Inside

|

The Way Out Hasan Imam casts an eye over the global economic crisis and offers policy recommendations for Bangladesh

These are troubled times and the mind cannot help but be troubled. Surveying the wreckage all around -- from Wall Street, the world of finance I work in, to Main Street, the real economy I live in -- it is disconcerting to see how quickly the contours of our world are changing. In Manhattan, the epicentre of the financial earthquake, the restaurants are emptier, the streets less busy, the shops empty. On a global scale, images of economic pain giving way to despair are troubling; this week alone, there are reports of riots in Bulgaria, student unrest in China, and violence in Iceland, as once peaceful citizenry gives in to despair. However, for those in positions of power, political or economic, entrusted with safeguarding millions of lives and livelihoods, surrendering to despair is not an option. There are policy tools available, which, if applied with care, can slow the rate of the recession, shorten its duration, and set the world back on a path to recovery. Back in Bangladesh, the situation is relatively calmer, as the full-blown impact of the global crisis has yet to hit home. However, we cannot afford to be sanguine; it is incumbent upon policy makers here at home to take the lessons from across the globe and proactively implement an interventionist agenda that combats the threat. This article, then, is not about the spiral of despair, but about the economics of recovery and hope. As the world sinks into a synchronised global recession, it is less important to ask how we got here and more important to figure out how to get out. In developed economies across the globe, where the crisis has already reached epic proportions, the needle has moved from the realm of academic debate about what to do and into concrete policy actions. From the US to Europe to China, politicians, central bankers and financiers are applying every macro-economic and legislative tool at their disposal to halt the downward spiral in their respective economies and chart a course to recovery. However, in Bangladesh, the same sense of urgency is lacking, understandably, since the financial contagion is still seeping into our economy and has yet to reach crisis proportions. There is both a danger and an opportunity in this. The danger is that we might be lulled into a false sense of security, that the worst is behind, and that our economy and capital markets have escaped with relatively little damage. On the other hand, the delayed impact offers a window of opportunity; we can learn from the actions of others and implement proactive policies to lessen the impact. With this in mind, let us consider the options available.

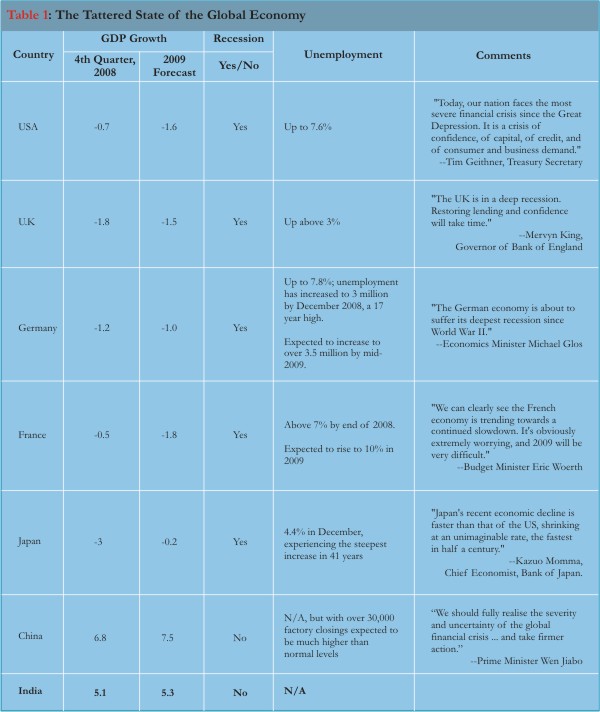

To Intervene or Not "Government intervention usually makes a bad problem worse. The most efficient economy is one left to its own devices." "Economic theory has long explained why unfettered markets are not self-correcting, why regulation is needed, why there is an important role for government to play in the economy." The debate has been raging among economists for much of this century: should governments intervene during times of economic crisis? With the world facing possibly the most severe economic slump in half a century, this question has taken on special poignancy. Not doing anything is an option. How can inaction in the face of an economic crisis be an option? In fact, over the last two decades, western leaders, including the last four US presidents, have been preaching, and in varying degrees practicing, a "hands-off" approach to the economy. This is not surprising. The philosophical underpinning of modern capitalism in the West is predicated on the belief that the private sector must be left to pursue its own profit goals, with little interference from the government. De-emphasising regulation and intervention, the proponents of the free market approach instead subscribe to a concept of economic Darwinism; only the fittest companies making rational economic choices should thrive, while those making bad choices must fail. A logical, although unintuitive conclusion of this theoretical construct is that recessions are inevitable, and even necessary. When demand rises, a virtuous expansionary cycle sets in; companies increase production, creating new jobs and improving wages, and in the process generating new demand. However, the expansionary forces tend to drive companies to excess -- creating too much capacity, taking on too much debt -- factors that eventually lead to business failures. As the failures pile up, companies shed capacity, cut employment and wages, and drive down demand -- the economy enters a recession. Therefore, recessions are inevitable and necessary; they purge the excesses that accumulate in an economy during the good times. A free market proponent will then argue against intervention to prevent a recession. Intervention may at times be necessary. Non-intervention may sound good in theory, but history reveals two practical limitations. First, non-intervention can magnify natural economic cycles -- unchecked by regulation, up cycles turn into "bubbles," or periods of excessive growth in demand and supply, followed by major downturns or "crashes." At times, these crashes are so steep that the economy cannot climb out unaided. In the words of famed economist John Maynard Keynes: "Free markets are not always self correcting." Second, the socio-political impact of up and down cycles is asymmetric; citizens enjoy long periods of prosperity, but have little endurance for long periods of economic hardship. Policy makers must weigh the broader social costs of a prolonged recession, and usually cannot justify inaction. How to Intervene: Once policy makers decide to intervene and fight a recession, the next question is how. There are three broad sets of intervention tools that can be used; interestingly governments across the globe are applying all three to combat the current crisis, and in massive doses. However, intervention can have unintended consequences, introducing harmful distortions in the economy. Therefore, the pros and cons must be carefully considered before application of any of the interventionist tools. As the French economist Fredric Bastiat warned: "Good economic policy must take into account both the effect that is visible and the effects that must be foreseen." Intervention Tool Set #1: Fiscal Stimulus There are two major sources of spending in an economy -- the public sector (government) and the private sector (retail and business). Fiscal stimulus involves public sector spending above normal levels in order to stimulate the economy. There are typically two ways to provide fiscal stimulus: · Direct spending: The government can increase its budget above normal level and spend the excess on projects -- roads and bridges, mass transit, education, energy supply -- with the goal of creating new jobs and improving the long-term competitiveness of the economy. · Tax cuts: The government can lower the tax rate, or provide special tax incentives, to individuals and businesses. This action increases the amount of money available to the private sector to spend on the economy. However, tax cuts can be less effective than direct government spending to stimulate the economy; individuals and businesses can simply choose not to spend the tax breaks or not to take advantage of tax incentives. · Beware of big economic distortions and deficits longer-term. Fiscal stimulus, while effective short-term, can be harmful longer-term. First, fiscal stimulus creates budget deficits (difference between what the government spends and what it earns), typically finances through borrowing. As the debt load becomes larger, the government has to impose higher and higher taxes to service the debt, eventually threatening the solvency and stability of the economy. Second, fiscal spending creates unintended distortions in the economy; government programs can end up directing capital to sectors that may not be the best use of resources. Classic examples are "bridges to nowhere," spending billions on infrastructure in a remote region that few will use. Third, government projects are usually difficult to dismantle. Over time, the bureaucracies created to run the programs and the communities that they benefit resist shutting down the program long after the need for the stimulus has ended. Intervention Tool Set #2: Monetary Stimulus Applied by central banks, monetary stimulus/easing involve increasing the availability of money in the economy, typically through the banking system. The objective is to make it easier for retail and business customers to borrow from banks and spend it on the economy, thereby counteracting recessionary pressures. This can be achieved in one of several ways: · Interest rate cuts: By lowering the interest rates banks can charge on loans or offer for deposits, the government makes it less attractive to save money and cheaper for companies and individuals to borrow. · Quantitative easing: The government can inject funds into the banking system by lending to banks directly and/or by buying assets from banks (such as bonds). The goal is to "ease" pressure on bank assets, thereby allowing them to lend more to retail and business customers. · Reserve reductions: Monetary authorities require banks to hold a certain portion of their assets with the central bank. By reducing this requirement, the central bank can free up banks' capital, which in turn is used by them to increase lending. · Beware of monetary stimulus for too long: For the very reason that monetary easing is useful in a downturn, it can be harmful in an upturn. Easy money tends to create "credit bubbles" or excessive expansion fueled by excessive levels of borrowing. In fact, availability of easy money in developed economies during the last two decades is one of the root causes of the current financial crisis. And given that economic policy is not precise, governments tend to wait too long to turn-off the excess money flow, thereby creating bubbles in the long term. Intervention Tool Set #3: Structural Intervention The most controversial of the intervention tools, structural intervention involves the government directly intervening in one or more troubled sectors of the economy. There are several ways the government can do this, such as passing new regulations, creating new agencies or banks, injecting capital into the sector, and forcing mergers between healthy and unhealthy players to repair the sector. · Structural intervention is a slippery slope. While governments typically intervene in limited measures at first, attempting only the basic minimum and indirect involvement, practical experience demonstrates a snowballing effect. The initial structural intervention often evolves into a nationalisation of the sector, whereby the government ends up as the majority owner of key players, reversing decades of privatisation and all the efficiencies associated with it. The Reality: In the US, the epicentre of the financial crisis, the new Obama administration has recently passed the largest fiscal stimulus package in US history, with a price tag of $787 billion. The package contains both direct spending on infrastructure, healthcare, and other projects with universal benefits. These steps have been complemented by monetary easing, with unprecedented reduction in interest rates -- to almost zero. The government has also been aggressive with structural intervention, most visibly in the banking sector, which is in meltdown mode with 14 banks already failed. In 2008, the government engineered healthier banks to buy the weaker ones, and has set aside $700 billion under the Troubled Asset Relief Program (TARP) legislation. Importantly, there is now discussion in the US about setting up a "Big Bad Bank" (BBB) to buy up the hundreds of billions of dollars worth of toxic assets sitting on the balance sheets of banks, and quarantine these assets. In Table 2, we have highlighted some of the actions taken by the US and other developed and developing countries, including Japan, UK, France, Japan, China, and India. While there are variations in the approaches of individual countries, the measures have some unifying lessons that are important to consider as Bangladeshi policy makers look toward contingencies. Be proactive, not reactive. Remember the age-old adage "A stitch in time saves nine"? This is good advice at any time. But it is also difficult to implement since regulators typically cannot muster enough political support for intervention when things are "not bad enough." Yet, we have seen this again and again; the size of intervention needed becomes bigger the deeper the crisis. There are two reasons for this. First, there is always a significant delay between the application of a stimulus and the time it impacts the real economy. Second, recessionary forces typically reinforce each other; falling demand during a recession drives companies to cut jobs and wages, which in turn shrinks demand further and deepens the recession. The bottom-line is that proactive intervention is far more effective than reactive action. No halfway measures. Consider the different US and German government approaches when domestic depositor confidence sank to unprecedented lows and the risk of "bank runs" became real. In the US, the government announced that it would increase bank deposit guarantees from $100,000 up to $250,000. But in Germany, the government announced a blanket guarantee covering deposits of all sizes. The US government's "half measure" failed to shore up depositor confidence and led to failure of smaller regional banks and a major shift of assets to government treasuries and the largest three banks. Germany's "full measure," on the other hand, stemmed the flight of bank deposits very effectively. This is only one example, but there are others, of how full measures are far more effective in restoring confidence and achieving the desired results.

Communicate the goal clearly. Two primary goals of any intervention tool are to change behaviour and restore confidence. A mixed signal does neither. An intervention of small magnitude, backed by a "big" and clear message, can be more effective than an intervention of massive magnitude with a confused signal. One of the main criticisms of the Bush government's interventionist approach to the financial meltdown in the US was the lack of a coherent message. Take the example of the $700 billion TARP legislation; a failure by US policy makers to deliver a consistent message on how the money would be used has meant that the TARP, despite its massive size, has done little to restore confidence in the banking sector. Policy Recommendations for Bangladesh: A Contingency Plan "Hope for the best, but prepare for the worst." Far from the epicentre of the global financial crisis, Bangladesh nevertheless remains vulnerable to the aftershocks. I have argued in an earlier article that due to its relative insulation from global currency and equity capital flows, Bangladesh has so far suffered neither a banking sector collapse nor a stock market crash, unlike many developed and emerging economies. However, as the world slides into the worst global recession in fifty years, the probability of secondary shocks hitting the Bangladeshi economy, through slowdown in export demand and remittance, is increasing. It would be irresponsible, and foolhardy, to not prepare for an economic crisis with a contingency plan in place. Policy recommendations: Taking into consideration the repertoire of intervention tools being used by policy makers across the globe, their effectiveness and their applicability to Bangladesh, here are a set of policy recommendations: Monetary authorities should shift to easy monetary bias, cutting interest rates. Bangladesh has one of the highest interest rates in the globe, with risk-free government debt yielding above 12% and banks offering deposit rates of 14% or more. When compared to the key interest rates in the 2%-4% range in most developed economies today, the monetary policy in Bangladesh is very conservative. During expansionary times, such a "tight" monetary stance can be justified on the grounds of controlling inflation and preventing the economy from overheating. However, currently inflation is not a big risk for the Bangladeshi economy: the price of oil is down to $40 a barrel (a 70% decline from a year ago), global food prices have stabilised, and a high "normal" unemployment level is keeping wages under check. Moreover, the risk of the economy overheating is low -- with global demand for Bangladesh's primary exports declining and remittance likely to be under pressure, 2009 GDP growth rate will slow with a high probability. Thus, the current situation and an impending slowdown dictate the need for a monetary easing -- the policy makers should consider easing interest rates as a first measure. Restrict credit flow toward short-term export capacity expansion, provide tax relief. One of the structural risks that typically emerge during an economic recession is capacity expansion in sectors with weakening demand. Typically, this occurs because of the time lag between planning and implementation; businesses plan to expand capacity in response to strong demand, but by the time the capacity comes on line, the demand may have evaporated. With export demand in certain sectors slowing, and weak demand likely to persist through 2009-2010, policy makers should discourage commercial banks from channeling credit toward short-intermediate capacity expansion projects in these sectors. However, these sectors are also major employers, and have been the source of high wages, lifting millions out of poverty. Restricting credit to prevent expansion should not be construed as discouraging the long-term growth of the sector. Moreover, the government should provide some short-term tax relief to the affected sectors so that they may continue to support jobs and wages in the face of declining demand. Apply fiscal stimulus to sectors that improve long-term competitiveness of economy. Recessions do not last forever, and businesses need to be prepared with adequate capacity when the upturn comes. For some sectors, like ship-building and power, capacity takes years to come online and, therefore, advanced planning and funding are required to ensure the long-term viability of these sectors. These are also the sectors that can improve the long-term competitiveness of the economy. This is where government's fiscal stimulus can play a role. In this regard, the new government's focus on the power and energy sectors is on the right track. The high technology sector, an area where Bangladesh has immense potential due to its cadre of low cost educated labour, is another sector the policy makers can develop through fiscal stimulus. Moreover, in order to have the maximum impact on job creation and stimulate domestic consumption, policy makers should channel funds into the SMB (small medium business) sector. Ease tax burden on productive sectors. Policy makers can use tax breaks to stimulate particular sectors of the economy without having to create/expand direct government involvement. Recently, the government instituted precisely this tool to aid the long-term growth and viability of the ship-building sector. Information technology (IT) and healthcare are two other sectors that could benefit from such tax holidays. Nurture capital markets, create a stabilisation fund. Bangladesh's capital markets stand at a critical juncture. While it can play a critical role in aiding the economic development of the country by efficiently channeling capital to the most productive sectors, and away from the riskiest ones, the Bangladeshi stock market is still small relative to the size of the economy. As I have argued earlier (see "Impact of the Global Financial Crisis on Bangladesh and its Capital Markets," Financial Express, Jan 16), while the DSE remains somewhat insulated from the effects of the global contagion, it is not immune. In fact, the recent volatility is an indication that the market has entered a fragile phase and downside risks remain significant. However, given the outperformance of the Bangladeshi stock market relative to its global counterparts, if the market comes out of the current downturn with only a correction, and not a crash, then the outperformance will attract global capital into the DSE, setting a new growth phase for our capital markets. Thus, policy makers need to nurture the capital markets at this stage. However, this should be done more through encouraging institutional participation versus promoting retail speculation through increased margins. Some of the concrete steps the policy makers can implement; fast track current mutual fund applications in regulatory pipeline, mandate banks to sponsor institutional funds, fast track privatisation of major government assets to promote the supply side of the equation. Finally -- and this may be most effective in the short run -- create a federal emergency market stabilisation fund for a two-year period. The primary goal of such a fund would be to intervene and create a floor for the market in the event of a crash. In order to minimise distortions, the fund should only invest in the major index and should have a two-year tenure. Creating an Opportunity out of Crisis Bangladesh's economy and capital markets stand at a critical juncture. As Bangladesh builds on the success of its garments sector, it is fast becoming a magnate for global manufacturing -- from sectors like pharmaceuticals to ship-building, we are making incremental strides. Yet, our country is still a long way from joining the ranks of middle-income economies of the world as the overwhelming majority of the population still live below the poverty line. And the global financial crisis will surely place a speed bump along the way. However, there is also an opportunity here; the global financial crisis is imposing a harsh Darwinian discipline on the global manufacturing industry. The higher cost, less efficient export industries in emerging markets like China and Vietnam are facing mass extinction, with market share shifting in our favour. Our crisis management policy must position Bangladesh to take full advantage of this opportunity. Parallel, but somewhat uncorrelated, is the development of our capital markets. Even though the Bangladeshi stock market has experienced significant growth in size and depth, it still remains small relative to the size of the overall economy. Thus, the silver lining to the impending economic crisis is not that we are immune from a slowdown in Bangladesh; rather it is that there is an opportunity for us to come out of the downturn stronger. However, steering the country through these difficult times will require thoughtful planning, proactive action, and vigilance on the part of policy makers. Dr. Hasan Imam is Managing Director at a global investment bank. |