Inside

|

Of Perspiration and Inspiration JYOTI RAHMAN looks at the rise and fall of productivity in Bangladesh -- and the reasons behind them.

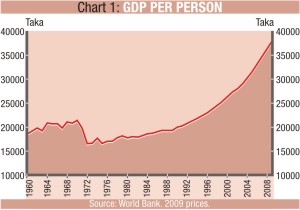

An oft-used correlate of standard of living is GDP per person, which is more popularly known as per capita income. It measures the amount of income that each person earns in a country in a given year. Steady improvement in per capita income is a necessary, though not sufficient, condition of improvement in living standards. No country in history has been able to pull its people out of poverty without a sustained increase in per capita income. In the then East Pakistan, per capita income (in 2009 prices) was 18,500 taka in 1960, rising to 21,400 taka a decade later -- an increase of nearly 15%. The scars of the Liberation War are etched hard in our collective consciousness, but those who didn't experience it may not always appreciate the economic costs. As a result of the war, between 1970 and 1972, per capita income fell by nearly a quarter to 16,500 taka -- over a tenth lower than what it was in 1960. The war also left Bangladesh on a slower growth trajectory. In the remainder of the 1970s, per capita income grew by just 8%. In the 1980s, it increased by another 13%. The pre-liberation level of per capita income was not reached until 1993.

But in the early 1990s, the Bangladeshi economy experienced a remarkable growth spurt. In that decade, per capita income grew by 31%. In the 2000s (to 2009), it rose by a further 44% -- standing at 37,900 taka in 2009. Chart 1 shows the evolution of GDP per person over the past five decades. The economic acceleration of the past two decades has been accompanied by noticeable improvements in social indicators. For example, life expectancy at birth rose from 40 years in 1960 to 44 years in 1971. In the following two decades, it rose by another 10 years. In the most recent two decades, it has risen by a dozen years and stood at 66 years in 2009. Similar trends are evident in most quantifiable metric of living standards. The economic take off, and the associated social improvements, have not gone unnoticed. Articles praising Bangladesh's achievements have been appearing in the Financial Times, the Wall Street Journal, the Economist or the (now defunct) Far Eastern Economic Review since the mid-1990s. Investment banks such as Goldman Sachs have been applauding Bangladesh for years now. And the World Bank has called Bangladesh one of the great success stories of recent years. For all this, however, critical analysis of the sources of growth, and future prospects, are few. Over time, per capita income can grow because of two reasons: first, if there are more workers in a given population; second, if each worker can produce more in a given period.1 The intuition behind the first source of growth is this: as more people are brought out of informal sectors into the formal, measurable economy, the aggregate economic pie increases and the average income rises. If this happens at a faster pace, the growth in per capita income picks up. Technically, faster rise in labour utilisation (the ratio of labour force to total population) leads to faster GDP per capita growth. In a seminal 1994 article about the East Asian growth experience, Nobel winning economist Paul Krugman calls this the perspiration path to prosperity.2 And there are obvious limits to labour utilisation/perspiration as a source of faster growth. At the limit, every able-bodied adult person is drawn into labour force. And it's by no means clear that it is desirable for everyone to work! Enter the second source of growth: GDP per potential worker (defined as anyone participating in the labour force) -- also called labour productivity. Clearly, higher productivity means a larger economy, and higher average income (and the corollary: faster productivity growth leads to faster growth in per capita income). Krugman calls this the inspiration source of income. The question then is, where did Bangladesh's growth turnaround come from -- perspiration or inspiration? Chart 2 shows that, while labour utilisation has been contributing to the growth in per capita income throughout the past three decades, it's labour productivity that has been driving the economic turnaround of the past two decades.

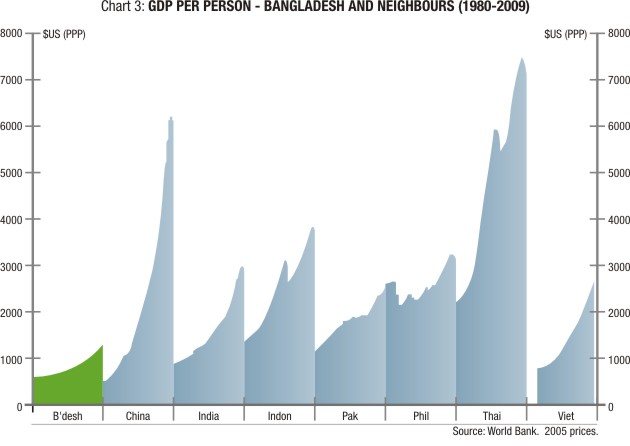

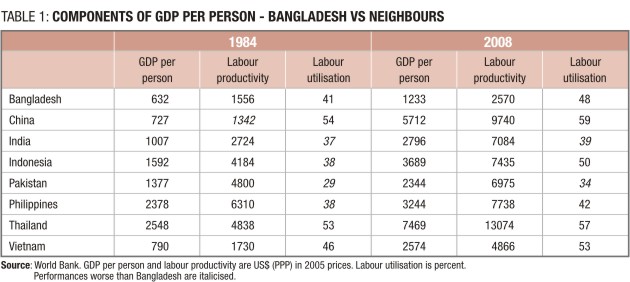

In the 1980s, the economy was characterised by recurring macroeconomic crises, and labour productivity growth was erratic. In the 1990s and the 2000s, Bangladesh enjoyed remarkable macroeconomic stability, allowing labour productivity to grow steadily. In addition, a combination of improving educational attainment, growth in the exports sector (particularly the rise of readymade garments), and in more recent years, adoption of information and communication technologies has contributed to labour productivity growth. The impact on per capita income growth is apparent. Notwithstanding the doubling of per capita income over the past generation and the concomitant improvement in the standard of living, a more sombre picture emerges when Bangladesh is compared with a set of neighbours. Of course, caution needs to be taken in any such comparison -- each country is unique, carrying the burden of its own history and demons, but bestowed with its specific resources and opportunities. Nonetheless, Indonesia, Pakistan, Philippines, Thailand and Vietnam have sufficiently similar socioeconomic and political characteristics as Bangladesh to warrant some broad-brush comparisons. The giant economies of China and India are thrown into the mix as well. Chart 3 shows that compared with these countries, the average Bangladeshi is still a lot poorer. Why is Bangladesh's per capita income still so much lower than the neighbours'? Is labour utilisation too low -- is there a perspiration gap? Or is it productivity -- that is, do we suffer from an inspiration gap? Table 1 provides the answer. A generation ago, Bangladesh had a better labour utilisation than India, Indonesia, Pakistan and Philippines. As of 2008, Bangladesh still had a better labour utilisation than India, Pakistan and Philippines. And yet, all these countries are richer than Bangladesh, as they were a generation ago. Clearly, the average Bangladeshi is not poorer because they work less than their peers -- there doesn't seem to be much of a perspiration gap. Rather, there is a strong inspiration gap. In 1984, China had a worse labour productivity than Bangladesh. By 2008, the average Chinese worker became nearly four times as productive as the average Bangladeshi worker. Workers of all the other countries in the panel were much more productive than Bangladeshis in 1984, and they continued to be so in 2008. Why are Bangladeshis poor? Not because they work less hard, but because they don't work as smart. Inspiration, not perspiration, that is holding us back. And what is holding productivity back? A few factors present themselves. Workers become more productive when there is investment in the economy. Investment, however, makes up less than a quarter of the Bangladeshi economy, lower than all the comparator countries save Pakistan. And a recent UNCTAD report suggests that even Pakistan -- a country besotted by a violent insurgency -- receives more foreign direct investment than Bangladesh. A sustained investment boom is needed before we can expect to see a productivity spurt.

Our policymakers are well aware of the need for an investment boom. However, the policies being adopted seem to be directed at making it easier for businesses to attain finances when there is no clear evidence that lack of finance is the binding constraint on investment. Indeed, recent sovereign credit ratings or analyses by multinational investment banks and multilateral agencies suggest that the average Bangladeshi business should face no more difficulty in obtaining finance than its peers in the region. Rather, there are other obstacles to investment boom. Energy and infrastructure bottlenecks are obvious candidates. Much has been written and said about these issues, but some numbers might be instructive. The average Bangladeshi consumed less than 150kwH of electricity in 2006, which is about a quarter of what the average Indian, Pakistani, Indonesian or Vietnamese consumed. We are struggling to meet the current electricity demand. Imagine what is needed before our workers can be expected to be as productive as their Indonesian peers. An investment boom and a sustained pick up labour productivity growth will also depend on factors ranging from education and skills of the workers to technology adoption and innovation to managerial and corporate practices to socio-political institutions and cultures. While the development discourse is still trying to come to grips with the relative importance of these factors and their policy implications, there is an emerging consensus -- governments can foster innovation and enterprise by making it easier for the private sector to conform to public policy.

How does Bangladesh fare? Not very well. For example, it takes 55 months and 41 procedures to enforce a contract in Bangladesh, when the same can be done with 39 procedures in 19 months in Indonesia, or with 34 procedures in 10 months in Vietnam. That 'red tape is a problem' is something the policymakers are well aware of. For example, Board of Investment chief claimed in July that bureaucracy is a bigger problem for business than electricity. And yet, the red tape problem has aggravated under the current government -- the Regulatory Reforms Commission and the Better Business Forum have been left to wither, while nothing has come of the Finance Minister's promise in his first budget under this government of a fresh start to regulatory reforms. These are difficult issues, and it's much easier to throw money through subsidies and easier access to credit. But that approach will only fuel inflation and asset price bubble -- both clear risks to the macroeconomy in 2011 -- while leaving investment and productivity unchanged. And it's not only the government that has a shockingly lacklustre attitude towards productivity -- our policy wonks and pundits leave a lot to be desired on this matter. Take the recent debate about the garments sector wage award for example. On the one hand, the claim was that the factory owners were squeezed, that the sector couldn't afford the wage rise. On the other hand, there were claims about the workers being exploited with a wage that wasn't even subsistence level. But hardly anyone mentioned that with rising productivity, a higher wage could be afforded without hurting the bottom line. Death in accidents and fires in our garments factories is sadly all too frequent, and there is no appreciation among our business leaders that improving working conditions could do wonders to lift productivity. Meanwhile, the absence of a genuine labour movement further hurts productivity prospects. Bangladesh has come a long way in the past generation. But now is not the time for complacency. There are still a lot of unfinished, and difficult, tasks ahead. And a productivity agenda should be at the forefront of our policy discourse. References Jyoti Rahman is an applied macroeconomist who writes with Drishtipat Writers' Collective (www.drishtipat.org/dpwriters). He can be contacted at dpwriers@drishtipat.org.

|