Inside

|

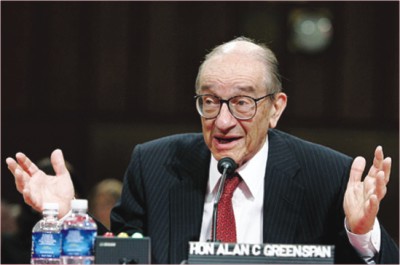

Bangladesh's Age of Turbulence Mir Mahfuz ur Rahman talks monetary policy in trying times THE admonition, "first, do no harm" applies to economists while speaking in public as well as to physicians. This is a phrase from the book Age of Turbulence in a New World by Alan Greenspan who was chairman of the Federal Reserve in the United States from 1987 to 2006. Famous for his ability to give technical and confusing speeches, Greenspan mocked his own speaking style in 1988 when he said: "I guess I should warn you, if I turn out to be particularly clear, you've probably misunderstood what I said." This is obviously new to the adviser to the IMF Asia and Pacific Department and our IMF country representative, who boldly held a news conference where the IMF suggested a tight monetary policy for Bangladesh, saying the existing policy is "too expansionary" to deal with soaring inflation.

As reported in The Daily Star: "The monetary policy should be less expansionary to contain the already high inflationary pressures," as escalating food and fuel prices in the international market will cause inflation in the country, which averaged 10 percent in 2007-08 fiscal, to go up. The IMF organised the briefing as part of its annual Article IV consultations for reviewing the country's economy. While this is not bad advice per se, the public boldness of the policy prescription and the required rapidity of the rejection of the advice by no less than the governor of the Bangladesh Bank, Dr. Salehuddin Ahmed, a respected economist, shows quite a bit of insensitivity on the part of the development financial institutions to allow the local central bank to go about its work in a straightforward manner. Flexibility and credibility are the password of central bankers. This flexibility permitted Mr. Greenspan to affect the economy by lowering interest rates in order to fight a recession while his credibility made it possible to do this without shocking the bond and stock markets. Over the years, he built credibility in the financial markets because of his efforts to fight inflation. Greenspan was precise on "inflation targeting," a practice in which the Fed makes public a projected inflation rate.

To those who are not trained in the economic science, monetary policy is the policy adopted by the central bank for control of the supply of money as an instrument for achieving the objectives of general economic policy. As stated in the Bangladesh Bank Order 1972, the principal objectives of the country's monetary policy are to regulate currency and reserves; to manage the monetary and credit system; to preserve the par value of domestic currency; to promote and maintain a high level of production, employment and real income; and to foster growth and development of the country's productive resources in the best national interest. In the first years after liberation, the primary target of monetary policy was to regulate not the quantity of money, but the direction of the flow of money and credit in support of the government financial program. In 1975, Bangladesh entered into a standby-arrangement with the IMF and the country's monetary policy changed shape, fixing an explicit target of safe limit of monetary expansion on annual basis. The principal target of monetary control was broad money (M2) i.e. the sum of the currency in circulation and total deposits of money in banks. After the government adopted a comprehensive Financial Sector Reform Program (FSRP) in 1989, following which the country's monetary policy assumed a new orientation towards promotion of market economy in a competitive environment. Bangladesh Bank started moving away from direct quantitative monetary control to indirect methods of monetary management. At present, the money supply is regulated through indirect manipulation of reserve money instead of credit ceiling. Major instruments of monetary control available with Bangladesh Bank are the bank rate, open market operations, rediscount policy, and statutory reserve requirement. After the introduction of FSRP, the refinance facility was replaced by rediscount facility at bank rate to eliminate discrimination in access to central bank funds.

However, as we apply the lessons of Mr. Greenspan in our neighbourhood of turbulence of emerging markets and poverty reduction, we need to be judgment specific in the economies' long-term goals. Even Mr. Greenspan has said in his book that regional economic dynamics are very important to national goals. Applying the same logic, the country's economic dynamics should be studied in conjunction with policy prescriptions taken from economies across the world. Bangladesh Bank's stated aim is to pursue a monetary policy that gives priority to investments in the agriculture and employment-generation sectors. While the Bank will monitor credit growth, it is not going to pursue monetary contraction because of adverse impacts on economic growth and poverty alleviation. If that is the upside, the downside is that both the IMF and local economists are probably right about the domestic monetary stance. The IMF is right in that the monetary stance is definitely not tight enough to combat inflation. While they concede that some inflation is inevitable given global food and fuel market developments, they correctly argue that a loose monetary stance is likely to further fan inflationary pressures. But the local economists are also right in that monetary tightening to stem the flow on effects of food and fuel inflation is going to work only by hitting businesses hard. It is important to focus attention on the reality of the circumstances on the ground. The IMF professionals were just doing their job, as stated in their mandate, and are even expected to hold a press conference on their work in the specific countries. However, we are in an Age of Turbulence, which requires attention to a few key factors. First, the IMF surely knows that monetary authority in a developing country is not independent of government, so good monetary policy takes a backseat to the political desires of the government. It is true that we have a non-political caretaker government running the country more efficiently and cleanly than ever in the history of administration since independence. But please raise your hand if you are willing to be the finance minister or central bank governor responsible for riots in the street by the urban unemployed? Or at the same time, willing to face the wrath of political parties willing to jump over your first stumble? Hence, the IMF should have realised that the press conference was a bad idea and keeping that chat private might have been more desirable. Second, in most countries where the IMF executives are trained, inflation targeting is the practice. The EU, Canada and Australia practice inflation targeting. However, Mr. Ben Bernanke, the new chairman of the Federal Reserve in the US, himself practices the Taylor Rule, which allows the central bank to respond to shocks in inflation and output. The central bank is well within its right to decide that the shock to output is not a risk that Bangladesh can take at this stage of growth nor in the current circumstances of turbulence. Third, the central bank governor has mentioned that raising the purchasing power of the poor is the road to combating inflation. There needs to be greater clarity on this issue. The rise in the purchasing power of the poor will cause a rise in aggregate demand, which consequently will cause further inflation. It is true that real incomes will rise through some sort of government pump priming of the economy. However, credit must be given as the focus is on the correct group of people, but we seek specific policy prescriptions on how the real eroding income of the people will be handled. Fourth, it is expected that Bangladesh shall have elections in December 2008. In the case of a political government taking charge of the government budget, the intention of the government to control public spending, restrict monetary policy, appreciate the currency, or raise interest rates is expected to be even more lax. In that case, the economy will be running at a faster speed in an effort to keep output growth strong while the government will resort to deficit financing to keep the rural and urban poor employed. In that case, we shall be in for real trouble. The long-term basis for economic stability is now. Finally, and most importantly, we must not forget the human face of a country. There will be major groups of people who will be left behind in this pursuit of output. Our per capita income has been raised to $600 but the real incomes of large swaths of people, especially the urban poor, has actually fallen due to the rise in the price of food -- which consumes the largest portion of their budget. It is the responsibility of the government to take strong steps to institutionalise a social safety net independent of the political class. If the IMF or any of its sister organisations have the clout or the funds to give us ideas on this, then that is the press conference that should be held. Mir Mahfuz ur Rahman, having studied economics and international relations at Johns Hopkins University, is a merchant banker. |

Bangladesh's macro-economic performance was quite strong in a year of floods and cyclones while being hit hard by steep rises in international food and fuel prices. While it is true that inflation has been a problem for the country, the inflationary pressures are stemming from global prices and domestic demand. Bangladesh Bank has a targeted GDP growth of 6.5% and inflation of 9% or less in FY 2008-09.

Bangladesh's macro-economic performance was quite strong in a year of floods and cyclones while being hit hard by steep rises in international food and fuel prices. While it is true that inflation has been a problem for the country, the inflationary pressures are stemming from global prices and domestic demand. Bangladesh Bank has a targeted GDP growth of 6.5% and inflation of 9% or less in FY 2008-09.