Inside

|

The Good, the Bad and the Uncertain

SYEED AHAMED evaluates the pros, cons and everything in between of the annual budget.

Fiscal year 2009-10 (FY2010) successfully moved from recession to recovery [1], and budget for FY2011 aimed to move from recovery to expansion [2].

The economy did experience an expansion with a 6.7% GDP growth in FY2011. During this period, the large and medium manufacturing industries grew by 10.4 %age point, and export earnings registered a 41.6% growth (Jul-May FY2001).

On the other hand, the economy also experienced a high inflation rate (10.7% in April 2011), high growth in broad money supply (23.5% on March 2011), and an increase in government borrowing from the banking system.

The economy is set to achieve a 7% GDP growth in FY2012. In order to sustain this growth pace, the economy now needs to move from expansion to sustainability. It is in this context that the Finance Minister has placed the new budget for FY2012.

This article reviews the budget proposals to identify the good, bad and uncertain areas from a macroeconomic perspective.

The Good Poverty and inequality

Following the previous two years' trend, the budget proposed a number of social safety net programmes to pursue the government's election promise of reducing poverty and inequality [1].

An amount of Tk 22,556 crore was allocated for various social safety net programmes in FY2012 which is 8% higher than previous year's allocation and 13.8% of this year's total budget outlay. However, when resources are limited, budget financing becomes a zero-sum game. Hence the allocation for some social safety net programmes were rationalised to finance and subsidise the all out efforts to revive the power sector. But even then, within the power sector, rural electrification was given the due priority with new programmes to install solar power system, new power plants and transmission lines.

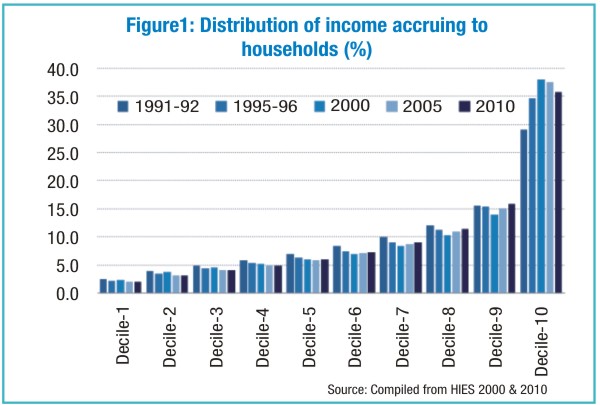

The last two budgets' focus on poverty reduction seems to have been complemented by the findings of the Household Income and Expenditure Survey 2010 (HIES 2010). According to HIES 2010, population living below the poverty line has decreased by 8.5 percentage points since 2005, while income inequality, measured by Gini Coefficient, also decreased marginally.

Figure 1 illustrates the income distribution of the country by dividing the households into 10 equal groups (deciles) according to their income. The income share of bottom 50% of the households decreased steadily from 24.5% in 1991-92 to 20.3% in 2005. According to HIES 2010, the situation remained unchanged during the past five years for the lower income groups, though the upper middle class households did acquire a marginal share of income from the richest decile. While crediting this government for improving the poverty situation between 2005 and 2010, one should keep in mind that two other successive governments were also in power during this period.

Balancing ADP failures

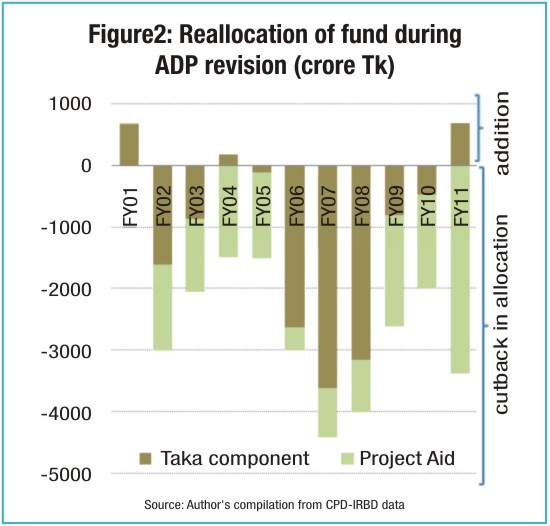

The failures of various ministries (including power, health and transport) to implement foreign aided projects resulted in the withdrawal of Tk 3,370 crore of foreign aid from the total ADP allocation for FY2011.

The Finance Minister, however, responded aptly during ADP revision by allocating an additional Tk 700 crore and reshuffling the allocations of taka component to substitute some of the losses incurred by project aid cut. Particular emphasis was given to important ministries such as Power and Transport during the fund reallocation. After many years, the revised ADP experienced a net increase in taka allocation in FY2011, despite the cutback in project aid (figure 2).

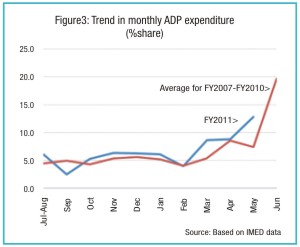

Figure 3 shows the trend in monthly ADP expenditure where only one third of the total ADP allocation is spent during the first eight months of the fiscal year, causing a last moment spending frenzy during the last two months. Though the government failed to get rid of this last quarter syndrome of ADP expenditure, FY2011 showed as improvement from the average performance of past years.

The size of the ADP as percent of GDP came down from 6.4% in FY2001 to only 3.2% in FY2009. Though total ADP expenditure for FY2011 fell short of target, the revised ADP for FY2011 still sits higher at 4.5% of GDP. To further accelerate the public investment, the target ADP for FY2012 has been set to be around 5.1% of the GDP.

The Bad Foreign aid

The Bad Foreign aid

The quantity and composition of foreign aid has changed to a great extent over the past decades. Between FY1991 and FY2010 -- foreign aid has further moved from grants to loan as the share of grants in total aid disbursement declined from 48.0% to only 28.7%; and sources have turned multilateral as the share of bilateral aid declined from 39.3% to 16.3%. During the same period, share of food aid declined from 15.5% to only 4.2% and share of commodity aid came down from 23.6% to nil.

Consequently, the share of foreign resources in deficit financing has gradually declined from 79% in FY1993 to only 36% in FY2010. In this context, the budget for FY2011 aimed to finance 40% of its deficit through foreign financing. However, net inflow of foreign aid registered a negative growth of 38.5% during the first three quarters of FY2011. Net flow of foreign aid declined from USD 1271 million in FY2010 to USD 1271 million in FY2011 during this period. Hence, according to the revised estimate for FY2011, foreign aid could only finance 29% of the total budget deficit. In the absence of budgetary support, project aid is the major source of foreign aid now. Hence, failure to utilise the available project aid of Tk 3,370 crore in FY2011 has turned far more problematic than ever before. To substitute the decline in foreign aid, the Finance Minister had to opt for high government borrowing to support the public investment. But that is going to have a negative consequence for the overall economy (discussed later).

Blackening the white money

While the government failed to invest TK 3370 crore of available foreign aid in FY2011, it continued the black money whitening scheme, apparently to address the lack of investment in the economy.

The prevalent arguments for whitening the black money have been -- a. money whitening schemes will increase investment in the national economy, and b. revenue earned from the scheme will help formalise the informal economy and increase government's revenue earnings.

Now, let's see how the past schemes performed in this regard. We do not assume that the advocates of such schemes have a fine moral compass. Hence, in this, we assume that economics is not a morality play and the issue of black money should be analysed from a pure material perspective.

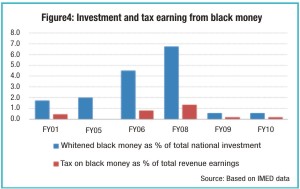

The black money whitening scheme was introduced by the military government of 1976 and was most successful during the last quasi-military caretaker regime (2007-08). Figure 4 shows the contribution of whitened black money in investment and revenue earnings. During FY2001 to FY2010, total revenue earnings accrued through money whitening schemes accounted only 0.47% of national revenue earnings. After the short-lived success of 'fear factor' during the caretaker regime of 2007, revenue earnings through money whitening schemes have come down to only 0.15% during FY2009 and FY2010. Similarly, total black money whitened during FY2009 and FY2010 accounted only half a percent of respective year's total national investment. Hence the investment-revenue arguments in support of black money whitening schemes appear unfounded.

The black money whitening scheme was introduced by the military government of 1976 and was most successful during the last quasi-military caretaker regime (2007-08). Figure 4 shows the contribution of whitened black money in investment and revenue earnings. During FY2001 to FY2010, total revenue earnings accrued through money whitening schemes accounted only 0.47% of national revenue earnings. After the short-lived success of 'fear factor' during the caretaker regime of 2007, revenue earnings through money whitening schemes have come down to only 0.15% during FY2009 and FY2010. Similarly, total black money whitened during FY2009 and FY2010 accounted only half a percent of respective year's total national investment. Hence the investment-revenue arguments in support of black money whitening schemes appear unfounded.

It is often argued that money whitening schemes bring the informal economy into formal accounting and discourage capital flights.

Black money is the undisclosed income that dodges income tax and can be earned both legally and illegally. Black money does return to the local economy -- either through consumption or through direct investment. However, unless the government legalises all sorts of illegal dealings, money whitening schemes will not be able to bring the illegally obtained earnings into the formal economy.

Instead, the scheme may cause an expansion of black money. Under the current system, a person with an annual income of Tk 50 lakh needs to pay Tk 11.05 lakh (Tk 11 lakh for female tax payers) as income tax. However, if (s)he can turn that earnings into black money without paying any income tax in the first place, (s)he can enjoy the benefit of money whitening scheme only paying Tk 5 lakh as tax, i.e. less than half the regular income tax. Hence, the system may encourage people to blacken their white money to obtain tax concessions.

The Uncertain Energy and power

The first set of uncertainties emanates from the standoffs in energy sector as regard the methods of coal extraction and treaties of gas exploration. Mining and quarrying of natural gas and crude petroleum registered a mere 1% growth in FY2011, against an average growth of 8.6% during the period of FY2006-10.

In the absence of alternative energy sources, most of the new power plants are now being designed to depend on imported diesel or furnace oil. The share of furnace oil and diesel in total fuel supply for electricity generation has increased respectively from 2.81% and 1.75% in 2010 to 4.71% and 6.82% in March 2011. The share of imported oil will further increase after the completion of the ongoing projects.

Since import of oil is heavily subsidised, this is increasing the government's subsidy requirements. Subsidy in power sector has already increased by more than threefold from Tk 994 crore in FY2010 to Tk 4200 crore in FY2011. A further 24% increase in power sector subsidies has been planned for FY2012. Growing subsidy requirements will increase the government's borrowing needs and further aggravate the deficit financing problem.

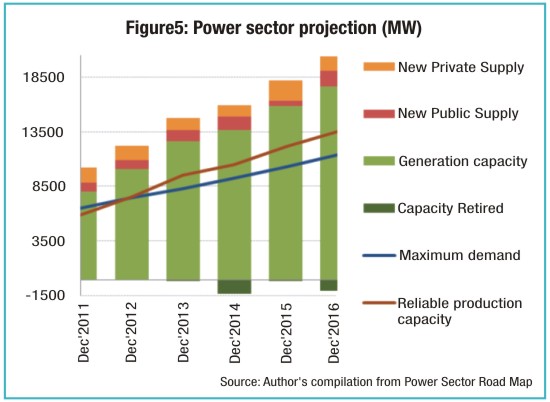

The second set of uncertainties emanates from the privatisation of power generation. The power sector Road Map plans to increase the share of private sector in total power generation from 40% in April 2010 to 58% in 2016. However, early experience of this privatisation hasn't been encouraging.

The government envisaged the installation of high-cost liquid fuel based peaking plants in the private sector as a short to medium term solution; until gas and coal based large projects get operational by FY2014. The government bypassed the tender process while assigning these projects arguably to fasten the implementation process. However, delays in implementing these private sector projects have failed to mitigate power crisis in the short term and jeopardised the purpose of tender-less contracting. Many of the quick rental plants are already facing technical difficulties and are failing to generate power at the agreed capacity. Hence, a growing share of these private sector power plants (figure 5) may create more uncertainties in the power sector.

Debt and deficit financing

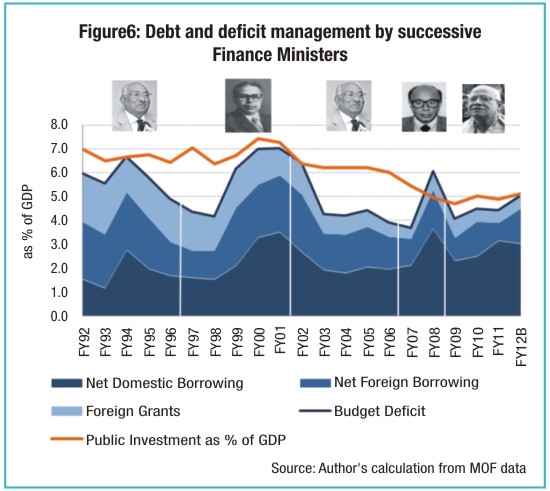

In order to understand the growing uncertainties in debt management, figure 6 illustrates the debt and deficit management under successive Finance Ministers of the past two decades.

It seems the BNP persistently pursued a 'low-public investment and low budget deficit' stance while AL's stance has been 'high-public investment and high budget deficit'.

After coming to power in 1991, BNP managed to bring down the budget deficit from 6% in FY1992 to 4.9% in FY1996. However, public investment as percent of GDP also came down from 7% of GDP in 1992 to 6.4% in FY1996. The succeeding AL government stopped the slide in public investment, keeping it around 7% of GDP. Consequently, budget deficit escalated from 4.4% in FY1997 to 7% in FY2001. Budget deficit was again brought down to 3.9% of GDP by the next BNP government, though public investment dropped to 6% of the GDP.

Owing to internal political and economic uncertainties, the caretaker government of 2007-08 witnessed an unusual situation with a sharp fall in public investment and increase in budget deficit.

Evidently, the incumbent AL government is now returning to its high-public investment & high-budget deficit stance. Since domestic credit has become the major source of ADP financing, such transition would be harder this time.

The problem with domestic credit is threefold:

The problem with domestic credit is threefold:

a. borrowing from Bangladesh Bank would be inflationary and the government is in no position to worsen the already high inflation rate;

b. borrowing from private banks would put pressure on the credit market and crowd out private sector investment; and

c. borrowing from non-Bank sources would be very expensive and create long-run fiscal burden.

Plus, domestic credit is more expensive than foreign borrowing. For instance, interest rate of a five year treasury bond that is scheduled to get matured in 2013 is 10.6%, whereas interest rates of most foreign loans are below 0.5%.

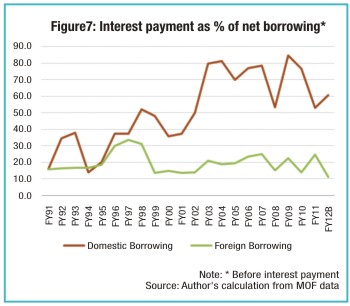

Meanwhile, government's domestic debt liabilities are reaching an alarming level. Figure 7 shows the annual interest payments of the government with respect to net borrowing (i.e. gross borrowing minus debt repayment). During FY2001-10, for every 100 taka net loan from the domestic sources, the government used to pay only 33 taka as interest. In FY2009, the government had to pay 84.5% of its net borrowing as interest payment. If the ratio reaches 100%, the government will be in a debt trap when it will have to take debt only to repay the debt.

Hence, debt management remains as the biggest uncertainty of this year's budget. And all other issues -- from ADP implementation to power subsidies -- are linked with it.

A spectre of debt liabilities is haunting the national economy. To mitigate this looming crisis, the Finance Minister needs to negotiate for more foreign aid to reduce pressure on domestic borrowing, properly utilise the available project aids to keep up the public investment, and rationalise electricity price to reduce subsidy requirements.

Notes:

[1] See “The Good, the Bad, and the Uncertain”, Forum, July 2010

[2] See “The Good, Bad and the Uncertain”, Forum, July 2009

Syeed Ahamed is a public policy analyst and a member of Drishtipat Writers' Collective. He can be reached at ahamed.syeed@gmail.com