FDI in Bangladesh

Mamun Rashid

|

Photo: SK Enamul Haq |

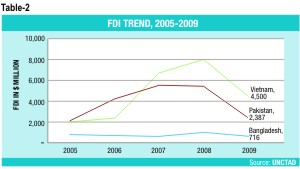

"Pakistan could learn about economic growth and confronting terrorism from its former eastern province.”-said Sadanand Dhume, columnist for The Wall Street Journal in his article titled Bangladesh, 'Basket Case' No More. Yes, our real GDP growth rate has been higher than that of Pakistan since 2006. Whereas we maintained a steady 6% level with slight ups and downs, Pakistan's growth rate faltered from 7.7% of 2005 to 3.7% in 2009 (Source: World Bank) and portrays a consistently declining trend. Still Pakistan could attract USD 2387 million FDI inflows in 2009 and our share was a USD 716 million, almost one third of Pakistan (Source: UNCTAD). Vietnam is an economy more comparable with Bangladesh in terms of size and other macro-economic indicators. Vietnam's growth rate slowly declined from 8.4% of 2005 to 5.5% in 2009 (Source: World Bank). Their FDI inflow in 2009 was USD 4500 million, more than 6 times our share

If we focus on the recent trend of FDI inflows, however, Bangladesh is in a better position. Total FDI inflows to all countries declined by 31% YOY in 2009 over 2008. Bangladesh saw a decline of 34% whereas the rate was negative 44% and 56% for Vietnam and Pakistan, respectively.

A direct relationship exists between natural resources of the country and investors' interest. For instance, Angola attracted USD 13,101 million FDI inflows during 2009, which is an almost 22% total FDI inflow to Africa (Source: UNCTAD). Investment in Angola is mostly directed towards oil extraction. In this kind of investments, the investor is willing to ignore local politics, economy and business environment. Their focus remains extraction of natural resources and exit in due course.

A direct relationship exists between natural resources of the country and investors' interest. For instance, Angola attracted USD 13,101 million FDI inflows during 2009, which is an almost 22% total FDI inflow to Africa (Source: UNCTAD). Investment in Angola is mostly directed towards oil extraction. In this kind of investments, the investor is willing to ignore local politics, economy and business environment. Their focus remains extraction of natural resources and exit in due course.

As we know, there are several other determinants of inward FDI attractiveness of an economy. Economic growth trend, more importantly projected growth rate is a key indicator. Subjective and more difficult-to-measure factors like level of terrorism, political stability, and corruption are also equally important. Various controllable and out-of-control factors play significant role in determining what portion of inward FDI of the world is going to which country.

Here are a few pain points that I believe, are holding us back but we can create sufficient control over the situation. These must be fixed so we can reach our maximum potential.

Eliminate bureaucracy

Nothing new, I know, this is a decades-old issue. The investment barrier that has been addressed time and again is the administrative bureaucracy-red tape. Till date it hampers the growth of FDI. In the Doing Business 2011 index, Bangladesh ranked 107th among 183 economies, 4 ranks up from Doing Business 2010 rank (Source: Doing Business Index published by World Bank). Still there is a long way to go in terms of making the hands-on experience better for the investors.

Nothing new, I know, this is a decades-old issue. The investment barrier that has been addressed time and again is the administrative bureaucracy-red tape. Till date it hampers the growth of FDI. In the Doing Business 2011 index, Bangladesh ranked 107th among 183 economies, 4 ranks up from Doing Business 2010 rank (Source: Doing Business Index published by World Bank). Still there is a long way to go in terms of making the hands-on experience better for the investors.

In the latest Business Environment survey, 67% entrepreneurs perceived that procedures for business operation are bureaucratic, showing a slight improvement over last year (Source: World Economic Forum).

Make land acquisition and construction Easier

“At the same time, office rents per square meter decreased in most locations across the entire Asia region. In particular, office rents fell substantially, by more than 20%, in India. Even in China rents fell except for in Shanghai and Dalian, where they stayed largely unchanged.” Commented Japan External Trade Organization (JETRO) in the April 2010 report regarding real estate costs. The situation is quite opposite in case of Bangladesh.

Land prices, especially in the industrial areas in Bangladesh have doubled in the last five years, according to my conservative estimate. Scarcity of land in the EPZs coupled with high acquisition cost in other places increase the cost estimates. As a result, many investors who follow the cost leadership strategy are eyeing other Asian countries with relatively lower land price, such as China and India. In India, there are hundreds of public-private Special Economic Zones with low land price and other lucrative facilities essential for industrial set-up. Chinese government rents land to foreign investors with a 99-year lease agreement with a low rental cost. Rent on housing for expatriate employees decreased largely in most Chinese cities except Shanghai and Shenyang and remained unchanged in most ASEAN nations. On the other hand, rents in Dhaka and New Delhi are reaching the same level as in Singapore (Source: JETRO).

However, there can be little justification for subsidizing cost of land for FDI (or for domestic investors) by the government. Otherwise we can expect to see troubles like what TATA's Nano project faced in West Bengal. A win-win solution can be investors offering the landowners equity in their undertakings instead of paying the full land price in cash at the beginning of the project. However, the foreign investors have uncertainties over the actual worth of the overheated real estate market. On the other hand, the landowners have uncertainties over the future cash flows of the project. Availability of reliable information, mutual trust, and an independent mediator can make this structure work.

However, there can be little justification for subsidizing cost of land for FDI (or for domestic investors) by the government. Otherwise we can expect to see troubles like what TATA's Nano project faced in West Bengal. A win-win solution can be investors offering the landowners equity in their undertakings instead of paying the full land price in cash at the beginning of the project. However, the foreign investors have uncertainties over the actual worth of the overheated real estate market. On the other hand, the landowners have uncertainties over the future cash flows of the project. Availability of reliable information, mutual trust, and an independent mediator can make this structure work.

In Bangladesh, the land purchase process is cumbersome, to say the least. It involves dealing with “what's in it for me” type of questions from the local extortionist to the Government officer at every phase and can be quite a frustrating experience for someone unfamiliar with Asian haggling. Even if you manage to get the land, you have to now wait for another year or so for gas connection. Then comes the question of construction. Bangladesh ranked 116th in the overall “Dealing with Construction Permits” criteria with no change in position from last year (Source: World Bank). Number of procedures and relative cost are okay compared with South Asia average. However, it takes 231 days in Bangladesh to complete the process starting from survey map collection to water and sewerage connection. The timeline is 241 days in South Asia and 166 days in OECD countries. I do not believe the investors mind the cost bit much; they are rather concerned with the timeline. This is a major improvement area whereby we can turn the weakness into strength.

In Bangladesh, the land purchase process is cumbersome, to say the least. It involves dealing with “what's in it for me” type of questions from the local extortionist to the Government officer at every phase and can be quite a frustrating experience for someone unfamiliar with Asian haggling. Even if you manage to get the land, you have to now wait for another year or so for gas connection. Then comes the question of construction. Bangladesh ranked 116th in the overall “Dealing with Construction Permits” criteria with no change in position from last year (Source: World Bank). Number of procedures and relative cost are okay compared with South Asia average. However, it takes 231 days in Bangladesh to complete the process starting from survey map collection to water and sewerage connection. The timeline is 241 days in South Asia and 166 days in OECD countries. I do not believe the investors mind the cost bit much; they are rather concerned with the timeline. This is a major improvement area whereby we can turn the weakness into strength.

Up-grade regulations and implement

If we look at the FDI history of China, it is evident that Govt. regulations played one of the most important roles in both accelerating the inflows and restricting the flows deliberately in selective sectors. In case of Bangladesh, archaic regulations, complex legal framework coupled with weak implementation are enough to drive away the potential investors. 46% participants in the Business Environment survey opined that obtaining information about changes in government policies and regulations are impossible (Source: World Economic Forum).

Take a step in their shoes

Tobacco companies pay an additional amount to the expatriate employees if they are posted in a country where working for a tobacco company damages the social status of the expat. Do the investors have to pay an additional allowance to the unwilling expat because he has to settle in Bangladesh for a while? Is that adding to the Cost to Company (CTC) of the investing company?

|

Photo: Adam Gault |

Think about the thousands of Thai, Chinese, Taiwanese expats posted in Bangladesh at EPZs and other establishments. We have learnt to live with the horrible traffic jam, hot and humid weather, and undependable weather forecasts resulting in unannounced rainfall. There are many other petty issues I do not even notice as a Bangladeshi. But these small factors are crucial to project Bangladesh as a preferred country for expats. We lack in amenities and recreation. There are not enough well-equipped, affordable gyms, sports clubs with spacious pools/tennis courts, state of the art shopping malls, and spacious multiplexes. These are the perks for the expat. Muslims being the majority, liquor purchase is well-restricted and night life is nearly non-existent. Schooling of the children is another issue I found the expats concerned with. Dhaka is fine, but the expats in Comilla EPZ, Sylhet gas fields do not bring in families due to this single concern and count their days to go back to their family.

Apart from the factors mentioned above, infrastructure is a pet peeve, so I am refraining from that discussion here. In terms of wages, we are in a better position than our neighbors. Average wage among the worker levels increased in India, Indonesia and China during the past years, which in turn increased our competitiveness. Despite all the challenges, during 2009-2010 (Feb), 89 new foreign and joint venture investment projects registered to Board of Investment (BOI) amounting to total USD 590 million (Source: Board of Investment Bangladesh). 82.5% of these investments were in the Service sector, distantly followed by 8.5% in Clothing sector. Within next 2 years, the composition is expected to change. Larger shares will most likely be occupied by the thrust sectors such as energy and power, transportation, etc. A number of bilateral agreements are in place for avoidance of double taxation. After much anticipation, Public Private Partnership Policy has been made effective since August 2010. With proper implementation, PPP can become the chosen vehicle for FDI. We have made good progress in the foreign relations front with United States and India during recent years. I hope some good news are also due from the ongoing discussions with Trade authorities of India, Turkey, Japan and Denmark that we read about in the newspapers. A lot of MNCs have re-invested their earning from Bangladesh to expansion and operations rather than remitting out, which shows their confidence and commitment to the franchise.

FDI inflow is most necessary for Bangladesh not only from the capital and foreign currency perspectives, but also because it transfers new technologies, skills and management practices embedded with the investor. After the global economic downturn, the world is turning to Asia and thus, it is much easier for us to attract attention than earlier times. Global FDI inflow is expected to exceed USD 1.2 trillion in 2010 and head towards $2 trillion by 2012 (Source: UNCTAD). In Asia, more countries and more industries are being included every year. All we got to do is create the right climate and allow the right investors as this is definitely the right time.

During October 2010, total 154 investment proposals worth USD 610MM were registered with the Board of Investment. Out of this, 45% came from foreign and joint venture investments whereas 55% came from local investment. Both sectors showed an upward trend of 27% and 19% respectively over September 2010 (Source: Board of Investment Bangladesh and the Financial Express). We must take note of this enthusiasm of local entrepreneurs and by no means discourage them by not doing enough for them. Local entrepreneurs' attitude to competition from FDI is really not very welcoming with fears of being competed out. In theory we preach that competition makes us excel and put in our best. But when it comes to practice, local entrepreneurs start advocacy to protect their business by creating entry barriers. This is also true that FDI follows strong domestic investment, which carries testimony about encouraging business environment as well as `opportunity to make money'. All the stakeholders therefore should understand relationship between domestic and foreign investment.

All the while we have to keep in mind that FDI is not an end in itself, it is the means towards economic growth. I do not suggest granting lower priced lands and utilities to investors just because they are foreign. The policy-makers can perform a deep dive objective analysis and who knows, the conclusion may be against FDI! But the approach should be to assess how much investments we need to attain the aspired GDP growth, how much can be contributed by domestic sector in itself, and how much foreign investment we need to bridge the gap. Then comes the question: does Bangladesh have the right investment climate to guarantee that FDI? If not, what is the strategy to ensure the desired amount of FDI? Instead of offering excessive generous facilities for FDI inflows and by that upsetting local talents, we should opt for more free-of-cost but better ways like promoting the county's competitive advantages. For instance, the desired investors must be communicated about the large pool of cost competitive young manpower that is the main attraction of Bangladesh as an investment destination. Are we certain that we have reached the right audience and made them aware of us? JETRO publishes a report on foreign investment climate in Asian countries for the benefit of Japanese investors who are interested to venture overseas. The table for Bangladesh has blank or n/a marked fields in some key indicators as the information on Bangladesh was not available to the Japanese authorities. The Bangladesh embassies and Trade Commissions abroad can put in a special drive to bridge these communication gaps. Bangladesh with growing middle class, increasing purchasing power, capacity building, information technology integration and respectable work ethics deserve to have better space as an investment destination, provided we put our efforts together.

Mamun Rashid is a banker and economic analyst. Views expressed are his own.