Inside

|

What's In Store for a New Government? Jyoti Rahman runs the numbers

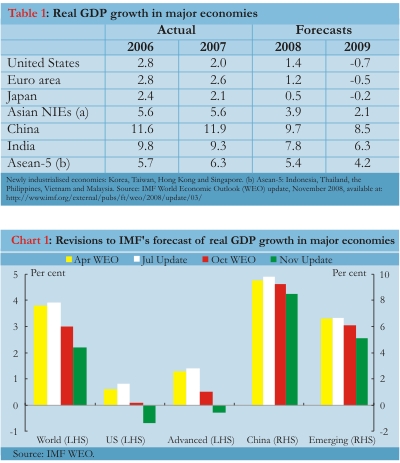

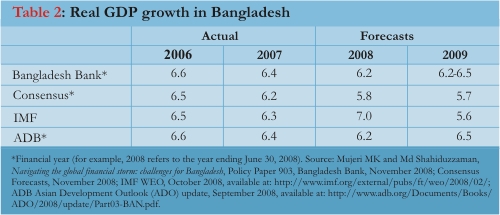

It is difficult to answer these questions, particularly given the uncertainty surrounding the world economy. The IMF significantly revised its October forecasts downward within a month of publication, the unusual step underscoring how quickly the events have been unfolding. Similarly, over the past couple of months, almost every day has seen some key forecaster downgrading their numbers. This heightened uncertainty notwithstanding, it is important to explore these questions. I try to do so by beginning with a summary of the IMF's latest forecasts and a general discussion of how the crisis will affect the developing countries before turning to the outlook for Bangladesh, with a focus on exports. Finally, I discuss the outlook for inflation. It is important to get inflation under control, and the central bank will remain focussed with that task. This means that it will be up to an incoming government to stimulate the economy if needed. Outlook for the World Economy Unless one has lived in outer space for the past couple of months, these forecasts won't come as a surprise. I'm not sure we've ever witnessed events such as these: near collapse of the financial system in the world's most advanced economies, de facto nationalisation of banks, unprecedented injection of liquidity into the system, trillions of dollars worth of wealth being wiped out in days, wild swings in the foreign exchange, equity and commodities markets -- these are the stuff our nightmares are made of. It is little surprise then that the IMF has so heavily revised down its forecasts (Chart 1). Six months ago, there was a lot of discussion about the decoupling hypothesis -- the idea that major Asian emerging economies like China and India, but also the smaller ones such as the NIEs or the Asean-5, have matured enough so that a US recession would not affect them as much as was the case in the past. Well, few believe that any more -- Martin Wolf of the Financial Times put it as a "wish-dream."

Recent World Bank reports detail how the developing world is vulnerable to the global financial crisis, with dwindling capital flows, huge withdrawals of capital leading to losses in equity markets, and skyrocketing interest rates. There are three reasons why the global financial crisis has evolved differently from other major crises to have hit the developing world: it is occurring in the context of increased financial globalisation; its origins are outside the developing world; and its impacts follow on from high food and oil prices. Unsurprisingly, countries with weaker fundamentals -- large current account deficit, signs of overheating, rapid credit growth -- have been more affected. However, countries that are less integrated into the global economy have been relatively unscathed. Aid-dependent countries have been vulnerable to disbursement shortfalls and changing donor priorities. Going forward, possible consequences for developing countries include falling exports, severe reductions in private capital flows and investment, increasing sovereign debt burdens, and government balance sheet deterioration. Bangladesh Economic Outlook The Asian Development Bank publishes a chapter on Bangladesh. The ADB's forecast for 2008-09 is 6.5 per cent -- unchanged from six months earlier, and is quite optimistic given the world recession. Their prediction is underpinned by: an expected manufacturing recovery, with growth reaching the pace recorded before production was upset by recent political upheavals on the back of strong export performance of garment and knitwear; continuing service boom, with consumption being supported by continued remittance growth; and an investment recovery boosted by improved confidence assuming political stability.

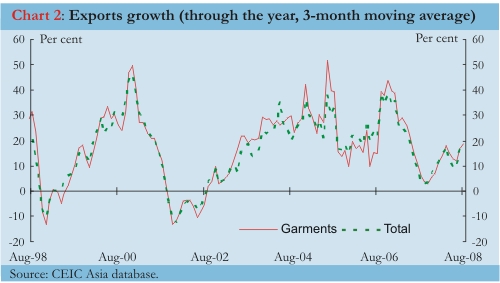

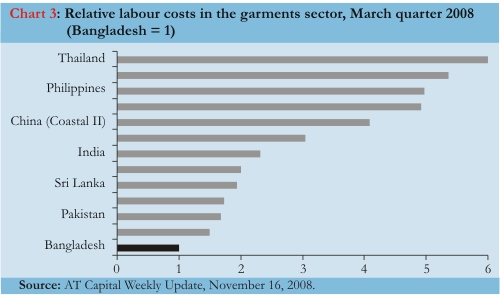

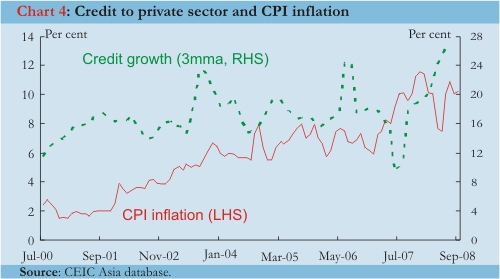

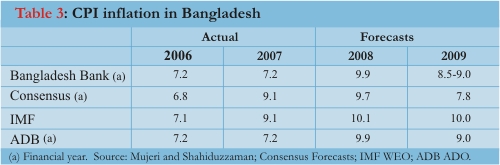

It ought to be noted that the ADB forecast was published before the most virulent phase of the global financial crisis was triggered by the collapse of Lehman Brothers in mid-September. The IMF forecasts were published in October, and do not incorporate the latest global outlook. As the average of private sector predictions, Consensus's November numbers probably best reflect the likely reality. Unfortunately, Consensus doesn't publish any reasoning behind these predictions. Mujeri and Shahiduzzaman (2008) provide a glimpse into the Bangladesh Bank's take on how the crisis will affect Bangladesh. They expect economic growth to remain resilient, and appear to be unperturbed about any slowing in remittances or foreign direct investment. They do anticipate foreign aid to shrink, and urge fiscal consolidation. They are also monitoring signs of stress in the financial sector. However, their biggest policy concern appears to be inflation. Before discussing inflation in more detail, it would be useful to explore the export channel through which the crisis might affect Bangladesh. Exports Chart 2 shows that a modest export recovery was on the way up to August 2008. While this recovery was before the global financial crisis hit the docks, but after the general slowdown had commenced -- most of our export market economies contracted in the September quarter. Chart 2 also shows that at similar stages of the 2001 recession, our exports were well on the way towards falling. While exports may yet slump again -- this recession is expected to be deeper and more protracted than the last -- there are two inter-related factors that may somewhat mitigate against the worst effects of the recession. Firstly, labour costs in our garments sector are much lower than our competitors in the region (Chart 3). Secondly, anecdotal evidence suggests that our ready-made garments are mainly sold in the relatively low-priced end in the rich world. This second factor is often called the Wal Mart Effect after the American retailer that specialises in cheap consumer items. Retail data from the US do seem to be consistent with the Wal Mart Effect -- as the economy has soured, consumers seem to have moved towards the cheaper end of the market. To what extent these factors help avoid an export slump remains to be seen. An additional complicating factor may be exchange rate movements. The US dollar has appreciated sharply, and since the taka is in de facto peg with the dollar, it has appreciated too against other currencies. Taka has gained about 10 per cent against both the euro and the sterling since April. Presumably, at some point the depreciation will start affecting the exporters. For now, however, the Bangladesh Bank's focus remains to be on the fight against inflation. Inflation International agencies such as the IMF or the ADB have often argued that the monetary stance taken by the Bangladesh Bank is too accommodative, pointing to strong credit growth as evidence (Chart 4). More alarmingly, there also appears to be a somewhat of a lagging relationship between credit growth and inflation -- a rise in credit growth today shows up in higher inflation a year from now. This is particularly worrying because it means that even if the banks were to tighten credit flow right away, there is probably already too much money in the system to keep inflation high. While the credit acceleration suggests that the Bangladesh Bank is right about remaining vigilant against inflation, there are also grounds for optimism. The imminent recession has resulted in sharp falls in oil prices -- a barrel of oil now costs less than $50, compared to nearly $150 in July. As oil prices tumble, all else being equal, inflation should ease. Another factor that should help with the fight against inflation is the recent appreciation of taka against the Indian rupee. Last year, I argued that taka's depreciation against the rupee contributed to rising food price inflation in Bangladesh. Since that time, taka has appreciated by as much as 15 per cent against the rupee. All else being equal, this should ease the inflationary squeeze.

Concluding Comments If the Bangladesh Bank remains focussed against inflation, then it will be the fiscal and structural policies that will have to steer the economy should the worsening global storm hit us harder than expected -- as the IMF's David Burton wrote in The Daily Star recently: fiscal policy can play a key role. However, with the budget deficit expected to be 5 per cent or so of GDP, a new government won't have much rooms to move. This means that policy priorities will have to be carefully assessed. Two factors should be considered in any assessment. First, it is important to design any initiative such that it doesn't foster inefficient rent seeking or corruption. Secondly, and more importantly, priority should be given to the supply side of the economy so that the potential growth rate can be lifted to 7 per cent or more. Of course, there are many ways for the government to implement supply side policies that raise growth rate in both short- and medium-term -- well-designed employment generation program and high quality infrastructure spending both fit the bill. This choice between competing policy platforms ought to be the stuff of politics. How long before we can expect that in Bangladesh?

1. Rahman J., How Will the Global Economic Slowdown Affect Bangladesh? Forum, May 2008. Available at: http://www.thedailystar.net/forum/2008/may/global.htm. Note : Since the piece was written, the World Bank has revised its 2008-09 growth forecast for Bangladesh to 4.8 per cent as exports and remittences weaken. Meanwhile, October data suggest a marked moderation in inflation. Photos: Amirul Rajiv Jyoti Rahman is an applied macroeconomist and a member of the Drishtipat Writers' Collective. He can be contacted at: dpwriters@drishtipat.org. This article has benefited from discussions at http://bdinvest.org/.

|

T

T