Inside

|

Can Bangladesh Textile Exports Survive?

The ongoing global economic crisis is having a devastating impact on all export dependent

economies, whether manufacturing or primary product exporting. The collapse in demand in major industrial countries in North America and the European Union has led to a sharp fall in export demand from the emerging and developing countries and a collapse in primary commodity and manufactured product prices. Even high performing countries like China and India have recorded sharp slowdowns or decline in export in recent months, following double-digit expansion over a prolonged period. Other high performing economies like those of Malaysia, Thailand, Philippines, and Indonesia are also suffering badly because of the ongoing crisis. Along with most exports, textile (including garment) exports from these countries are also declining sharply due to the economic meltdown in North America and Europe. In contrast, export of textile products from Bangladesh surprisingly remains quite buoyant. Knitwear and woven garments exports have increased by 41.8 percent and 36.2 percent, respectively, during July-December 2008 over the corresponding period last year. Although the high growth rate is partly attributable to the low base of last year during this period, and with the growth rate likely to come down somewhat in the coming months, most garment and knitwear exporters are bullish about the near-term outlook and are talking about shortage of skilled manpower in the sector. Naturally, one would like to ask why Bangladesh experience is so different from others. The most common explanation is the "Wal-Mart effect" -- named after the world's largest retailer based in the United States, which caters mostly to ordinary Americans. The argument is based on the hypothesis that since Bangladesh primarily exports low-end textile products -- the kind of products marketed by Wal-Mart and whose sales have been least affected by the crisis -- and income declining in industrial countries, consumers would be buying more low-end Bangladeshi made textile products. Prof. Taslim, CEO of Bangladesh Foreign Trade Institute, questions this widely believed hypothesis and rightly points out that: "Our export sector is in deep trouble if it is spewing out mostly inferior goods since the demand for these products will certainly decline when income rises. We do not yet know of any product whose demand increases with both an increase and a decrease in income." I certainly agree with this view since the robust growth of textile exports in recent years (presumably normal times) could not be explained by the hypothesis that Bangladeshi products are inferior.

Another argument put forward by the IMF resident representative in Bangladesh, Mr. Jonathan Dunn, during his presentation on the IMF's Asian Economic Outlook, also throws cold water on the Wal-Mart effect as the basis for explaining the growth in textile exports from Bangladesh. He points to the fact that most households in the US and Europe have closets full of clothes which may last several years even if they do not buy new clothes. The closets I saw at my own and my friends' houses during the last three decades of living in North America certainly testify in favour of Mr. Dunn's argument that households used to a certain quality/brands of clothes would not be shifting to inferior products in the short term, while their overflowing closets could easily meet their needs for several more years. It is also not conceivable that Bangladeshi manufacturers and workers have suddenly become much more productive than those of China, India, and Indonesia, and will take market share away from these strong competitors. All these countries have larger and better market access, modern production facilities, and better infrastructure than Bangladesh. Why is the Bangladesh textiles sector doing so much better than most others in this difficult time, and will it come out of the global crisis on a positive note?

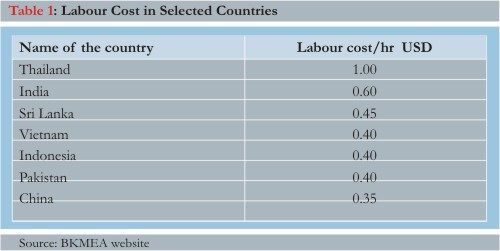

The answer to this puzzle appears to lie in the series of newspaper reports in recent months pointing to the opening of representative offices of major global corporations for buying textiles products directly from Bangladesh. Decisions regarding sourcing of supplies by major global multinational corporations (MNCs) are strategic in nature and based on medium- and long-term considerations. MNCs are aware of their excessive dependence on major emerging economies, and the cost pressures and exchange rate appreciations experienced by these economies in recent years. MNCs also recognise that, as the fastest growing economies like China and India are getting richer, they are becoming non-competitive in many low value-added products including textiles. Many MNCs have already concluded that they would need to find alternative or diversified sources for procuring their supplies. Although this strategic shift started several years back, the process is gaining momentum with cost pressures intensifying in China, India, and other emerging East Asian economies. The apparel sectors in Vietnam and Bangladesh gained remarkably in the post-MFA period, contrary to the doomsday scenarios painted by market analysts and economists at that time, due to this strategic shift by MNCs. The impact of this trend is markedly visible in the most recent data on export of textile products to the US market. (Figure 1) The momentum is gaining strength. The shifts are based on the overall lower cost structure and its outlook, while taking into account the ability of the new sourcing countries to meet the quality and punctuality of deliveries. Bangladesh and Vietnam both meet these considerations and are the apparent beneficiaries of the shift in sourcing. The momentum is gaining strength as both Vietnam and Bangladesh have crossed a critical mass in the area of textiles exports and have got the attention of all major MNCs engaged in textiles products. With unit labour cost at $0.25 per (Table 1), despite deficiencies in labour productivity, Bangladeshi manufacturers are likely to remain highly competitive for years to come.

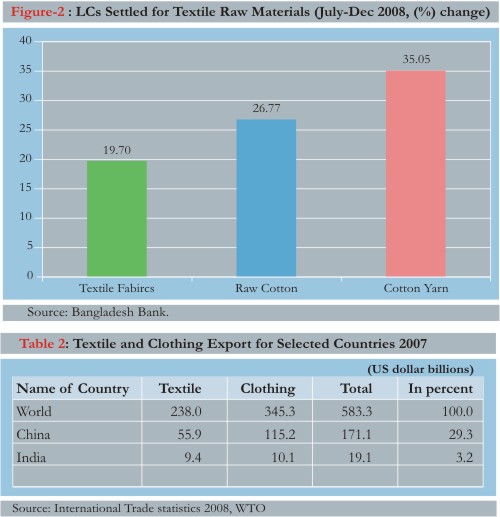

How far can the trade diversion toward Bangladesh carry us through? If we can fulfill buyers' expectations in terms of quality and punctuality, the sky is the limit. Although textiles account for 75 percent of Bangladesh exports, they account for less than 2 percent of the global market for textiles. At present, the global textiles market is about $600 billion a year, of which China accounts for 29 percent (Table 2). If Bangladesh can divert only 2 percentage points of global textile production out of China, we can more than double our exports to $25 billion per year. This shift alone may more than offset any temporary slowdown in demand arising from the global slowdown. How is the Bangladesh textiles sector going to perform during the current economic turmoil? Certainly, the effect of lower demand in industrial countries is affecting Bangladesh negatively. After all, Bangladesh textiles are normal products. However, because of the large shift in demand toward Bangladesh from other larger producers, textile exports from Bangladesh may still grow at a respectable pace throughout the crisis. It is more like a situation that we characterise in economic literature as "a positive substitution effect outweighing the negative income effect" emanating from the global downturn. Forward looking indicators for the overall activity level in the textiles sector in Bangladesh indeed point to a continued bullish trend. Letters of credit (LCs) settled for imported major textiles-related industrial inputs increased by high double-digit rates during the July-December 2008 period over the corresponding period in the preceding year (Figure 2). The industrial inputs imported under these settled LCs will be used by the textile related firms in the coming months, and the LCs are generally backed by firm orders from foreign buyers.

How will the Bangladesh textiles sector perform in the post-turmoil period as the industrial countries recover? Certainly, if we believe in the Wal-Mart effect, the Bangladesh textiles sector and the economy will be doomed in the post-recovery phase. If the hypothesis presented above holds, the pace of substitution toward Bangladesh will increase further, and we should expect a more robust performance of the textile sector in the coming years. With continued political stability and necessary infrastructure support (electricity, transport and port facilities), and if the current open trade regime for importation of textile inputs is maintained, the sector will be ready for a much faster export growth once the global economy moves to an expansionary phase. Ahsan H. Mansur is Executive Director, Policy Research Institute. |