|

||||||||||||

Energy roadmap - an illusion?--M. Tamim Providing electricity to people--M. Asaduzzaman For a national rapid transit system--Tanvir A. Khandaker Gas crisis: Sustainable solutions -- Ridwan Quaium Solar Bangla to Shonar Bangla -- Salahud Din Ahmed Transport infrastructure: Altering its skewed pattern -- Tawfique Ali Sustainable environment: Challenges ahead -- Pinaki Roy Bangladesh's role in climate negotiations -- Dr. Atiq Rahman Climatic signals on development antenna -- Dr. Dwijen Mallick Major disasters and management issues -- Mahbuba Nasreen

|

||||||||||||

|

||||||||||||

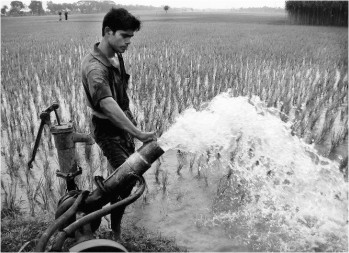

Photo: Fahad Kaizer/Driknews |

||||||||||||

Energy roadmap - an illusion? M. Tamim Fossil fuel is not going to last forever but there is no viable alternate in foresight at this point of time. Fossil fuel is going to dominate the energy mix for at least the next fifty years. Obviously the green house gas effect on our environment is going to put a lot of restrictions on energy use and sustainable energy use will make it more conservative and efficient. On the other hand, more than two billion people in the world without access to any commercial energy are not going to keep quiet and will make their claim. Quest for energy is going to be more violent and intense. Despite the hype for alternate or renewable energy, it can only play supplementary role at its present technology and price. Except a very few, most of the countries are feeling the pinch of energy shortage and the volatile oil price is wiping out years of advancement in many developing countries in the world. Bangladesh is struggling to meet its energy demand principally due to the shortage of gas, its only primary energy that the country has been heavily dependent on for the last thirty odd years. The country has been hearing a lot of rhetoric from all quarters on energy independence and long term energy planning for the last two decades. Unfortunately, it has not seen a clear long term road map addressing all aspects of energy security. Knee jerk reaction to a serious problem that requires serious study, planning, preparation and implementation in a continual manner will just make it worse. Any makeshift solution is temporary by nature. Despite many master plans by both Petrobangla for gas and PDB for power, no comprehensive and clear road map has been constructed by either agencies or the concerned ministry. The separate master plans are not even coordinated. The existing plans by the two agencies will be examined later. To construct a clear energy road map, the first task is to assess the demand not just for power or gas but the complete picture. This should include both commercial and non-commercial energy. Ninety five percent households in the country use biomass for cooking and yet the last major inventory of biomass was conducted in early eighties when biomass comprised more than 65% of the total energy use. Since then, commercial energy use has increased asymptotically and the biomass contribution has been calculated either by exclusion or interpolation. The present contribution of biomass to the total energy use is quoted to be anywhere between 45% and 55% by different authors. The same applies to other sectors of energy use. Sale of diesel at petrol pumps are attributed to transport sector whereas almost all household diesel generators buy the diesel from the same stations and so does many irrigation pumps. Independent sector wise demand assessment and a regular monitoring system must be in place to get a hold on the energy growth engine. Apart from gas, assessing the energy supply situation has been fairly straight forward so far. Record of imported oil is well documented and contribution of coal is so minor that the illegal imports of cheap low quality Indian coal would not make much difference. The Barapukuria coal production is also recorded. It is indeed unfortunate that Petrobangla, after fifty years of operation, does not update its gas reserve estimate on a regular basis in a systematic way. As a result, every energy professional in this sector has to hear a common public question what is the true/actual gas reserve of the country? Lack of information makes the public more confused. A solid official statement from Petrobangla, the gas authority of Bangladesh, could have easily killed the 'floating on gas' speculation in early 2000.

The situation in power sector is equally confusing. PDB reports demand of electricity on the basis of its official connected load whereas the actual demand is far more than that as almost everyone is using more electricity than one's paper load. The numerous illegal connections make it even more difficult to assess the actual demand. If additions of generation claimed by different governments are added together, there would be more power today than we can use. Yet, in the jargons of installed capacity, derated generation, forced shut down, stranded capacity due to gas shortage, the highest power production is recorded at 4600 MW. In peak summer it is still hovering around 4000 MW. It would be a great service to the nation if every month PDB once publishes the status of all its units (including the date of the contract and commissioning of each unit) on a given day. This would give a clear picture of the generation situation and eliminate any confusion. Once the demand and supply is well understood, the next step is to assess the requirement. In Bangladesh case, the principal problem is shortage of primary energy that stemmed from its mono fuel dependency on gas. Classical energy security theory demands that energy mix and the sources must be diverse to reduce the vulnerability. The national energy policy of 1996 clearly envisioned this problem and suggested the increase of coal use in power production. Any road map should clearly state few things the energy mix, source of primary energy, financing, technical options and economics of the projects. The projection of growth of the major commercial energy, electricity, is the driving factor of modern development and dictates the energy requirement. A five year (2010-15) project profile for adding generation has been published by PDB that hopes to add 11606 MW during that period. Even with 30% slippage in project implementation as stated by the agency that is a staggering 8100 MW in five years. National or international financing for power projects are very tricky. Despite significant improvement in foreign currency reserve due to the contribution of RMG sector and remittance from repatriate workers, no major energy and power project can still be undertaken without international funding. The limitation mainly stems from the restriction of maximum funding limit by local banks. A bank can lend a maximum of fifteen percent of its capitalized fund to a single project and it also has sector capping to avert risk. In 2008, the record Bangladeshi commercial loan of mere $60 million was syndicated by eighteen banks and commercial lending agencies for a local power company to generate 110 MW. Most of the international commercial lenders do not solely rely on the sovereign risk guarantee of government of Bangladesh. They require partial (political) risk guarantee (PRG) from international lending agencies. ADB and World Bank provided PRG for the Mehgnaghat and Haripur power plants respectively. World Bank has also committed $200 million PRG for the Bibiyana 450 MW power plant. Even with a conservative estimate of $0.8 million/MW investment requirement, Bangladesh will require about 6.5 billion dollars for 8100 MW generation in the next five years. The published list only assures of funding commitment for about 1000 MW (all old projects). To evacuate this power, at least 4 billion dollar will be necessary for upgrading and constructing new transmission and distribution (T&D) lines. Despite serious gas shortage, the projects enlist 4211 MW pure gas based power plants that would require supply of at least 800 MMcfd (million cubic feet per day) gas for the next 15 to 20 years. Petrobangla has only agreed to supply gas to 150 MW Sylhet, 150 MW Bhola and 450 MW Bibiayana and the 2x120 MW Siddhirganj peaking plants. With the intention of shutting down some old plants it also committed to supply gas to 225 MW rental plants. About 3000 MW planned generation has no guarantee for gas and without a prior gas sales agreement none of them will materialize. The immediate need for liquid fuel based power plants is essential. The three or even five year rental plants are required to buy time for the intermediate and long term solutions to kick in. The PDB plan shows a total of 2000 MW liquid fuel based plants of which one fourth are diesel based and the rest are furnace oil based. There is additional 2380 MW of dual fuel plants. If gas is not found, they would essentially be run on liquid fuel. In addition to the existing liquid fuel based plants (about 500 MW), the new liquid fuel based power plants would be about 4380 MW. Out of these power plants about 1300 MW are peaking plants that are supposed to run for six hours a day (5-11PM). In the above mix the rental portion is nearly 1600 MW. From PDB balance sheet it is seen that plant factors for base plants varies between 70% to 94% depending on the fuel type and its availability. Peaking plants would run at 30% capacity. The HFO (furnace oil) based power production cost is about Tk 10/kWh and diesel based cost is Tk 15/kWh without the fuel subsidy given for these plants. Gas based power production cost varies between Tk. 1.7 to Tk 2.4/ kWh. A hypothetical scenario of 4000 MW liquid based power plants running at average 60% plant factor for 340 days a year will produce (4000 x 24 x 340 x 0.6 x 1000 ˜ ) 2.0 x 10^10 kWh. Assuming a conservative Tk.10/kWh rate, the production cost of this electricity will be 20000 crore taka (2x10^11). Even if the average purchasing cost is raised from the present Tk. 2.62/kWh for the distribution companies to Tk 4/kWh (a 52% increase), the electricity subsidy for liquid fuel generation will peak at Tk 12000 crore per year (1.7 billion dollar). This is only indicative for the financial planners.

If the fuel subsidy is added, the financial assistance will go even higher. The above production costs are based on Tk. 26/litre furnace oil and Tk. 44/litre diesel respectively. As most of the liquid fuel based plants are HFO based, an indicative calculation will be shown using that fuel. It has been reported that BPC plans to import 1 million ton (10 lacs) additional furnace oil to meet the need of the 1000 MW new power plants this year. At about a specific gravity of 0.95, a ton of HFO will deliver 1050 litres of oil. A million ton will produce 1050 x 10^6 litres of furnace oil. The existing furnace oil pricing is based on old oil price. The present import cost of furnace oil is about Tk 40/litre. A subsidy of Tk 14/litre will force BPC to lose approximately (1050 x 10^6 x 14) Tk 1500 crore per year. With increasing capacity, the HFO import will increase in the subsequent years. BPC is planning to raise the furnace oil price to Tk 35/litre. As a result the pass on fuel cost will increase the electricity generation cost. Presently, about 600 MW power cannot be generated due to gas supply shortage (a deficit of 120 MMcfd). As the PDB plan is heavily dependent on finding extra gas supply (at least 1000 MMcfd for the total dual and gas based power plants), it is worth looking at the Petrobangla gas production augmentation plans. Without going to details, the year wise projection provided by Petrobangla in June 2010 budget (energy revamping document) may be examined. According to that document, Petrobangla is supposed to increase its gas production by 158 MMcfd by December 2010. Of the presented list about 50 million cubic feet has been added and from previous year's workover programs another 50 milloin has been added. Out of all these projects, only Sundalpur was an exploration well and all are either workover or development wells. The plan shows that all activities by Petrobangla and IOCs would add 585 MMcfd capacity by 2015 (provided the present production rate can be maintained). Out of that 300 MMcfd is expected out of IOC development programs in Bibiyana and Moulavibazar. Petrobangla also added an expectation of 60 MMcfd from it four exploration wells. These numbers are based on reasonable risk assessment but chances of failure are very much there. Augmentation of 400 MMcfd under the present work plan would be a safer bet. The plan adds an ambitious 500 MMcfd LNG import by next two years (2012). For fuel source diversification and long term security it is the right direction but the financial, technical and economic stake must be looked into. At the present market price of LNG to Bangladesh port would cost about Tk 500/Mcf (1000 cubic feet) which is equivalent to $10/Mcf. Adding the regassification and T&D cost, this would be no less than $11.6/Mcf (Tk. 615/Mcf). At present, the weighted average selling price of Petrobangla gas is about Tk 115/Mcf. The loss from LNG import will be (500 x 10^3 x (615-115)) 25 crore taka per day, roughly 1.3 billion dollar a year. The suggested LNG import technology is Floating Storage and Regassification Unit (FSRU) with a capacity of 5 million ton per year that would require a 90 km under sea pipeline. This is the quickest and cheapest solution that is getting more popular worldwide. The entire project will cost at least one billion dollar. The hope of bringing gas from Qatar by 2012 is over ambitious and unlikely to happen in such a short time. It is clear from the present planning that adequate gas is not being secured in time to meet the need of the country. Even if it is assumed that 1000 MMcfd gas would be added to the system by 2015, it would be entirely used up just to meet up the deficiency that is expected to grow to 1000 MMcfd by 2015 from the current 350 MMcfd. Even with a 50% increase in power tariff, electricity and related fuel subsidy will run into 2 billion dollar/year at peak production. Fuel subsidy for other sectors will also increase substantially with increasing oil price (presently at about $ 93/bbl) without price adjustment. The investment requirement for just the power and energy sector (without the exploration cost) in the next five years will be more than 10 billion dollars. Some of the technological options to materialize these projects will require large number of skilled and trained manpower which the country is strongly lacking behind. If the new power sector plan is taken in its entirety, Bangladesh will produce 48% of its power from gas, 30% from oil, about 17% from coal and 5% from other sources with a targeted total production of 15,600 MW by 2015 (existing 4000 MW + 11600 MW). This is definitely not a good energy mix. Large contribution from oil based power will make the average electricity cost very high. Given the present primary energy supply scenario and a much better economic multiplier of gas use in industry, a more reasonable mix would be coal 50%, gas 30%, oil 15% and others 5%. The energy roadmap should work towards this target. Electricity production cost from Barapukuria coal is Tk. 3.80/kWh. Even with imported coal, this will be less than Tk 5/kWh. Coal mine development will require anywhere from 1.5 to 3 billion dollar over a period of 3 to 5 years depending on size and technology. A 1000 MW coal fired power plant costs 1-1.2 billion dollar. Production cost from new nuclear plants are about Tk 5/kWh. For a 1000 MW nuclear plant even the oldest approved technology will cost 3.0 billion dollars over a 5 to 7 year construction period. Electricity import from India will not be less than Tk. 4/kWh (Rs. 2.5) at the beginning for the first 250 MW. Later on if more power is bought from Indian open market or private producers, that will definitely be not less than Tk. 5/kWh.

At one time when the country had some short term excess gas, generating plants were the problem but the principal problem faced by the country today is not the lack of power plants. Due to old perception and other motives, governments seem to be focused on building more power plants whereas 600 MW generation capacity is stranded due to lack of gas supply! The foremost and ominous problem faced by the nation today is lack of primary energy. The government plan for gas exploration is heavily dependent on BAPEX effort. Their seven year vision plan that was approved by the last government is keeping them completely occupied. Even if extra money is poured into their existing program, they will not be able to accelerate their activities due to lack of equipment and manpower. BAPEX dependency and expectation may be politically safe but will not solve the gas deficit problem. Simultaneous large scale new exploration by international companies along with BAPEX is immediately required to tackle the gas supply situation. It beats all logic when buying gas at $1.5-$2/Mcf from IOCs (including free gas) is argued as anti-state whereas LNG or pipeline gas import at $10/Mcf is justifiable? Onshore, shallow offshore, deep offshore all exploration opportunities should be opened as soon as possible for international participation with adequate incentives for wider participation. This will not hamper BAPEX activities. Another comfortable position is not to develop country's own coal mines. It is again politically safer to import coal and avoid all controversies. Bangladesh have about 7 tcf proven gas reserve; by doing 3D seismic and some development drilling another 7 tcf may be added to the proven category from the existing gas fields. Two independent studies have shown that finding another 10 tcf from onshore and shallow offshore is highly probable. Most conservatively one may expect addition of 15 tcf to the reserve through extensive exploration. This will involve few billion dollar investment. By taking this direction, the country will find enough gas for industrial growth to a point when the economy will be able to sustain high energy cost. Under this picture of our principal primary energy - gas, the only other sustainable and affordable option is to develop coal. The opposition to coal import has been very feeble and all the resource nationalists and activists have said little on its impact whereas they have shown strong reservation about developing indigenous coal. There are many technical difficulties in large scale coal import. For resource diversification the effort should be supported but not at the expense of keeping the national mines idle. Much has been told about the technology and environmental impact of coal mining. No resource extraction is pain free but effort must be taken to make it tolerable. The opposition to coal development has not been able to offer a viable alternate solution to our primary energy requirement. As a part of ensuring primary energy, coal must be developed immediately. Proper investment in coal power generation can easily eliminate the need of any coal export but Bangladesh simply doesn't have the money, technology and the manpower to develop any sort of coal mine. International collaboration is needed and modality can be found where the entire integrated operation can be economically (commercially) viable. Economics and finance are always neglected in all our planning at least in public documentation. No new electricity generation solution is viable in the present market at less than Tk. 5/kWh without subsidy. Similarly one cannot expect any investment in gas sector if the bulk of Petrobangla gas (65%) is supplied at $1/Mcf whereas the regional gas price is not less than $5/Mcf. The global nature and price of all kind of energies has to be clearly understood and adjusted. From the beginning, Bangladesh's power and energy sector was dependent on international aid agencies. Until very recent times, Bangladesh could not drill any well on its own finance or set up a processing or power plant. All major transmission pipelines that exist in the country are either World Bank or ADB funded. The most recent gas sector vulnerability has been exposed in the inability of GTCL to set up three critical compressors due to sudden increase in price that could not be covered by the original ADB loan. Drilling of six development wells that are extremely important to enhance the production capacity of Petrobangla is being delayed due to mainly fund shortage. Many naïve and few experts want to use the foreign currency reserve for everything as if it is free money sitting idly in Bangladesh Bank without realizing that it is public money just kept in dollar. Before planning anything, financing must be secured. It is not possible to discuss all aspects of a comprehensive energy plan in a newspaper article. One has to include transport, agriculture, industry, fertilizer, domestic and commercial use of energy. Each of these sectors requires demand-supply analyses, financial requirement and economic viability study. Socio economic and environmental assessment has become standard for all energy projects. Along with these standard exercises a clear man power development plan need to be undertaken in parallel. In 1972 only 3% people had access to electricity, today it has reached nearly 50% even after doubling of the population. The country has come a long way. However, incorporation of energy issues remained ad-hoc, shaped by reaction to global and domestic political events, rather than a pro-active strategic vision. The time has come to have one now. The writer is Professor, Petroleum Engineering Department, BUET & Former Advisor, Caretaker Government. |

||||||||||||