Inside

Original Forum |

| Causes of RMG unrest -- Refayet Ullah Mirdha |

| Who Pushes the Price up? -- Asjadul Kibria |

| Padma Bridge: Dream vs reality -- Mohammad Abdul Mazid |

Self-financing Padma Bridge -- Nofel Wahid |

| Unaccountability in Private Medical Services -- Mahbuba Zannat |

Medical Waste --- Mushfique Wadud |

Abysmal state of Emergency Medical Services |

On Clinical Negligence -- Eshita Tasmin |

The Population Growth Conundrum -- Ziauddin Chowdhury |

| Rohingyas and the 'Right to Have Rights' -- Bina D' Costa |

| Two-State Solution: Israeli-Palestinian Peace -- Dr Kamal Hossain |

| Forms of Government -- Megasthenes |

A Letter from Alghamdy and War Crimes Trial |

Self financing Padma bridge

Nofel Wahid argues that building the Padma bridge with the government's own money is feasible and economically viable as well.

Shakespeare wrote in Macbeth, 'Life is a tale told by an idiot, full of sound and fury, signifying nothing.' Funnily enough, you could say the same about the politics of development in Bangladesh. It is hardly a surprise that the World Bank's cancellation of the Padma bridge project has created so much 'sound and fury.'

What is not sound and fury though is the fact that we do not need WB loans to build the Padma Bridge. The government has announced that the Padma bridge will cost Tk 23,000 crore over 4 years. This year's budget forecasts show that the total Annual Development Program (ADP) budget for the next 4 years is expected to be more than Tk 300,000 crore. In other words, the Padma Bridge will cost about 8% of the ADP budget.

The simple fact of the matter is that the government can finance this bridge from the ADP budget alone. However, ADP financing of the bridge will make it relatively expensive because our ADP budgets are mostly financed through direct government borrowing from the banking sector at interest rates of up to 11-12%. It will definitely be more expensive than the 0.75% concessional interest rate that the WB was offering on its loan.

If the cost of financing matters a lot, it begs the question: why does the government even bother having its own development agenda? If the ADP budget is deficit-financed at high interest rates, and donors can implement the same projects at a cheaper rate, why isn't the entire ADP budget outsourced to donors? Now that is a question worthy of an idiot!

This much is obvious -- if the government is going to finance its own development budget, regardless of whether the interest rate it pays is 1% or 11%, the government might as well build the bridge with ADP money. And if the Padma bridge is not a high priority development work, I do not know what is.

That said, I must admit that financing the entire project from the ADP budget is not the best idea in the world. Some portion of it can be ADP-financed, but definitely not all of it. There are significant benefits to be had from using other funding sources. Issuing sovereign bonds in the local market (including zero-coupon convertible bonds), and subsequently allowing those bonds to be traded on a secondary market will help create a more liquid sovereign bond market in our country. That in turn will enable the development of a vibrant corporate bond market, lowering the cost of funding as well as systemic risk for local businesses that are currently over-reliant on bank borrowing.

Furthermore, deeper bond markets will provide greater investment choices to investors, which can help prevent the kind of price bubble we saw in the stock market a couple of years ago or are experiencing currently in the real estate market. The essential point is: raising funds from the local capital market will lead to a number of wider benefits.

However, this line of argument is also not without its critiques. One such critique is that this project will require a large amount of foreign currency, which will be costly to attain if the funds are raised locally and then have to be converted into foreign exchange. That is no doubt a valid cause for concern, but one that is prone to exaggeration.

Let us crunch some numbers on this. It has been reported that 60-70% of the project cost will be in the form of imports of capital machinery, materials, consultancy services etc. With the total project cost estimated to be Tk 23,000 crore, let us assume that the import cost will be Tk 16,000 crore (about 70%) over the next 4 years. That translates to a Tk 4,000 crore annual increase in the demand for US dollars.

In other words, all other things held equal, our trade deficit will rise by Tk 4,000 crore due to higher imports to build the bridge. Well, let us put things into perspective. In the first 9 months of the last fiscal year (2011-12), we imported Tk 220,956 crore worth of goods and services. That means the increase in US dollar demand from Padma Bridge-related imports would be equivalent to only 2% of the import demand for foreign exchange in the last fiscal year.

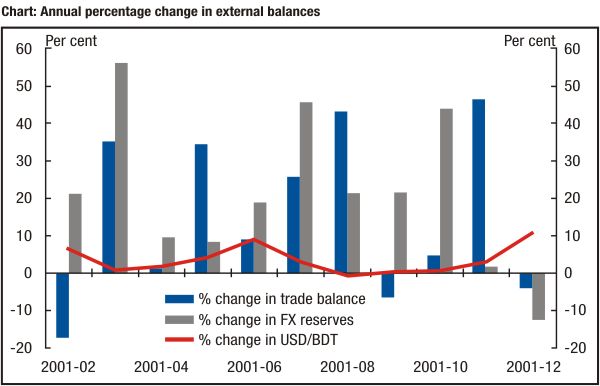

What impact will a 2% increase in the trade deficit have on the exchange rate? Perhaps the chart below can help with the answer. It shows the annual percentage change in the trade deficit, the foreign exchange reserve balance and the US dollar-taka exchange rate for the last 10 years.

A 2% increase in the trade deficit would hardly register on that chart. Our trade deficit fluctuates a lot every year. In FY 2010-11, the trade deficit rose by 46%. And yet, the exchange rate only depreciated by 3%. The reason for that is because up until recently, the Bangladesh Bank (BB) used to maintain a pretty tight dirty float, which basically means that BB did not allow the exchange rate to fluctuate very heavily.

More recently, in the last fiscal year, the exchange rate depreciated by nearly 11%, even though the trade deficit actually fell by 4%. The reason for the depreciation is, as the chart shows, our foreign exchange reserve balance fell by 13%. It was the reason why BB borrowed $1 billion from the IMF, essentially to avert the mini balance of payment crisis at the time. In any case, the important point to note here is that a 2% increase in the trade deficit will hardly cause a ripple as far as the balance of payment situation goes. So concerns that converting locally-raised Padma funds in to foreign exchange is going to precipitate a balance of payment crisis is highly exaggerated, to say the least.

All things considered, I do not think it is unreasonable to conclude that we are capable of financing the Padma Bride on our own. That said, financing a bridge and implementing a project of the sheer large scale and complexity as the Padma bridge are two different things. So let us address the real elephant in the room. Does the government have the institutional capability to deliver this project?

A project of this size will undoubtedly require the implementation of lots of other side projects, such as dredging the river, river training, construction and maintenance etc. Does the government have the managerial capability to put all the little bit and pieces together? It is tempting to think that donor involvement might actually be useful under such circumstances, purely from a management point of view. One cannot help but imagine -- what could possibly go wrong if the World Bank supervised the project like a strict headmaster?

A look at our past experience with the Jamuna bridge might be useful at this point. The Jamuna bridge was completed in 1998 at a total cost of $696 million. The WB, ADB and OECD between them donated $600 million for the project, and the Government chipped in with the rest. The bridge was built by Hyundai, one of South Korea's biggest conglomerates, that is no doubt well-known for their very safe cars. By the mid-2000s, just a few years after construction, cracks appeared on the bridge. An investigation by BUET engineers (see link) found that the cracks were partially caused by Hyundai's faulty design, as well as the unregulated use of the bridge by excessively heavy trucks. At the end of the day, both causes are really the fault of past governments.

And what about the other half a dozen smaller, but important bridges that have been built since that time? How well are those bridges being maintained? Going back to the example of the Jamuna bridge, the fact that the bridge design was faulty, even for a project that was heavily supervised by donors, points to a simple fact. There is no substitute for the government doing its job honestly and properly. No amount of donor paperwork and process of checks-and-balances will excuse the government from its duty to conduct due diligence. The government is the final arbiter of its own interest, and it has to perform by building the Padma bridge on time and without cutting any corners.

Am I being too naïve with my expectations? Possibly! Here again, our past experience with the Jamuna bridge is telling. The Jamuna bridge was first proposed by the late Maulana Bhashani in 1949. The first feasibility study of the bridge was not done until 20 years later in 1969, with the study estimating the cost to be $175 million. Following liberation, a new feasibility study conducted by the Japanese donor agency, JICA, concluded that the bridge would not be economically viable, so the project was dropped.

It was then revived by the administration of General Ershad in 1982, with Mr Muhith as the General's then finance minister. The bridge design was changed and the new estimated cost stood at $420 million. The Ershad administration even went as far as raising Tk 500 crores in funds through surcharges and levies. But it failed to start construction, which subsequently began under the BNP government in 1994 and was completed by the AL government in 1998, at a cost of $696 million.

It took us 49 years and a 300% cost blow-out (mostly due to inflation) to implement Maulana Bhashani's proposal. Surely, a Padma bridge that takes us 25 years to build and only has a 150% cost blow-out is a measure of progress, no? That might be a bit of rhetorical sound and fury signifying nothing, but what is not insignificant is that we have the money to build this bridge.

The Government should stop spinning tales and just get on with it.

Nofel Wahid is applied economist and can be contacted at wnofel@gmail.com.