Inside

|

Inflation and price fixing

While watching the news on a cable TV channel recently, I came to know about a few arrests made by the authorities for price fixing. The questions that automatically came to mind were: How may these arrested persons be brought to justice? What legislation in Bangladesh deals with price syndicates? Price fixing This article looks at the relationship between price fixing and inflation. In particular, it sheds light on the legislation relevant to the issue. What exactly is this legislation? The law refers to it as a "deeming" provision. Under such clauses price fixing is prohibited per se, that is, no matter what. The obsolete law The MRTP Ordinance 1970 (PC vol17 pp.508-523) was written under martial law 37 years ago, and some of the clauses make no sense in today's context. As it stands today, the ordinance is as good as obsolete. Interestingly, the price fixing under collusive agreements between competitors was prohibited even in that ordinance. If the ordinance is still operational, price fixing is theoretically still prohibited under it: "Unreasonably restrictive trade practices shall be deemed ... If there is any agreement between actual or potential competitors for ... fixing the purchase or selling prices or imposing ... with regard to the sale or distribution of any goods or services." However, it is limited by a few exclusion clauses drafted in old US anti-trust metaphors. If it were a part of any comprehensive national competition legislation today, as mentioned earlier, the exclusion clauses would not have been there. As we can see, the concept of a competition policy is no stranger to us. We just need to revisit it and put things into perspective, in particular, with regard to its relationship with the current situation.

The inflation debate The point to clarify here is that the excess money supply is definitely the largest contributor to the inflation that we are faced with. Therefore, no matter how well you handle the structural nuances, it will remain as the major problem. However, the reverse argument is also true. That is, even if you manage the monetary policy well, you need to rectify your market structures sooner or later. The two issues are very much independent in nature; while one relies on the central bank and its policies, the other relies on legislation and their proper enforcement. On the other hand, external shocks are part of any modern, open economy. It is very difficult to predict them, and it is even more difficult to insulate a market from them. This makes the structural issue and the competition policy all the more relevant to the anti-inflation campaign. The main legislation The idea behind RTP is simple. It is assumed that competition is beneficial to market allocation and productive efficiencies, thereby reducing prices. This leads to obvious benefits to the consumer. However, given the chance, some businesses tend to monopolise the market in search of higher, or supernormal, profits, as in the case of our price syndicates. RTP legislations prohibit such behaviour. The Sherman Act 1890, proposed by Senator John Sherman and enacted by President Benjamin Harrison, was the first of its kind, and stated: "Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several states, or with foreign nations, shall be deemed guilty of a felony …" There are basically three types of RTPs which affect the market: The economic benefits from prohibiting vertical acts are intuitively less clear than that of the horizontal acts. Therefore, as far as we are concerned, the focus should be on horizontal acts or collusive behaviour among competitors only. This move will serve two purposes. Firstly, it will address the issue of price fixing directly, which after all is the order of the day. Secondly, bringing in the prohibitions against collusion will also serve as an "introducer" to the public, for the legislation may be difficult to comprehend at first. We have to understand that, in a country where killing of the innocent go unheeded at times, the niceties of the Sherman Act may not be appreciated overnight. However, the other categories cannot be pushed under the table. For example, the time for dealing with mergers and acquisitions may arrive sooner than we think. What if tomorrow one of our cell phone companies wanted to take over one or more of its competitors? Should the government allow it?

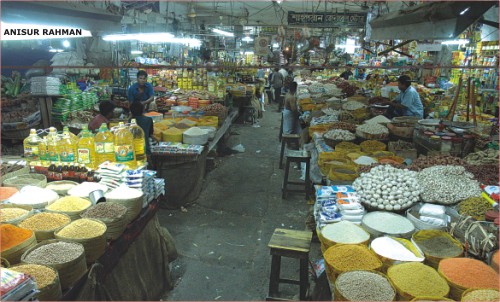

An important by-product It is assumed that a certain behaviour, called "unconscionable conduct," is responsible for higher prices. As far as we are concerned, it involves unscrupulous or immoral behaviour within the supply chain of our market. It may occur at the very beginning, when the product moves on to the suppliers (middlemen in our case) from the producers. It may also take place at the other end, in the market place, were sellers take advantage of the weaker bargaining power of the buyers. It was very encouraging to see that the Consumer Association of Bangladesh (CAB) had pushed a legislation called Consumer Protection Act 2000, which actually incorporated the points mentioned above. The draft proposal also identified that our supply chain problems have a certain "Bangladeshi flavour," hence, they should be handled accordingly. But where is CP Act 2000? It is already the middle of 2007. For the reasons mentioned below, as far as CP is concerned, time is of the essence. Tip of the iceberg

For the reasons mentioned above, our government should introduce the legislations as soon as possible. We have to remember that enactment of the laws in this case is merely the beginning, and not the end, of the solutions. Conclusion However, to deal with the cartels and the unscrupulous conduct, one would need to use a firm regulatory hand ultimately. RTP and consumer protection is based on the reverse argument of "laissez-faire." The government just needs to get its direction right. These are cases of market failure, and to rectify the situation the first thing that is needed is comprehensive competition and consumer legislation. And it is also vitally important for our national interest that the new law be an enforceable one. Niaz Murshed is a graduate in Economics, University of Pennaylvania and the first chess grandmaster of the sub-continent. |

Therefore, in our context, it is better to enact all of RTP together. However, enforcement should be selective. The horizontal prohibitions should lead the way; the other ones should follow according to need.

Therefore, in our context, it is better to enact all of RTP together. However, enforcement should be selective. The horizontal prohibitions should lead the way; the other ones should follow according to need.  In addition, jurisprudence must also be given time to develop and align itself with the idiosyncrasies of the enforcement. The situation in practice may be different from the one originally perceived in the legislation. Adjustments must be made to take care of loopholes.

In addition, jurisprudence must also be given time to develop and align itself with the idiosyncrasies of the enforcement. The situation in practice may be different from the one originally perceived in the legislation. Adjustments must be made to take care of loopholes.