Guide to invest in capital market

Ruhul Ameen

I am a fellow of the Institute of Cost and Management Accountants of Bangladesh and a Former Secretary, Councilor, Vice President of the Institute and also a former Treasurer and Chairman of its Dhaka Branch Council (DBC). As faculty of the Institute I would take the privilege to write a few words for our members who are already in the Share Market as investors and those who want to invest in the share market.

People from all strata are entering into the share/securities market irrespective of whether they are investors or new issuers. New Issuer Company and corresponding investors are the precondition for healthy growth of the share market. The numbers of new investors [Beneficiary Owner (BO) accounts] in Bangladesh are increasing day by day. Central Depository Bangladesh Limited (CDBL), Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) are relentlessly working to increase their capacity to meet the growing demand of the investors and the issuer companies. DSE and CSE members are opening their branches in different areas to cater for this growing demand. But their exists some miss matches of demand and supply, which concern every one related to this market. Especially the new comers, who are investing both in the secondary market as well as in the IPO (Initial public offer) through members' branches, located in Dhaka and also outside Dhaka. These new comers are subject to mistakes due to lack of proper knowledge, high expectations caused by rumours etc.

The move to expand the market base was taken by DSE in early 2006 to bring its trading facilities to all districts of the country. In its first phase, Chittagong, Sylhet, Rajshshi and Barisal were included as divisional priority and Bogra and Comilla as district level first target areas. Internet service provider's (ISP) limitation halted the expansion program to some extent otherwise this could grow much more. The Road Show to create awareness among the local and foreign investors in the capital market of Bangladesh should be continued. If the program could be conducted outside the country, it would attract more foreign and Bangladeshis working abroad.

The move to expand the market base was taken by DSE in early 2006 to bring its trading facilities to all districts of the country. In its first phase, Chittagong, Sylhet, Rajshshi and Barisal were included as divisional priority and Bogra and Comilla as district level first target areas. Internet service provider's (ISP) limitation halted the expansion program to some extent otherwise this could grow much more. The Road Show to create awareness among the local and foreign investors in the capital market of Bangladesh should be continued. If the program could be conducted outside the country, it would attract more foreign and Bangladeshis working abroad.

I hope that marginal new investors in the capital market will exceed 3-4 million in the lower middle class and raise the market-cap to 60% of the GDP. It will help government to raise fund from the capital market reducing borrowings from the banks. It will enable the banks to fund more to the business and also attract Non Resident Bangladeshis' (NRB's) remittances to the Share Market that could help reduce excessive pressure on the consumer market. This will create a well-balanced investment friendly environment by minimising financial expenses for the entrepreneurs/ borrowers and reducing cost of fund to the bankers/lenders. This win -- win situation can only be possible from capital market. If this can be made possible, our future will be bright; we will be able to be a middle earning country soon. Our competitiveness in the world market will increase; we will be able to stand with pride. We have to believe that the capital market is the best vehicle to speed up growth of the country as in other nations. We need immediate action from the bourses to undertake regular awareness program to educate the new investors about the risk management, investment planning, portfolio management and other basic knowledge about shares and securities, company fundamentals etc.

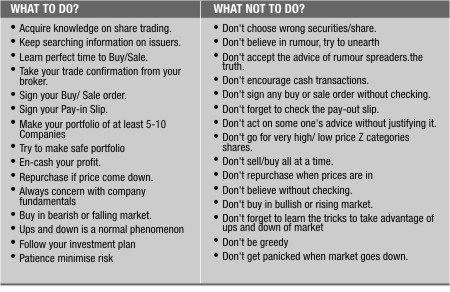

I am appending below 15 do's and don'ts for the new investors in the share market. These are of course not a comprehensive ones. Any suggestions from the readers are always welcome.

|

Photo: Star |

The way the share market is growing, I feel the good entrepreneurs are now having the best time to raise fund from the Securities market. Securities market provides both Equity and Debt. Equity is raised in the form of shares. Debt is raised in the form of Debenture, Preference share, Convertible Bond (convertible from bond to share) etc. Equity is raised against ownership i.e. profit and loss sharing basis and Debt is interest bearing which is always cheaper than bank borrowing rates. This money can be used as working capital. So if the fund can be used efficiently the financial cost can be reduced. Government can also raise fund for its nationalised factories by listing those in the bourses secondary market, trading of its shares or debentures. By using this instrument government can raise huge capital by giving attractive incentives to the general investors.

Supply of Securities is a real constraint in our economy. Both the bourses are trying relentlessly to encourage new issuers. It is actually the task of the Merchant Banks to work for bringing in new issues. SEC may liberalise its stringent regulations to bring more issues the market.

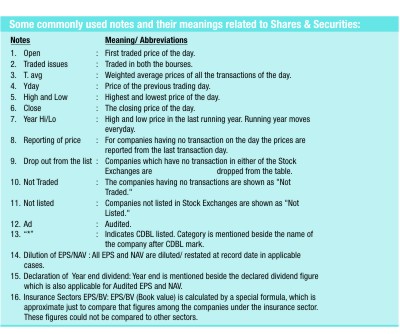

The way banking, Insurance, Leasing, Telecom, Power etc. sectors are growing with the help of capital market others will gradually follow their path. We need not to run after rumour. We should now try to learn the commonly used terms in "share business":

* P/E: Price Earning Ratio-Closing price/ Earning per share.

* Book Closure/ Record Date: Name of registered shareholders on a particular day.

* AGM: Annual General Meeting.

* EGM: Extra Ordinary General Meeting.

* Companies' Categories like as:

- A = Regular AGM and minimum 10%

dividend.

- B = Regular AGM but dividend is less

then 10%.

- N = Newly listed Companies.

- Z = No regular AGM, no dividend.

* Share holders' equity: Share capital+ Share money deposit+ Share premium + Reserve &

* Surplus.

* NAV/ Share (Net Asset Value): Share holders' equity/ No. of shares.

* Cash dividend Yield (%): Cash dividend per share/Market value per share.

* EPS (Earning per share): Net Profit After Tax/ Number of shares.

* Market Capitalization: Closing price* Number of shares.

* Reporting periods: a) Q1 = 1st Quarter, b) Hy = Half Yearly, c) Q3 = 3rd Quarter.

We should also learn the reasons of Bullish and Bearish market? What means bubble, what risk is involved if it happens etc? What is the way to minimise your risk is also a very important thing to learn? Selection, of portfolios, collection of information and proper timing to buy and sell are the most important things to make gains in the capital market.

We should also learn the reasons of Bullish and Bearish market? What means bubble, what risk is involved if it happens etc? What is the way to minimise your risk is also a very important thing to learn? Selection, of portfolios, collection of information and proper timing to buy and sell are the most important things to make gains in the capital market.

Share Traders should have proper education and training on the following among others:

Classes of shares: The training should explain the various types and classes of shares, including the rights and privileges of a shareholder.

General meetings

* What is a general meeting? AGM? EGM?

* When should an AGM be held?

* What should be discussed?

* What is my role at an AGM?

* What information can I expect from a company prior to the AGM?

* What is the difference between an AGM and EGM?

* Who can call a general meeting?

Minority shareholders rights

* What is a "minority shareholder?"

* What rights do I have as a minority shareholder?

* How can I exercise my minority shareholder rights?

|

Photo: Star |

Right to dividends

What is a dividend?

Dividends are payments of profits to shareholders as approved by the shareholders in the AGM. Dividends may only be paid out of the net profits of the company or previous years undistributed profits. If there are no such profits, dividends cannot be paid.

Do shareholders receive dividends every year?

Shareholders may not receive a dividend every year. There can be many reasons for not paying dividends. For instance, when the company makes a loss and liquidity not permits it cannot pay dividends.

Management and directors may also recommend not paying a dividend when the company has investment projects that will earn a high rate of return for the shareholders in the future.

How is a dividend decided?

Dividends are recommended by the board and approved by the shareholders.

Shareholders may not approve a dividend in excess of that recommended by the board.

When the shareholders approve a dividend in the AGM, all shareholders have the right to get dividends on the basis of their share holdings.

Once the dividend is declared, shareholders should receive their dividend payments within two months.

What is a Bonus Share?

Bonus Share is another term for a stock dividend. Instead of cash dividends, a new share is issued to each shareholder as dividend as approved in the AGM.

When a stock dividend is proposed, companies should explain to shareholders the potential dilution of their shareholding and the implications of such dilution. Cash flow implications of a bonus share issue should also be explained.

How can my shares be transferred to a new owner?

Directors. The Shareholders' Handbook should include:

* The shareholders' right to nominate and elect directors.

* A statement to the effect that all directors represent all shareholders to run the company.

* Roles, restrictions, responsibilities, and liabilities of executive and non-executive directors should be disclosed to shareholders. The distinction and relationship between management and the board of a company should be explained.

* Directors' remuneration, including executive directors.

* The ratio of executive to non-executive directors.

* Shareholders should be informed of a register of directors' interests in contracts or arrangements of the company and their right to inspect such a register.

Voting rights

* Right to request a poll or ballot at a general meeting

* Right to proxy

Any shareholder may elect a proxy to attend the AGM and vote on his behalf. The shareholder must inform the company in writing of their chosen proxy at least 48 hours prior to the AGM. The person elected as a proxy need not be a shareholder of the company.

Reporting and disclosures

Reporting and disclosures

A. Shareholders have the right to receive information about company resolutions, decisions, and operations such that it can be understood by a layperson.

B. Distribution of Annual Report. Annual reports and minutes of the AGM should be made easily available to shareholders before AGM.

If shareholders are not provided with a copy of the Annual Report and minutes of the last AGM, they should be informed where and how they can obtain a copy.

Shareholders can also utilise the libraries of the SEC, DSE, and CSE to obtain information about public listed companies.

C. Annual reports should include:

* Audited financial statements, which include Balance Sheet and Profit and Loss Accounts, Cash flow statement and Statement of changes in equity.

* Auditors' Report.

* Directors' Report

* Clear identification of the company's risk factors and consequences.

* Capital structures and arrangements that enable certain shareholders to obtain a degree of control disproportionate to their equity ownership should be disclosed.

* Total shares authorised and allotted, as well as number of shareholders in various ranges.

D. Companies should provide unaudited quarterly results to shareholders, as well timely information about events or results that will materially affect the company.

E. Shareholders have the right to see Memorandum and Articles of Association of a company, at the company's registered offices.

F. Companies should disclose whether and how they are upholding: social corporate responsibilities (CSR); environmental responsibilities; workers' rights; gender rights; other standards/codes appropriate to the industry (e.g. consumer rights, passing quality control/safety standards) etc.

Required shareholder approval

Shareholders must approve all ordinary resolutions of the company put before the AGM, which include resolutions:

* To increase, decrease, consolidate or divide all or any of its shares;

* To convert paid-up shares into stock and reconvert stock into paid-up shares, as well as subdivide shares; and

* To cancel shares which have not been taken or agreed to be taken by any person.

Shareholder's approval (three-fourths) is required for major company decisions, including:

* To change the Memorandum or Articles of Association of the company

* To reduce share capital

* To decide reserve capital

* To remove a director from office

* To remove an auditor before the expiry of his term

* On winding up through the Court

* For a voluntary winding up because of excess liability

* To sanction all arrangements between a company and a creditor

Rights issues

* Rights Issue refers to an increase in share capital by a company. The procedure for a Rights Issue is defined in Section 155 of the Companies Act, 1994, Further Issue of Capital.

* Shareholders should be made aware of the criteria for the issue of Rights Shares, and the limitations of the issue of Rights Shares

* When a Rights Issue is put forward to the shareholders; a three-fourths majority should be required for approval.

- Directors should explain the reason for the Rights Issue and the suggested use(s) of the funds that will be raised.

- Shareholders should receive a clear explanation of the potential positive and negative outcomes of the Rights Issue, specifically the dilution effect should be clearly explained.

* After a Rights Issue, directors should report back to shareholders about the uses of the funds and the returns from said projects. Directors should provide an audited quarterly account of the Premium Share Account, which contains the proceeds from the Rights Issue.

Regulatory bodies

* Shareholders should be made aware as to the role of the regulatory bodies.

* Shareholders should know and understand the procedures for upholding their rights, registering complaints/actions against a public company, its board, or any other entity, if those rights are abused.

* Regulatory bodies should disseminate the "Rights and Responsibilities of Shareholders" in the public sphere, or ensure that companies include a Shareholders' Handbook in the prospectus for an IPO, so that potential shareholders may take an informed decision to subscribe.

The author is former Vice President, ICMAB, Dhaka.