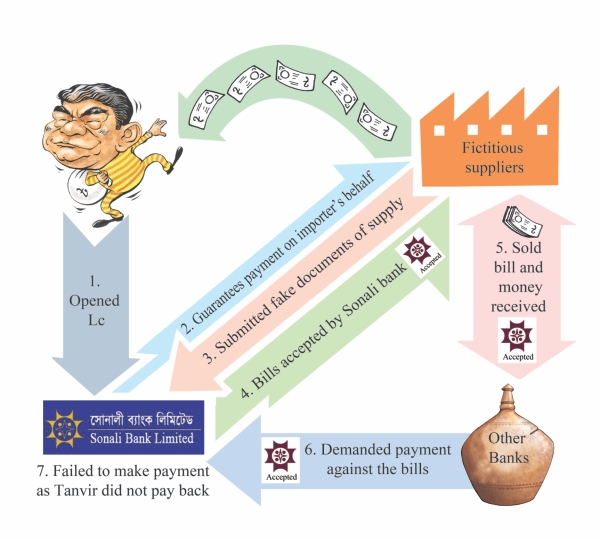

Looting through Loans Tanvir Mahmud, Managing director of Hall-Mark group did not use a gun to rob a state-run bank of Tk 26.8614 billion. He took loans; yet what makes him stand out as a defaulter is the way he used bank's regular lending practices to siphon money out of 28 banks in the country. Interestingly, Tanvir's pocket became full at the expense of Sonali Bank reputation as he successfully sold the state-run bank's brand name in bagging money from other private and state-run banks. Thanks to him most of us have been introduced to different banking terms for the last couple of months such as Letter of Credit (LC) and Inland Bill Purchase (IBP). Both of these are loan products used to fund international and also local import-export business. LC for instance is the guarantee banks give to exporter to pay on behalf of the importer. In trade, an exporter may not trust an importer to pay bills upon receipt of the goods ordered. He asks for advance payment. On the other hand, an importer may not want to pay before receiving the goods. Thus a bank mediates by promising to pay the export bill on behalf of its client the importer. However, the ultimate liability to pay the export bill falls upon the importer, that is, the importer has to return the money to the bank. So LC is a kind of loan used by importers worldwide to finance the import. Upon receiving a LC (the guarantee of payment) from the bank, the exporter delivers the goods. He then submits all relevant documents showing proper delivery of goods, as required in the LC terms. The bank confirms the authenticity of the documents and makes payment to the exporter and later collects the amount (often with interest) from the importer.

However, such a normal regular lending practice goes haywire, when the importer is a conman and the LC issuing bank, the bank that originally offers the loan, does not abide by any lending rules. Former banker Mamun Rashid, Professor and Director of Brac Business School explains how exception of all existing lending rules and norms has been made in the recent banking scam. He says that there was “absence of proper risk appraisal, risk rating on the client, risk grading, risk approval, loan disbursement, security, collateral and loan recovery.” For loan appraisal, Rashid explains, a bank needs to know its clients, his business turnover, group turnover, nature of the business etc. In Tanvir's case, it seems, his only assessment was political consideration. According to audit reports total negligence is evident in the entire process starting from loan appraisal to recovery. There was hardly any security collateral provided by Hall-Mark to avail the loans and those provided were mostly overvalued or fake. Against these fake security collateral documents, Tanvir opened local LCs worth Tk 5 billion at the Ruposhi Bangla branch of the Sonali Bank to buy yarn from Anwara Spinning Mills, Max Spinning Mills and Star Spinning Mills. The three spinning mills were fictitious. Thus there were no actual delivery of goods and the supply documents submitted at the Ruposhi Bangla Branch, were also fabricated. According to probe report it appears that the bank officials accepted the fake documents and disbursed the money to the account of the fictitious suppliers of yarn who in turn transferred the money to Hall- Mark's account, from where it went to another bank account of the group. When the time came for Hall-Mark to repay the Tk 500 crore loan, it defaulted.

Since both the accounts of the importer and the fictitious exporter were in the same branch of the bank, in the books asset (loan taken by Hall-Mark) and liability (deposit of money in the accounts of the three spinning mills) appeared to net off. “Anwara Spinning Mills's bills were discounted by Sonali Bank itself, while the importing client was Hall-Mark and Hall-Marks's client was also Sonali Bank. They thought they were netting off. Liability and asset zeroing. But basically Hall- Mark, also the owner of Anwara Spinning Mill took away the money. Ultimately the beneficiary was Hall-Mark. So, in the book liability and asset was netting off but practically it never netted off,” explains Rashid adding that it happened because Hall-Mark never paid the loans and there was a past due. “Hall-Mark took the money to buy land, Pajero or siphon it off abroad. Therefore there was recurring past due on the account of Hall-Mark,” he says. “There was an overdue of Tk 2,686.14 crore on account of Hall-Mark out of which Tk 1900 crore worth of bills were purchased by Sonali Bank and the rest by the 27 other banks,” he refers to a report published in the Daily Star. Purchasing inland bills is a common practice in India as well as China, says Rashid. He says that in India it became so rampant that they started discounting bills from any client and any bank, as it is considered very low risk. “You discount (purchase at a lower rate) on the basis of bank's acceptance and then you earn a lot of interest.” This assurance that the LC issuing bank will pay-off the bills on due date also led the other state-owned and private banks to get involved into this scam. For instance, Janata Bank Limited purchased bills of Anwara Spinning Mills and Max Spinning Mills, against LCs issued by Sonali Bank's Ruposhi Bangla Branch for its client Hall- Mark Fashion Ltd and its interest-linked company. Upon receiving payment Anwara and Max withdrew most of money. However, Ruposhi Bangla branch failed to make payments to Janata Bank and some of the bills still remain overdue.

Twenty-six other banks faced similar situation purchased IBPs carrying Sonali Banks's acceptance. According to Rashid, it is the overall laxity of lending manager towards bank risk that gave rise to such huge amounts of overdue bills. These banks relied on Sonali Bank's guarantee to make payments to the bills. Referring to other recently uncovered scam where forged signatures were found on accepted bills, he argues that before purchasing the bills carrying Sonali Bank's acceptance, the bank officials of other banks should have verified the signatures. Currently, the bank to bank transaction and information sharing regarding issuance of local LCs and bill acceptance and purchase is done manually. Dr Salehuddin Ahmed, opines that had these transactions taken place electronically, such forgery would not be possible. “Had the transfer been through the SWIFT account then it could have been a difficult one,” he says. SWIFT (Society for Worldwide Interbank Financial Telecommunication) provides banks with a unique code for bank to bank message delivery and fund transfer replacing the need for manual signature verification. Regarding taking exposure on a single bank, Rashid says that other banks should have set up a limit on the purchase of acceptance bills of a particular bank; they should have asked the crucial question “Can Sonali Bank go on giving acceptances like this?” A recent report in The Daily Star shows that about 40 banks' unpaid amount against acceptance bills stood at around Tk 29.76 billion as of June 30, 012. It means 40 banks in the country owe this amount to other commercial banks that purchased these bills from their export clients. The report says a portion of this amount remained due to complaints of false documentation and faulty accepted bills against local and foreign LCs — the same irregularity that happened in Hall-Mark scam. Criticising lending institution's current practice of purchasing IBP, Rashid questions, “Can another counter-party bank keep on discounting inland bill and payment liability and pay to the exporting client without verifying the sanctity of the transaction or without taking a particular limit?” He says that Bangladesh Bank does not have a guideline for risk appraisal of IBP.” However, many of the foreign commercial banks in the country have their own guidelines for risk appraisal of IBP, he informs. He points out, “In international markets, the best practise will tell you that even banks should be treated as a counter-party risk. We should only take bank risk based on its capital, its asset quality, its management integrity or quality, profitability and liquidity.”

|

||||||||

Copyright

(R) thedailystar.net 2012 |

Sometimes, depending on the LC type, the payment terms can be deferred that is importer or the LC issuing bank pays say after three or six months from delivery of the goods. In that case, if the exporter needs the money immediately, he can sell the accepted LC documents (carrying the acceptance seal of the issuing bank, thus guaranteeing payment after the stipulated time) at any lending institution. Banks often buys these bills from their clients at an amount less than value of the LC, which is called bill discounting or IBP. Banks do so because lending officers rely on the guarantee that the LC issuing bank will make payments upon arrival of the due date.

Sometimes, depending on the LC type, the payment terms can be deferred that is importer or the LC issuing bank pays say after three or six months from delivery of the goods. In that case, if the exporter needs the money immediately, he can sell the accepted LC documents (carrying the acceptance seal of the issuing bank, thus guaranteeing payment after the stipulated time) at any lending institution. Banks often buys these bills from their clients at an amount less than value of the LC, which is called bill discounting or IBP. Banks do so because lending officers rely on the guarantee that the LC issuing bank will make payments upon arrival of the due date.