Inside

|

Surviving the Great Recession

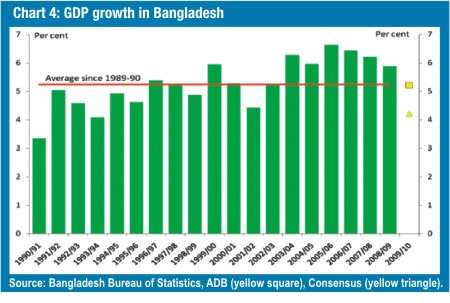

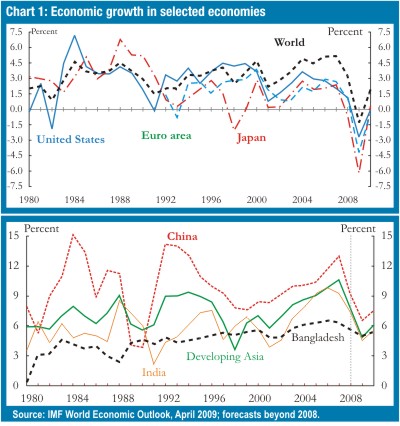

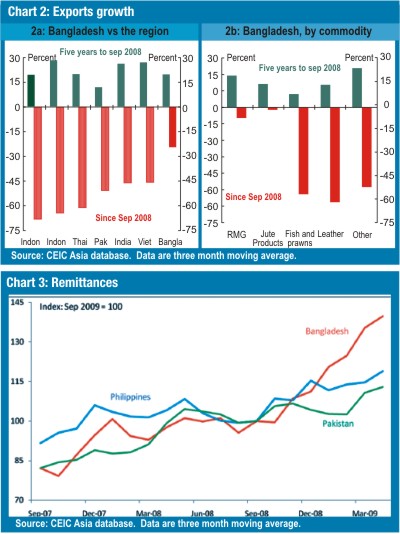

By the time this piece is read, the first budget of the Grand Alliance government will have been finalised. At the time of writing, it is not clear what the budget entails in terms of policy details. However, macro-economic conditions and outlook facing our policy-makers are relatively well understood. The budget will be brought down as the world economy passes through the most turbulent times since the era of silent movies. Pundits are calling the current slump the Great Recession -- perhaps not as dire as the Great Depression, but far worse than any recession since. The IMF's forecasts for the world economy are discussed first in this article. Then the focus shifts to Bangladesh: how have we managed thus far, and what are the forecasts for 2009-10? While Bangladesh has proved remarkably resilient thus far into the recession, a slowdown is nonetheless expected. More importantly, there are good reasons to think that the world economy will have markedly different contours when this recession ends, and our ability to grow strongly in the post-recession world may well require carefully crafted policy support. These are briefly explored in the final section. World economic outlook Then things changed dramatically in September 2008, when a large American bank (Lehman Brothers) failed and the largest American insurance company (AIG) was bailed out by the US government. In a matter of days, credit flows dried up and financial markets worldwide stopped operating as perceived counterparty risks spiked. In a matter of weeks, trillions were lost from global stock markets. No economy with external links -- large or small, rich or poor -- was spared. Confidence slumped. Households in the rich world stopped spending. And then the financial crisis hit the docks in the last months of 2008. Industrial production and trade plummeted. The world economy shrank by an annualised rate of 6¼ per cent in the last quarter of 2008, and then by a similar magnitude in the first quarter of 2009. While the crisis started out from the US housing market, the US economy hasn't been the By any reckoning, this has been the sharpest synchronised slowdown the world economy has witnessed since World War II. The IMF forecasts the global GDP to shrink by 1.3 per cent in 2009 -- the first contraction in the post-war era. Advanced economies are expected to suffer the most -- the US is expected to contract by 2.8 per cent, the euro area by 4.2 per cent, Japan by 6.2 per cent. The developing world will not be immune. China is expected to grow by 6.5 per cent in 2009, India by 4.5 per cent -- both half their 2007 rates. Major South-East Asian economies are collectively expected to record no growth at all this year. Developing Asia is expected to grow by only 4.8 per cent, compared with the 10.6 per cent recorded in 2007. Chart 1 shows economic growth in major advanced as well as key Asian economies. Chart 1 also shows that relative to our neighbours, Bangladesh is not expected to suffer as much. The IMF expects Bangladesh's economy to grow by 5 per cent in 2009, a modest slowdown from the 2007 rate of 6.3 per cent. Bangladesh economic outlook Consider exports first. Between September 2008 and February 2009, exports from Bangladesh fell by an annualised rate of less than 4 per cent -- while this is an unwelcome reversal from about 20 per cent a year growth witnessed in the recent years, it is still a significantly better performance than 70 per cent or so annualised fall in the East Asian region over the same period. Monthly exports figures are, however, highly volatile and often exhibit strong seasonal patterns. To mitigate against this, the data are often averaged over three months. When the smoother data are used, it appears that Bangladesh's exports have fallen, but by nowhere near as much as has been the case for our neighbours (Chart 2a). Fish and prawn, leather goods, and other products have driven the fall in export growth (Chart 2b). Ready-made garments (RMG), which account for nearly two-thirds of the country's exports, exhibit a much smaller fall than total exports in the months since the recession An even more sanguine picture emerges when we consider remittance. Since September 2008, remittances to Bangladesh have grown by 40 per cent -- far ahead of Pakistan and the Philippines, two other countries that depend on remittances (Chart 3). The tenacity of exports and remittances are reflected in the advance estimates of the national accounts, which show that Bangladesh's GDP is estimated to have grown by 5.9 per cent in 2008?09. While this is slower than 6¼ per cent or so averaged in recent years, this is, indeed, a mild slowdown compared with what is being witnessed around the world. However, a number of worrying signs are emerging. Such dark clouds suggest a further slowdown in GDP growth in 2009-10 -- the question is, by how much? The Asian Development Bank forecasts a GDP growth of 5.2 per cent in the next fiscal year, while Consensus Economics -- a collection of private sector forecasters -- expect growth of 4.2 per cent. Chart 4 shows the slowdown in historical context. The ADB assumes normal weather conditions, and expects buoyant agriculture growth to continue next year. However, both industry and services sectors are expected to grow at a more subdued pace -- the first reflecting weaker exports sector, the second because of weaker income and remittances growth. It's easy to show with some quick-and-dirty back-of-the-envelope sectoral calculation that under reasonable assumptions, GDP growth next year could turn out to be weaker than 4 per cent. The calculation is provided below. -If manufacturing exhibits zero growth, but the rest of the industry sector grows at the average post-1980s pace, then industry contributes to about ¾-1 percentage point. -A range of plausible assumptions -- the 1990s pace for trade and social services growth, stronger rate of growth for government services, and weak or flat growth for finance and business services -- suggest that the service sector could add about 2 per cent or so to GDP growth. That is, it is not too implausible that Bangladesh could experience the lowest rate of growth since 1990-91, when the country was buffeted by the first Gulf War, the anti-Ershad uprising, and a devastating cyclone. Of course, manufacturing could grow if there is domestic demand, and the service sector can contribute more than 2 percentage points to GDP growth if there is sufficient domestic demand. If these happened, a respectable 5 per cent plus growth in 2009-10 is also very plausible. Beyond the recession The recession has its source in excessive leveraging by the financial sector of the advanced economies. Even when a sense of normalcy returns, advanced economies' banks will not issue as many loans as they did in the pre-recession era. The de-leveraging process will lead to subdued credit creation and capital flows, prohibiting a strong recovery in business investment. This will have flow on effects on jobs and household income in the rich world. Meanwhile, overly indebted households in a number of advanced economies, faced with tighter credit conditions and a tougher job market, will tighten their belt. This consolidation of household balance sheet will mean a subdued demand profile for exports from the developing world. There is a risk that demands for the developing world's manufactures may also be hit by rising protectionism in the rich countries. With massive budget deficits and likely double-digit unemployment rates, governments facing re-election in the coming years may well find it easier to hide behind populist protectionism than enact tough fiscal consolidation.

In the post-war era, the most successful development model was to rely on manufacturing exports to the advanced world, use the income generated from the trade to invest in physical and human capital, and improve living standards. Even without protectionism, the de-leveraging process in the rich world will make this formula less feasible for Bangladesh. That is, even if Bangladesh survives the Great Recession relatively unscathed, economic development and poverty alleviation in the coming years will require innovative policy approaches. It will be interesting to see how the challenges ahead are reflected in the budget. 1. See here for detail: http://jrahman. Wordpress.com/2009/04/01/some-scary-numbers/. Jyoti Rahman is an applied macroeconomist. |

worst hit. That unfortunate fate befell the export dependent rich countries -- Japan's GDP has shrunk to its 2003 level, economies of Taiwan, Singapore, and Hong Kong have declined by 10 per cent or more, similar contractions are being experienced by Germany and Spain, while smaller European economies are shrinking by double digit rates. The developing economies have done slightly better, but only just.

worst hit. That unfortunate fate befell the export dependent rich countries -- Japan's GDP has shrunk to its 2003 level, economies of Taiwan, Singapore, and Hong Kong have declined by 10 per cent or more, similar contractions are being experienced by Germany and Spain, while smaller European economies are shrinking by double digit rates. The developing economies have done slightly better, but only just.  entered its most virulent phase. Before the recession hit, there was a lot of discussion about the Bangladeshi RMG sector being relatively less affected because the products are mainly sold in the relatively low-priced end in the rich world, a segment of the market has not done as bad as the rest of the economy -- the so-called Wal-Mart Effect, after the American retailer that specialises in cheap consumer items. Results thus far may have validated this thesis.

entered its most virulent phase. Before the recession hit, there was a lot of discussion about the Bangladeshi RMG sector being relatively less affected because the products are mainly sold in the relatively low-priced end in the rich world, a segment of the market has not done as bad as the rest of the economy -- the so-called Wal-Mart Effect, after the American retailer that specialises in cheap consumer items. Results thus far may have validated this thesis.