|

||

On a sustainable development trajectory -- Mohammed Farashuddin Steering the economy in 2010 -- Professor Mustafizur Rahman Food Prices and Security Exploding myths, highlighting lessons -- Rizwanul Islam Rising inequality takes shine off growth --M M Akash Rural financing ~ the innovative way -- Khondkar Ibrahim Khaled Participation and representation key to pro-poor planning -- Fahmida Khatun Why list on a stock exchange? -- A.F.M. Mainul Ahsan Pushing agriculture forward -- Dr. Quazi Shahabuddin Policy choices in the FDI domain -- Syeed Ahamed Capital market window to faster growth -- Abu Ahmed Regional Connectivity-Indo-Bangla initiative -- Dr. M. Rahmatullah Foreign banks' lively role -- Mamun Rashid Why regulatory reforms? -- Zahid Hossain Energy management issues -- M. Tamim Jute bubble, lest it bursts! -- Khaled Rab Climate Change Policy Negotiations-Can Bangladesh play a leading role? -- Dr. Saleemul Huq Copenhagen and beyond --Dr. Atiq Rahman Save Bangladesh, save humanity -- Dr A. M. Choudhury For a human rights-based approach -- Dr Abdullah Al Faruque Gender dimension to policy on disaster management -- Mahbuba Nasreen Rainwater harvesting -- Dr. Manoranjan Mondal Environmental degradation and security -- Dilara Choudhury Climatic impact on agriculture and food security -- Prof Zahurul Karim PhD Monoculture destroys coast and forests --Philip Gain Towards a strong adaptation strategy -- Md. Asadullah Khan Biodiversity conservation: Challenge and opportunity -- Mohammed Solaiman Haider Grameen Shakti's renewable energy role -- Abser Kamal

|

||

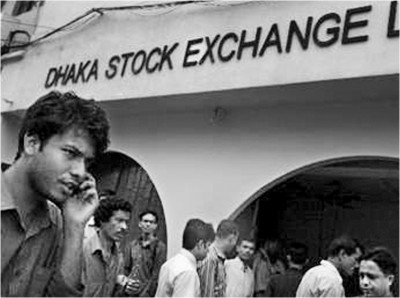

Why list on a stock exchange? A.F.M. Mainul Ahsan

There is a total of 1,25,929 firms listed with the office of the Register of Joint Stock Companies and Firms in Bangladesh. Among 1,25,929 firms, 81,888 are private companies, 1,417 are public companies, 125 are foreign companies, and 32,295 are partnership firms. However, only about 266 firms are listed on the Dhaka Stock Exchange (DSE). So it's clear that firms have neglected the fact that getting listed on the stock market could be tremendously beneficial to their business in the long run. What could be the benefits of going public? A need for low-cost capital should be the main motive for a company to get listed on Stock Exchange, for instance, Dhaka Stock Exchange (DSE). Stock market listing is one of several sources of capital leveraging, but also happens to be one of the widest and most accessible forms of investment for both investors and businesses. A listing on the burses allows a company to raise capital and use it to finance investment and expansion or even to pay off existing debt. The primary gain of raising capital from the market is that it eliminates a number of intermediation expenses apparent in the other forms of capital raising. As a result, the market endows companies with capital at a cheaper cost. For example, for a long-term industrial loan, a firm might has to pay more than 15% as interest, where a 10% dividend in the DSE is considered a modest return in the stock market, and thus the firm will be able to save 5% on the cost of the capital. And, a lower cost of capital leads to higher market value for the firm. Even after getting listed, a company can further boost up capital from the market, through the issue of fresh securities such as rights issues or through the issue of a new nature of securities. By getting listed on a stock exchange, a company will gain market exposure to a broader membership of the financial community. And, the superior profile, tied with larger lucidity, could add to the company's capacity to have access to traditional sources of capital in significantly reduced price. Hence, a listed company can access to all sort of capital with minimal cost compared to a private company not listed on the stock exchange. Furthermore, being listed on the DSE or in a stock exchange means that a firm has met required standards set by the proper authorities, e.g. Securities and Exchange Commission (SEC). This can add credibility to a business through positive customer perception of value in a company and its products. Research shows that presence in a burse enhances consumer awareness, confidence, and also improves a company's corporate standing. Also, in addition to the credibility resulting from the indirect endorsement from the listing, the stock exchange puts forward companies a right of entry to a wide-ranging and mounting investor base, which contains both entity investors and plentiful domestic and foreign institutional investors. This enables the company to embark on expansion of the companies activities and grow in the future in domestic and foreign market. Listing is likely to enhance the visibility and recognition of a company that may help product identification and the marketing efforts of the company. Visibility refers to the extent to which analysts follow a firm's stock, and the amount of a firm's news coverage. Listing on DSE or any other stock exchange facilitates companies to ascertain a price for their shares since it can be traded in the stock exchange and has a performance signal as opposed to a private company not listed. If a company perform well in its business arena, price of it shares will increase, and vise versa. For instance, though Singer Bangladesh's net asset value per share is Tk.279, market price for its share is Tk.2,973! In case of square Pharmaceuticals Ltd., market price for each share is Tk.3,065 while net asset value per share is Tk.905. Because of weak form efficiency of DSE, firms on Dhaka Stock exchange could get over-valued even though they perform poorly! Because of lock-in rule, i.e., restrictions on selling entrepreneur's existing shares for 3 years, immediate cash-out is not allowed in Dhaka Stock Exchange (DSE). After lock-in period, entrepreneurs of the firm can take their money out of the firm and invest in another opportunity, if they want to. In addition, you can motivate employees offering extra incentives by granting share options since owner feel much more obligation than an employee. Moreover, having your firm traded on the DSE or any other stock exchange gives you greater potential for acquiring other businesses, because you can offer shares as well as cash. So, your firm's shares will also work as a form of currency to acquire other potential businesses. An equity listing may also help in improving the relationship with the government and financial community. A listing on a burse can also give the impression that the company is a major player in domestic business and will enhance the prestige and valuation of goodwill of the company. A listed firm has the opportunity to be included in an index, for instance, DSE 20 index. Portfolio managers typically invest pooled funds into a portfolio with the same weighting, which undoubtedly creates additional demand for the shares of the company and thus increases the price of the shares. Also, being included in an index raises an issuer's visibility and profile, and can improve investor awareness. If you are still not convinced to get listed on the DSE or on a stock exchange, here is another one: the income tax rate differential between listed and non-listed companies is 10 percent. According to the budget statement 2009-10, publicly trading companies are paying 27.5% tax whereas non-public companies are in 37.5% tax bracket. It is true that listed firms will be subject to intense rules and regulations by different government agencies, for instance, SEC. When a company moves from private ownership to public, much information must be disclosed, for instance, salaries, transactions with management, sales, profits, competitive position, mode of operation and other material information. However, increased disclosure could be a blessing since it increases transparence within the firm. Greater transparency increases the willingness of international and local investors to commit capital. Moreover, the enhanced transparency may influence value through pure cash-flow effects by reducing agency costs. For instance, transparency reduces the potential diversion of a firm's cash flows to managers and controlling shareholders, and, as a result, increases value of the firm. Therefore, the higher the agency cost, the more the potential benefit from disclosure. Since agency cost is much higher in the government owned firms, benefits from listed on the stock exchange will also be higher for those firms. However, going public is costly both in terms of money and time. Costs related to legal, printing, audited financial reports to shareholders, public relations, and manpower devoted to preparing for a public offering can be substantial. Red-tapism in government offices in Bangladesh is another hassle. Moreover, after getting listed on a stock exchange, management of the company may lose some flexibility in managing the company's affairs, particularly with actions, which require shareholders' approval. Some might say that negative news about the stock market on the media, and manipulation extravaganza of 1996, mainly influence firms not to get listed. However, I found it fascinating that the main reason is most businesses are unaware of benefits of getting listed in the stock market. However, truth is benefits of getting listed on a stock exchange enormously out-weigh costs. One might ask that why his firm should get listed in a Bangladeshi burse instead of in a highly liquid market like India, London or NYSE. While stock markets in the developed part of the world is still either struggling or on a recovery stage, stock markets in Bangladesh are doing pretty good. For instance, since October 2007, Dow index declined 25%. However, in 2009, DSE General Index rose 59%, and DSE 20 indexes went up 12%. According to the International Monetary Fund (IMF), group of seven rich countries is expected to show a 1.3% rise in gross domestic product in 2010, compared to 5.1% economic growth in emerging economies. Investors see the BRIC markets, i.e. Brazil, Russia, India and China, as oversaturated and overpriced. Instead, they are looking for other markets in which to put their money to work. Surely emerging markets like Bangladesh are going to be the next destination of those concerned investors. It is obvious from the above discussion stock exchange listing of a company has many durable benefits to the company in terms of its potential to grow and expand than a private limited company. Listing a firm on an exchange is a great idea for a business seeking improved market awareness, greater potential for capital investment, enhancements to brand equity and negotiating influence etc. However, listing on an exchange should probably be in line with or in accordance with business strategy, otherwise the listing may be premature or unnecessary. The author is a PhD Student, Texas Tech University, Texas. |

||

© thedailystar.net, 2010. All Rights Reserved |