Inside

|

Terms of Trade

The global recession has produced two parallel shocks that have a bearing on Bangladesh's economic prospects in the coming years. First is the adverse demand shock that could stifle export growth over the near term, though export prices in general have held up so far. Next is the negative commodity price shock that is the consequence of depressed aggregate demand worldwide.

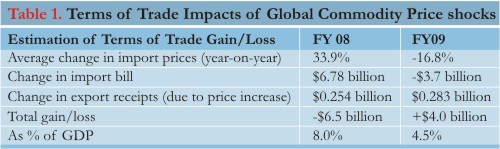

With imports making up 24% of GDP in FY08, and export prices holding steady, this translates into substantial savings for the economy, just as the commodity price spiral in the first part of 2008 resulted in significant additional costs. The net effect is a terms of trade gain or loss for the economy as a whole. In the jargon of international trade, terms of trade (or TOT) is the relative prices of a country's export to import. For an economy, a favourable terms of trade shock works like a positive income effect, enabling the economy to afford import and consumption of more goods and services. A negative TOT shock will have the opposite effect. The steep rise in fuel and commodity prices in the first part of 2008 presented Bangladesh with a significant adverse terms of trade shock which undermined its ability to finance imports and maintain macro-economic stability without infusion of budget support from multi-lateral agencies. That situation has been reversed following the onset of the global recession, which depressed prices of some of Bangladesh's major imports, such as fuel, fertiliser, edible oils, metals, and inputs for textiles and readymade garment sectors. This favourable reversal in its terms of trade can be put to good use as it prepares to cope with the fallout of the global economic crisis. The global crisis which originated in the financial sectors of the developed world ended up damaging the real sectors of their economies, shrinking production, investment, jobs and, ultimately, aggregate demand -- the engine that drives those economies. Today, like many other developing countries, the Bangladesh economy is deeply integrated with the economies of North America and EU, mainly through trade. Indeed, it is consumer demand in those countries that keeps the garment factories in Bangladesh churning out $12 billion of exports each year, and growing. That consumer demand is now under threat by the onset of the global recession. Though Bangladesh has stood up well during the first six months of the onslaught, which began roughly around September 2008, it is unlikely to escape unscathed in the coming months. Yet, for all the gloom and doom that might be emerging in the wake of the recession, there appears to be some silver lining for Bangladesh. True, depressed demand is hurting export-dependent developing countries. Bangladesh, though, could potentially ride out the storm in decent shape, provided effective measures are put in place before a major slowdown unfolds within the domestic economy. Several developments seem to work in its favour. It is being described as the "supplier-of-choice" when it comes to sourcing readymade garments (RMG), particularly in these depressed markets. Buyers recently find "value-for-money" in its low-cost production lines, compared to China, India, and Vietnam. Second, being focused on the low end of the apparel market, there is the benefit of the "Walmart effect" that has not only kept exports from plummeting but given it some impetus in tandem with the rise in Walmart sales. Third, contrary to most predictions, garment exports from Bangladesh have boomed in the post-MFA period, and the "Made in Bangladesh" seal is recognised in large and small retail outlets all across Europe and America. Drawing on the data from the World Bank's Commodity Market Review, we estimate that the extra import payments incurred as a result of the global price spiral was to the tune of $6.8 billion, which was roughly 8% of FY08 GDP. Against this was a modest gain from export prices which generated extra earnings of $250 million only. Among the commodities with the sharpest rise in prices were foodgrains and edible oils (70%), fertiliser (119%), and petroleum (51%). The reverse scenario presented itself in FY09, with the slump in commodity prices which translated into substantial savings in our import bill. The terms of trade gain or loss experienced by Bangladesh is presented in Table 1. For an economy, a favourable terms of trade shock works like a positive income effect, enabling the economy to afford import and consumption of more goods and services. For Bangladesh, the estimated terms of trade gain of $4 billion in FY09 or roughly 4.5% of estimated GDP for the current fiscal year will help cushion some of the trade related shocks that the economy is facing or will face in the coming months.

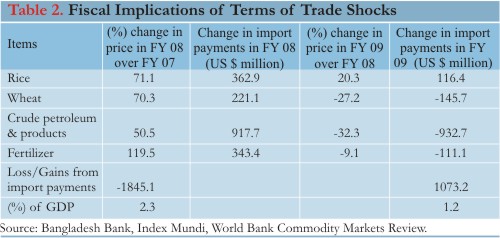

These terms of trade gains will not be limited to the improvement in the balance trade deficit, but will be showing up in: (a) increases in the current account surplus, (b) accumulation of foreign exchange reserves, (c) a lower budgetary deficit, and (d) budgetary savings that will create more fiscal space for additional public spending that might be warranted by deteriorating market conditions emanating from the global recession. Thanks to continuing growth of remittances coupled with strong export performance, the current account of the balance of payments has been in surplus for the past four years -- even in FY08, despite the huge negative terms of trade shock equivalent to 8% of GDP. This year, though exports and remittances have slowed lately, all indications are that they will end the year with a minimum of 12% and 20% year-on-year growth, respectively. Together with the terms of trade gains, it is no surprise that the current account has been increasing rapidly, and is expected to reach $1.1 billion by year end, which is equivalent to 1.3% of GDP, thus creating some space for any expansionary policy. Though, in a floating exchange rate regime, this should have resulted in the appreciation of the exchange rate, recent Bangladesh Bank intervention (buying US dollars) in the foreign exchange market, has kept appreciation at bay, resulting in the accumulation of official reserves, which could hit $7 billion by year end if the current trend persists. Terms of trade shocks also could have significant budgetary implications (Table 2). Budgetary outlays on food, fertiliser, and petroleum subsidies vary with changes in international prices of these products. In FY08, losses of Bangladesh Petroleum Corporation (BPC), which used to be financed off-budget, were brought into the budgetary fold. When all the extra costs due to price increases in FY08 are reflected in the budget, it adds up to nearly 8% of budget outlays or 2.3% of GDP. Likewise, there are extra savings from the positive terms of trade shock in FY09, which create fiscal space amounting to 6% of outlays, or 1.2% of GDP.

Fiscal and external space for policy response What are the policy options? Developed countries have addressed the crisis with financial, monetary, and fiscal policy packages. Most recent measures are the fiscal stimulus packages adopted by the G20 developed and emerging market economies. The emphasis in the two G20 summits has been on global co-ordination of the counter-cyclical stimulus packages which are expected to turn things around in roughly two years, if the plans prove effective. While the fiscal stimulus packages around the world add up to about $2 trillion (roughly 3% of global GDP), additional actions to boost resources with multi-lateral agencies like the World Bank and IMF could make another trillion dollar of funding available for emergency support to affected economies. Does Bangladesh need a stimulus package to boost its own level of economic activity? If so, what size is appropriate and within sustainable limits? To answer these questions, one will have to be judgmental and resort to some presumptions about near-term macro-economic outlook as the global fallout from the economic crisis takes concrete shape. The transmission channel by which the global crisis is having an impact on the Bangladesh economy has been ascertained: it is through trade and export dependence as well as its reliance on remittance from migrant workers. It is also evident that non-RMG exports have suffered a bigger setback while remittance and RMG exports have experienced deceleration in their growth rates in the last quarter of FY09. We figure exports and remittance will likely end the year with an annual growth performance of 12% and 20%, respectively, which could still be counted among the best performance for a developing country under the current circumstances. As such, the government's interim stimulus package of Tk. 340 billion looks like a measured and appropriate response. Some fine-tuning of the allocations in light of claims from the textile and garment sectors would help tide over the last quarter of the current fiscal year without a major problem. Therefore, we believe the primary focus of the government should be to formulate a contingent plan within the remit of the forthcoming budget to address any decline in exports or remittances, which might lead to slowdown in general economic activity at home. The Keynesian jargon for describing the typical stimulus package in developed countries is "counter-cyclical policy." But such a policy serves as a bulwark against a recession -- actual decline in output. Bangladesh faces a possible deceleration in output growth, not a decline. A stimulus package would help restore growth momentum, not alleviate a recession.

As such, the appropriate description for a stimulus package would be an expansionary policy. This is not merely a matter of semantics but helps to draw a distinction between the contexts in which policy responses are carried out in developed and developing countries facing the global crisis. Appropriateness of the size of the stimulus package that could be embedded in the FY2010 budget depends on the expected severity of the impact on Bangladesh in coming months on the one hand and the fiscal and external space that the economy can muster during the year. By default more than by design, there seems to be some fiscal space in the budget for accommodating a modest stimulus package within the realms of macro-economic sustainability. In the absence of any fundamental reform of tax laws and administration, revenue effort appears behind comparator countries and will remain so for the short-term at least. Although revenue mobilisation has shown no signs of improvement (except for FY08 due to the vigorous anti-corruption drive by the CTG), significant shortfalls in ADP implementation year after year has left the fiscal deficit in the comfortable zone of 3-4% of GDP for the past five years where the sustainable deficit is estimated to be around 5%. Even domestic financing has remained within the non-inflationary limits of 2% of GDP. Add the terms of trade gain of roughly 1% of GDP, that would create fiscal space of at least 2% of GDP for a proper fiscal stimulus, should that be needed.

On the external front, the balance of payments has been running current account surpluses for the past four years and is showing signs of trending upwards of 1.5% of GDP, thanks again to the positive terms of trade shock. With a sharp slowdown of imports over the next six months, even sluggish export performance next fiscal will yield a similar current account surplus. It is relevant to note that these current account surpluses also reflect the phenomenon of under-investment that has beleaguered the economy for more than five years running. Gross domestic investment, at 24% of GDP, currently falls short of gross national savings by as much as 5% of GDP. With the ADP framework faltering, the PPP framework for infrastructure investments now being floated sounds like a novelty that has legs to stand on. At least for the first half of the next fiscal year, PRI projections indicate trade and current account balances moving in the same direction as in the current year, i.e. on the plus side. Consequently, foreign exchange reserves -- currently around $6 billion (barely three months' projected import bill) -- are set to rise beyond $7 billion, if the balance of payments stipulations hold. In these circumstances, any depreciation of the taka appears unlikely without deliberate intervention of the central bank. To sum up, acknowledging that, in light of the impending consequences of the global recession on our economy, a stimulus package is warranted in the forthcoming budget, it would be prudent to keep it within the sustainable limits of combined fiscal and external space presented by our economic circumstances. Dr. Zaidi Sattar is Chairman, Policy Research Institute of Bangladesh. Research support was provided by PRI's Rubaiya Zaman. |