Inside

|

The Tentative Asian Tiger? Faisal Salahuddin explores what we can learn from our neighbour Vietnam -- the latest Asian Tiger

If countries were cousins, Vietnam would most likely be Bangladesh's khalato bon. They both have very similar builds, looks and even a somewhat similar recent past or at least the same family environment -- they both seem to belong to the same tiger family. Vietnam has been rapidly morphing into the latest Asian tiger. We are still hesitating at our puberty of possibilities -- to be or not to be. How does a cub become a tiger? The answers are complex and many: diet, exercise, and evolution. For countries: sound policies, regulation and an enabling business environment. But each country has its own story. True, every flower blooms in its own rhythm and season. But, they all share some common ingredients like water and sunlight. Countries are no different than flowers. To grow, they often need certain ingredients. Here we will talk about some of these ingredients from an experiment -- Vietnam -- that is both recent and relevant. Rather than making comparisons to the city-state Singapore (5 million), or with mega-state China (1.3 billion), Vietnam's population size (85 million) and economic history and successes are more comparable and easily scalable to ours. We officially have a "Look East" policy. However, just looking or staring or even ogling will not be enough. Analysis needs to replace, or at least supplement, slogans. We need to "Understand East" and then "Customise East" to our own needs and realities. Only then can we all jointly form a clear and credible vision of the future. This article -- a journey through words and charts in green and red -- is a modest effort in that direction without being trapped by the narrow interpretation of the Washington Consensus or being blinded by the fad-driven anti-globalisation zeal. Green for Bangladesh. Red for Vietnam. Here I argue that Bangladesh displays many of the ingredients and early signs to grow like her cousin Vietnam, and then highlight some lessons from Vietnam's experience.

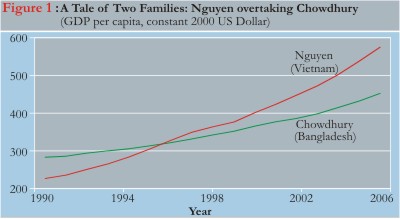

A Tale of Two Families: Chowdhury and Nguyen Up until 1994, Chowdhury was richer and more productive than Nguyen (Figure 1). But starting in the early 1990s, Nguyen started growing faster and overtook Chowdhury, who was still continuing along the same path. These individual stories also hold true at the country level. Vietnam has been growing rapidly at around 7-8 percent since 1990. Our growth picked up too -- but remained a notch below Vietnam's. Since 1990, on average, Bangladesh grew by 5 percent (see Figure 2).

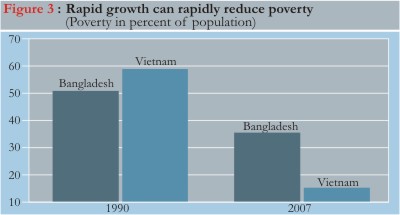

High and sustained growth can do magic. Rapid growth reduced Vietnam's poverty at double the rate achieved in Bangladesh. Even though it started out with a higher rate of poverty than ours, its poverty rate is now much lower than ours (Figure 3). In a year or two, Vietnam will be a middle-income country. Although the generation born around the time of Bangladesh's independence (Generation Bangladesh, see March 2008 Forum) is reaching now middle age, Bangladesh has yet to reach middle-income status.

Family History and Facial Similarities Both became independent political entities in the 1970s. Bangladesh became independent in 1971 and went through turbulent political volatilities. Five years later, in 1976, Vietnam became a unified country after 20 years of political instability following the American invasion. Vietnam was far more severely war-ravaged -- with widespread poverty more acute than ours. Our rajakar problem and challenges with national reconciliation pale in comparison to their complexity of uniting the communist North and the collaborator, pro-American South. The 1980s were difficult a period for both the nations. After suffering hyperinflation and price controls, the communist government in Vietnam adopted "Doi Mai" -- the restructuring and opening up of its economy, partly inspired by the opening up of China a decade earlier. In the 1980s, Bangladesh witnessed a military government and slow growth, followed by some liberalisation toward the end of the Ershad regime. Bangladesh started sending workers abroad. Garment exports started picking up. The real divergence in growth between these two cousins unfolded during the 1990s when we started growing faster than in the 1980s, but Vietnam's growth rate was even higher. It is not enough to be seduced by the sexy analogy of Vietnam. A nation can dream of development in lucid poetry, but real growth happens in messy prose. A nuanced understanding of the "hows" of economic growth is essential Yet, at the beginning of the 1990s, Bangladesh was ahead of Vietnam in exports. In fact, Bangladesh exported slightly (about USD$100 million) more than Vietnam in 1990. Last year, Vietnam exported about four times as much as Bangladesh (Figure 4).

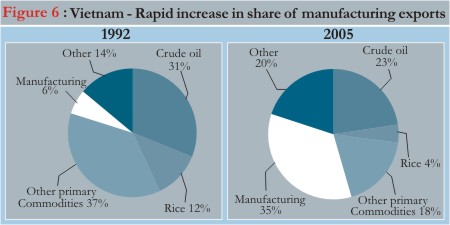

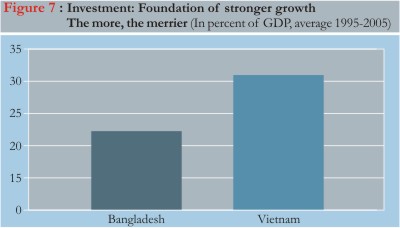

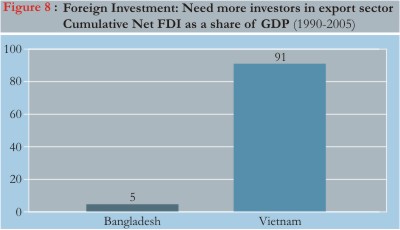

Rapid export growth propelled Vietnam's economy forward. As a share the country's total output produced (GDP), exports made up 75 percent (as opposed to our 20 percent) in 2007 (Figure 5). Sure, having oil to export helped. But, unlike the Middle East, Vietnam's is not an oil story. Most of the export growth came from the manufacturing sector, where foreign investors from all over Asia and the US built plants and exported a variety of products of increasingly greater value: garments, footwear, auto parts, and now electronics. Over the years, Vietnam's exports have increasingly shifted towards manufacturing. As a share of total exports, manufacturing exports have increased six-fold since 1992 (from 6 percent to 35 percent in 2005, Figure 6). In the meantime, the export base has become diversified. Initially starting with low value-added items such as garments, and then gradually moving to high value-added products such as electronics. A county's export capacity does not spring out of nowhere. It needs productive investment (Figure 7). Poor countries are generally short of savings and lack modern technology. That's where foreign investors can play a role. During 1990-2006, Vietnam attracted about 18 times more net foreign direct investment (FDI) than Bangladesh (Figure 8).

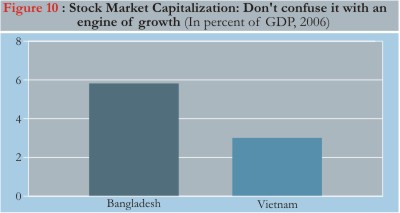

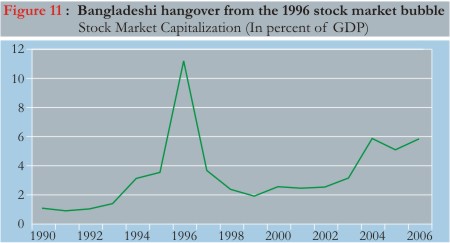

Foreign investors are like pollinating bees -- a country needs to attract the right kind in the right sequence to help with industrial pollination. We need long term investors who will invest in bricks-and-mortar productions and help with technology transfer. Not so much the "hot money" type with a short investment horizon through the financial or capital markets. Like whimsical bees, the hot money investors can sting, often without any subsequent pollination (Remember our 1996 stock market crash? (See Figure 11). In Vietnam, foreign investors built plants that produce products for export. Vietnamese growth had nothing to do with FDI in the financial sector or in consumption (i.e. stock market investment or fancy shopping malls). Vietnam has been very cautious, perhaps rightly so, in opening up its financial and retail sectors and real estate to foreign investors. Now, the million, or rather, billion dollar question, is how to attract the right kind of foreign investment in the right sectors.

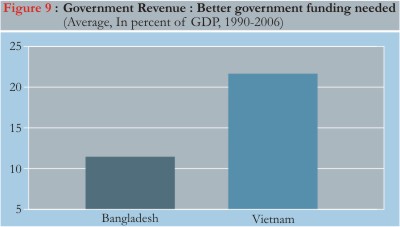

In Vietnam, higher FDI-financed investment created jobs, transferred technology, created a dynamic labour force, and improved productivity. It created a virtuous cycle of investment, export, growth, and employment. People grew happy and proud, and so did the government. Vietnam's government provided a very supportive role in attracting FDI. In order to maximise the impact on growth, and as the single largest player in the economy, the government has to be both: i) a referee, and ii) a parent. A referee because it needs to provide and enforce clear rules of the game -- a transparent regulatory environment. A parent because it needs to provide public goods and services where markets may fail: education, law and order, health, infrastructure like roads and bridges. But parents need income to pay for these services. The Vietnamese government has been much better funded than ours -- at least twice as much. For every 100 taka of goods and services produced (GDP), the Vietnamese government collects 22 taka as tax and other revenue; Bangladesh, on the other hand, collected 11 taka per 100 taka on average during 1990-2006 (Figure 9). But this tragedy of a poor and weak government is the result of a two-way bargain. As citizens we get the quality of government services that we pay for. For the government, it is easier to raise taxes if it delivers quality services. We need to pay taxes and improve our public service because the quality of public goods directly shapes the quality and duration of growth. Otherwise we might stagnate in a low-tax-low-quality-service-and-low-growth trap. It is time for us to listen closely to the sound of success from Vietnam, and then distinguish what Vietnamese songs tell us and what they don't.

Positive Lessons from Vietnam Vietnam's success story based on export-led growth is the result of market forces and private sector investment operating in an environment enabled by an effective government. In the early 1990s, Vietnam had many export restrictions (e.g. rice), price controls (e.g. utilities) and subsidies (e.g. fuel). It moved towards increasingly market-based policies supported by a government set on economic growth and conscious about social equity. As the decade progressed, it removed export restrictions, scrapped price controls, and gradually underwent trade integration with other Asian economies, and then the US. The public sector created the way for the private sector.

As domestic policies improved, the macro-economy stabilised, inflation came down, and increased trade integration attracted foreign investors who viewed Vietnam as their export production hub. Foreign producers did not have to worry about annoyances such as hartals or load-shedding. They appreciated that labour was cheap and highly productive. The ports were functional -- not operated as some local mayor's private property. Government regulations were sometimes confusing, but investors knew the government was sincere and responsive to the their needs. The Vietnamese government realised that the best way to buy the support of its young population (very similar to Bangladesh's) was to create jobs through higher investment. Productivity improvement in agriculture also helped the rural sector because, as in most developing countries, most of the people were employed in the agriculture sector. In Vietnam, unlike in Bangladesh, growth accelerated because of the government's policies. We grew despite our government. Sure, Vietnam had plenty of corruption, e.g. government ministers misusing public money for road construction by betting on cock fighting. But its corruption was not confrontational like ours but more consensus-based and discreet -- perhaps reflecting its political structure.

The exclusive focus on exporting manufactured goods helped Vietnam in several ways. First, exporters nurtured skills, technology and expertise, which spilled over to other enterprises. Second, growth in the manufacturing sector created demand for institutional reforms and infrastructure. For example, a garment factory consistently makes more demands for roads, electricity, ports, and security than a grocery store. This can trigger a virtuous cycle of institutional reform and economic growth. Third, manufactured goods (the exportable kinds at early stages of development) are often labour intensive and create many jobs. Thus growth touches many lives, spreading the dividend of growth and reducing poverty. Vietnam's growth highlights the over-riding importance of growth itself for reducing poverty. This is not to suggest that only growth will do. But without it, sustained improvements in human welfare are impossible: one cannot redistribute nothing. A bigger pie makes the job of more equitable redistribution much easier. Negative Lessons from Vietnam One wrong lesson to take from Vietnam is that you need a one-party or autocratic system to achieve high growth like Vietnam.

A one-party system worked for Vietnam. With our political history, the East Asian political model of primarily one-party systems (Korea, Indonesia, Malaysia, Singapore) will not work for us. Our political lipstick needs to have a democratic colour, however fickle the colour initially might be. Vietnam's Communist Party provided stability. This is not directly applicable to Bangladesh. But that's OK. In the case of political systems, the price of extreme stability very often is future rigidity. Extremely stable systems can also be very brittle when faced with large shocks. Although democracies are initially more volatile, they are eventually more robust and resilient, especially in a large, crowded and politically sensitive nation like ours. Bangladesh has grown too large and connected to have non-responsive political leaders. The population is too politically aware and volatile to flourish under unaccountable autocracy. Democracy is thus both optimal and inevitable for growth and good governance. Let's make it clear that the choice is not between a stable autocracy or a suicidally confrontational democracy (remember last year!). A happy medium -- more democracy with less plutocracy, less hartalcracy -- is the right fit for us. The Bangladeshi sky is large enough to accommodate more than two families or two parties constantly fighting each other to death where the dreams of tomorrow die in the street crossfire. Another wrong lesson to draw is that you need to attract foreign investors to the stock or bond market to grow rapidly. Thriving stock markets or headline-grabbing private equity deals had nothing to do Vietnam's early growth takeoff. In fact, Vietnam did not have functional stock or corporate bond markets up till 2006. And as a share of GDP, even our small stock market was double the size of Vietnam's (Figure 10).

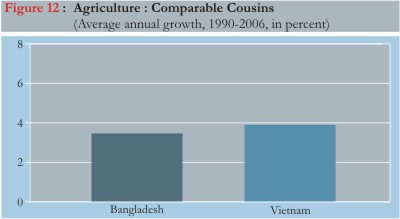

Of course, private equity can be helpful but our national growth strategy cannot, at least for now, solely rely on it, given the existing quality of governance and legal environment. Vietnamese growth did not come through Wall Street-style private equity flows, nor did China's or India's. Of course these flows can help. Any capital flows with long term commitment will. Financing through the stock and bond market will be helpful. Finally, agriculture was not the key engine for sustained growth in Vietnam. It was manufacturing. Don't get me wrong. I am all for improved agriculture productivity and food self-sufficiency, especially given rising global food prices. Also, most of our workers are employed in this sector. Higher productivity means better living conditions for the farmers. We also need a strong agriculture sector for healthy agro-processing industries and a robust rural economy and food security. But we have to keep in mind that growth in agriculture is ultimately constrained by and subject to Mother Nature (land shortage, weather, etc). No developing country has ever become a middle income country rapidly by only relying on the agriculture sector. In fact, Vietnam's share of GDP from agriculture has come down by about half during the last 15 years, and manufacturing's share has rapidly increased. The good news is that from 1990 to 2006, our agriculture sector grew at a comparable pace to Vietnam (Figure 12). What is even more interesting is that agriculture value added per worker is higher in Bangladesh relative to Vietnam (Figure 13) -- our farmers are more productive than Vietnam's. We should keep improving our agricultural productivity and branch out to more agro-processing industries that can help increase higher value-added exports. Bangladesh's performance so far And our growth has remarkably been a "despite" growth story. We continued to grow despite our poor government and governance, despite angry Mother Nature (the floods and cyclones), despite the hartals, despite the confrontational politics, despite the dysfunctional ports and parliaments, despite endless load-shedding and hapless roads.

Now imagine Bangladesh without some of these drags. Think how strong our underlying growth momentum must have been. In a Bangladesh with a government and politics that would underpin not undermine growth, double digit growth does not have to be a distant dream. The other heartening aspect of our growth is that it has been a bottom-up story. All the great sources of growth like remittances, the garments industry, the micro-credit revolution, and improvements in social indicators are bottom-up phenomena. Our small farmers have tripled our food production. Every year, migrant works remit home ten times the funds of all the donor agencies combined. Our mostly poor and female garments workers underpin a globally competitive industry. But the tragedy of our bottom-up growth has been the bottleneck at the top. The nation is in dire need of visionary politicians that would debate and understand the future of our economic freedom and development. Even in favourable winds, how can a bird take off if its wings are tied? Economists generally are a narcissistically noisy bunch. One rare place of unity among this generally noisy group is that development is about replicating successes. We have replicated some even improbable successes. Think of our garments, labour exports, mobile telephone industry, and micro-finance revolution. Want a list of new shows coming to a theatre near you? Here they are: agro-processing industries, footwear, pharmaceuticals and ship-building. Surely hope is on the way, if not at the door.

Fortunately, a good number of these successes sprang up in the export sector, and some even in the coveted labour-intensive manufacturing sector. More interestingly, early successes in garments, telecom and banking are breeding and multiplying entrepreneurs who can spill over to other sectors. The beauty of exponential growth is that it works in a non-linear way. Signs show that our industrial potential is nearing a tipping point for the take off. Good luck can also boost our future performance. We have some good luck to celebrate. Development often behaves like the real estate market -- location matters. We happen to be located in the right continent in the right century -- buttressed by the two rising economic powerhouses -- India and China. The 21st century is the Asian century. We must not miss the boat. We need to first deeply integrate our trade relations with the global markets, and then gradually our capital markets. Meaningful trade integration needs to coincide with attracting foreign investors in the export sectors. Like in other emerging market countries, capital market integration needs to be handled with care. Now, let's summarise. Silently but surely, we already have some of the ingredients for replicating the China-India growth model, but with a special Vietnamese twist. Amidst all the tempting possibilities, the picture is clouded by the bottlenecks from our public services and political instability. These bottlenecks are limiting the large-scale spillover and replication. We need to remove them. Drive Carefully: Beware of Speed Bumps We need a good regulatory regime and efficient public services where various government agencies implement a coherent vision about economic growth. Just like how strong fences make good neighbours, markets work best when there is a strong regulatory environment. Some of the crucial institutions need strengthening: a strong central bank, competent SEC, an unpoliticised Board of Investment, streamlined EPZ. Shortages of human capital in these institutions will be, if not already, binding constraints. Also, we cannot expect quality public services at the current compensation level. No pay, no gain. The challenges facing these institutions during rapid growth rise rapidly, because with rising growth, political powerbrokers look at these institutions to reward their party loyalty. But the party leaders need to realise that in today's media-driven democracy, efficiently running these institutions can allow them to create jobs and be voted back in power. A couple of corrupt ministers in these key places can really reduce the popularity of any elected government. Need an example? Think of the recent power sector mess. Macro-economic stability is like teeth -- we rarely appreciate the value until we lose it. We should never take it for granted. The recent macro-economic instability in Vietnam -- rising inflation, growing current account deficit -- should serve as a good reminder. We need to ensure macro-economic stability, low inflation, and appropriate exchange rate and monetary policy. Here we dearly lack capacity and public understanding. The quality of our public debate on these issues is very low and deliberately populist. We also need to be cautious about hot money inflows. True, we currently don't have this high quality problem but we may be facing this soon. Capital flows into real estate/stock market can easily create bubble and destabilise financial market, especially when regulation is weak and financial markets are shallow. No developing country at our stage of development grew out of poverty through capital inflows to stock market and real estate. These flows very often create frenzy, then bubbles, and then crashes. Nobody, except for the manipulating few, wants to party and end up crashing as the Dhaka stock market did in 1996. Like Chinese porcelain, trust in the financial market is very fragile; it takes a long time to heal. We did not recover from the hangover of our 1996 stock market crash for a long time (Figure 11). Economic history is littered with countries that got badly burnt with hot capital flows (remember Asian crises in 1997?). The Bangladesh Bank cannot be asleep at the wheel and has to manage this process very prudently. Unless we address the currently stifling infrastructure problems of power, ports and roads, we will remain the country that talks about potential. No growth is conceivable without seriously tackling these hurdles. With increasing pressure from a growing economy and population, these bottlenecks will only get worse if left un-addressed. Now comes the bottleneck from individuals. Our policy makers need to upgrade their knowledge set. The same goes for our pundit class, especially the vocal populist kinds who are often tickled by the media and love their rearview (often blindfolded) commentary on growth that is often fact-free and itchy with ignorance. Finally, we have a real silent famine in our quality of education. We badly need to upgrade it. In a globalised world, competitiveness is about productivity, which cannot take off without education. Investors don't come only if labour is cheap; they come only when labour is both cheap and productive. Good Growth Makes Good Politics Even for the most heartless, unpatriotic and selfish politicians, it now makes a lot of sense to promote growth. Generation Bangladesh, people around or under 40, number around 100 million. With a baby boomer population, higher growth and more jobs will buy the politicians and their parties more popularity. But regardless of how we look at it, the next elected government will need to realise that tremendous political dividend could be gained by delivering growth. Just ask Brazilian president Lula or the Vietnamese and Chinese leaders: they will confirm that equitable growth is sweet for the party. Job creation for our growing labour force should be the ultimate strategy to inspire party loyalty. A footnote to our political leaders and MPs: You need to change your current model of job creation. You can call your industrialist friends for 10 jobs for your party workers -- but not for 10 million jobs. Only policies that can unleash investment and growth can create that many jobs. The essential difference between Bangladesh and Vietnam is the political leadership. I see all the reasons to believe that once our politicians and public officials provide a credible vision of future, capital from abroad will not be an issue. The world now is flush with cash chasing places to invest. There is already buzz among investment professionals -- at home and abroad. Patriotism and profit are emotive combinations -- they can beautifully reinforce each other. Foreign investors are also beginning to taking note. Bangladesh is in the Goldman Sachs' Next 11, JP Morgan's Frontier 5 -- lists of upcoming emerging markets. Plus we have our gushing remittances. So capital will be no problem if there are political vision and commitment. Let's Talk About Tomorrow Vietnam benefited from its rapidly growing neighbour China, with whom it has had a 1000 year history of tension and fighting. We are much luckier in that we have a far friendlier common history with India -- we need to leverage our large growing neighbour India. If in many ways Vietnam is our khalato bhai, our political DNA suggests that India is our chachato bhai. Politically, Vietnam is a small replica of China with one-party system; Bangladesh can rapidly grow like a smaller and a more manageably homogenous version of India under a multi-party democracy. Development -- be spiritual or economic, individual or national -- is ultimately one's journey of choice and conviction. In the end, we as a nation are responsible for our own journey of development. We need a democratic and visionary leadership. Why is it we never hear our political parties talk about jobs? In the next five years, we need to create at least 10 million jobs to keep the number of unemployed people at the current level. Politicians, please take note: good politics is about creating jobs -- not cheap talk or promises for group seduction. Seduction does not last long. Our political debate needs to be about dreams, not memories. Too much debate about the memories of the past and individuals. Too little debate about the dreams of the future and institutions. Let's change the debate. Our chachato bhai and khalato bon are already roaring like tigers. It is time for Bangladesh to go beyond being just a land of tigers -- by becoming a tiger itself. After all, if not now, then when? Faisal Salahuddin, an actuary and macro-economist, is affiliated with Princeton University and can be reached at faisal. salahuddin@gmail.com.

|