Inside

|

Fallout Forrest Cookson takes a closer look at how Bangladesh's economy might take a hit Every day, news about the world economy seems to get worse: world equity markets are declining; earnings reports issued by major corporations, particularly financial institutions, are weaker; every industrial economy is either already in or entering a period of recession with negative GDP growth and lower consumption expenditures. Throughout the world there is widespread fear and trembling. Will you lose your job? Will your holdings of stocks be eroded by falling prices? Will your bank fail and destroy your savings? It is a common view that Bangladesh is substantially isolated from the world economy. The authorities, of course, as is their responsibility, express confidence that all will be well; economists who have spoken on the point express views about the limited impact of the world crisis, at least in the next year or two. What are the risks to the Bangladesh economy? Export Growth

The economic crisis will hit the non-garment exports very hard. For example, frozen foods are quite sensitive to income and the price offered will weaken. Shoe production businesses are trying to build market share, difficult to achieve in a shrinking market. The coming recession is like to lead to grave difficulties for Bangladeshi exporting companies outside the garment sector who will face weaker demands and lower prices. The first casualty of the crisis will be the fledgling export industries whose growth will be held back. Garment Sector Exports Demand: The most commonly expressed opinion is that the Bangladeshi garment exports are largely aimed at the low end of the markets so that demand will remain robust despite the drop in total clothing expenditure by Western consumers. But there should be all types of responses here: Some will buy cheaper clothes; some will simply buy fewer more fashionable clothes. We all hear tales that it is the low-income households who are losing the most in this crisis, not the middle classes. If that is indeed the case then the impact on the presumed Bangladeshi end of the market is dire. Competition: The second factor in the market prospects is the competition from other producers. The standard argument is that China is no threat as their costs are high; the buyers are telling Bangladeshi producers that they are cheaper than the Chinese and that no one else can compete with Bangladesh costs. One should be very cautious here in assessing what is happening. Table A on the following page presents the shares of the EU, US, and Canadian markets of China and Bangladesh in 2003 and 2007. Bangladesh is the second largest source of garments to the EU market; but in the past four years with all kinds of changes in trading rules and in the exchange rate movements the Bangladesh exporters managed a small 8% increase in their share of the market, but the Chinese increased their share 62%. The same pattern can be seen in the US market, where Bangladesh exporters increased their share by 43% from 2.8% to 4.0%; the Chinese exporters increased their share from 13.8% to 31.7%, an increase of 130%. The Canadian market shares are perhaps more interesting: Bangladesh has increased its share from 5.3% to 6.4% or 21%, but the share peaked and has been declining; the Chinese share increased from 29.5% to 52.8%, 79%. Altogether China is clearly the major factor in these apparel markets; a small increase in the Chinese market share could result in a sharp drop in the Bangladesh shares; so one must be very cautious about writing off the Chinese. For example, the woven fabrics are very dependent on Chinese sources of supply and problems with price and availability may arise. Squeeze: In a weakening market there will be a harsh squeeze that the apparel industry will face: First, there will be pressure on prices for the EU market arising from the depreciation of the euro and pound sterling with respect to the taka. While one cannot be sure how these exchange rates will change the most likely future is that the euro will stay weak with respect to the dollar, and hence the taka. Second, the appreciation of the Chinese currency has caused the cost of imported fabric to increase in taka terms. In a period of weak prices this has put great pressure on producers of woven goods. Third, with weakening markets, the buyers who intermediate between the large retail firms and the manufacturers will become ever more frantic and manipulative. Many of these people are full of dirty tricks, misrepresentations, and illegal maneuvers to force down the effective price of the apparel exports. Conclusions about exports: The garment sector will face adverse consequences arising from the world crisis. From the on-going decline in private consumption expenditures in the industrial countries, apparel demand (in constant prices) will decline, reaching a maximum decline of about five percent over the next four years. While the low end products that comprise most of Bangladesh's exports will suffer less demand reduction, competition for market share will be very intense; while China's cost is higher, their ability to compete is very strong, as can be seen from the steady increase of their market share over the past several years. They will certainly fight to retain the export volumes that they have achieved. I project that Bangladesh will lose a few percent of the dollar value of its garment exports in the next two calendar years; recovering in the third year. But the past rapid growth will slow.

Food Prices The nation now faces the unwinding of the consequences of the higher rice prices experienced last year; farm gate prices will decline, wholesale and retail prices will begin to decline. It may take a several months to work through the system but the decline in rice prices to significantly lower levels will certainly take place as a consequence of the slower growth of the world economy. Speculation that contributed to the rapid rise in rice prices will work the other way and drive the price down rapidly. Of course this will help persons who are not rice surplus producers, but rice farmers will generally find that the lower farm gate prices and discouraging; the boro crop in 2009 will show little change over 2008. The shift of income to rural areas at the expense of the urban areas will reverse itself. This will help to ease the pressure for wage increases in the industrial sector. Wheat and maize prices will probably also come down; cooking oil will decline but not as much as the grains. The source of increase of soybean oil was partly the shift of land to produce bio-fuels. The food price index should begin to decline over the next few months. Oil Prices Remittances During the next year a 15% fall in remittances from the above countries plus others that are expected to depreciate with respect to the dollar would cost the balance of payments $400 million; but this would be offset by a continuing rise in remittances from the Middle Eastern countries for which recruitment of new workers has been going on. Loss of Confidence in Capital Markets and Banks?

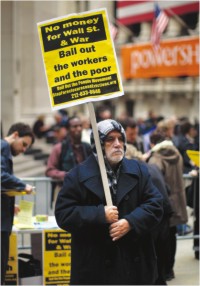

Foreign Investment Interested in Energy Sector? Macro-economics Investors will be very much more uncertain as to what is going to happen. Additional capacity in export industries will be deferred until the real picture for the sector emerges. I believe that investors will become much more cautious for the next year or two. Taken together, we can expect some slow down of the economy in the face of reduced investment, less personal consumption, and stagnating exports. The Bangladesh economy will follow along the same path as most other countries. Temptress at the Gate The temptress at the gate is the call for more regulation, tighter capital controls, and reduced flexibility in the financial sector. All over the world, the cry is heard that there was insufficient regulation and it was this that led to the disastrous collapse of such a large part of the world's financial sector. The United States and Europe seem determined now to take control of the financial sector -- what we used to call the "commanding heights" and to insure a better economic performance. With odds on Barack Obama being the favorite to become the next president of the United States, and a strong-willed Democratic-controlled House of Representatives, one should expect a determined drive to increase the regulation of the financial sector in the United States. This will be a serious error but inevitable. What about Bangladesh? Will Bangladesh Bank and the next elected government be tempted to interfere even more in the banking sector? Already Bangladesh Bank exercises far too much control over the private commercial banks. Dictating terms of the boards, controlling salaries of managing directors, limiting transport expenses -- these are all symbols of excess interference. Interest rates although uncontrolled in principle move remarkably little. The non-performing loan level of the banks remains precarious but it is not clear what additional supervision would be able to do about this. (Note: official data does not fairly represent the conditions.)

Here are some calls for change that we are likely to hear: 2. Promote government owned banks! The four NCBs are insolvent. The government specialised banks are insolvent. Nothing could be worse. 3. Increase regulations over what banks can do; for example distinguishing between loans to "productive" and "non-productive" sectors. Bangladesh could use more retail consumer banking and diversified types of financial institutions. 4. Increase government ownership of key sectors of the economy. Exactly the wrong way to do but this was on the cards even without the financial crisis. Each of these would be a disaster for the economy. Overcoming Temptation The nation will have a rough time with a slowdown in investment and exports, resulting in slower economic growth. However, the inflation rate will slow down. The financial system is unlikely to face any threats of loss of confidence. But the greatest problem will be the keen interest that the bureaucracy and the leftist economists will have in moving towards government ownership and intrusive regulation. Forrest Cookson is an Economist. |