Inside

|

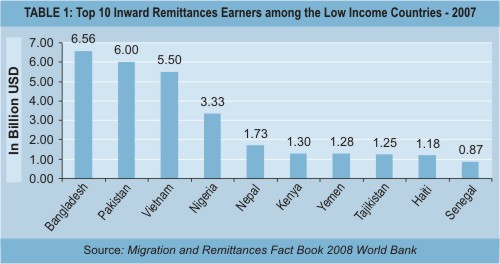

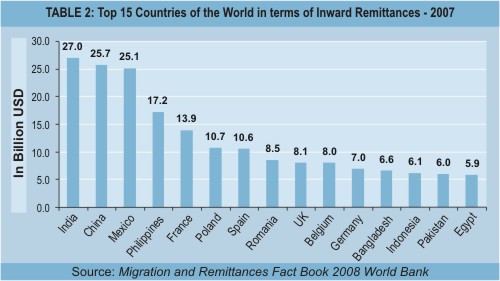

Money on the Table Mamun Rashid shows how remittances can be a $30 billion a year business for Bangladesh Remittance has emerged as an important contributor to the poverty alleviation efforts in developing and least developed countries. At the same time, remittance inflows also support growth, both on the supply side (as investment fund for increased output) and on the demand side. Even if the demand is for imported items, no pressure is created on domestic resources, with the remittance itself providing the wherewithal. In 2007, the total remittance inflow in the world was $337 billion, out of which $251 billion or 74 percent flowed into the developing nations. Out of this $251 billion, $61 billion flowed to the developing countries of Latin America and the Caribbean region, out of which $25 billion went to Mexico. East Asia and the Pacific region have the second highest share of the total inflow to the developing countries of $59 billion. The top five recipients of remittances in this region are China ($25.7 billion), Philippines ($17.2 billion), Indonesia ($6.1 billion), Vietnam ($5.5 billion) and Malaysia ($1.7 billion). Europe and Central Asia gained $47 billion, about 19 percent of the pie. The highest remittance recipient in this zone is Poland ($10.7 billion) followed by Romania ($8.5 billion). The Middle-East and North Africa and the sub-Saharan Africa region secured 11.4 percent and 4.6 percent of the pie respectively, with corresponding remittance inflow of $29 billion and $12 billion. If we look at South Asia, the total remittance inflow in 2007 was $44 billion, an increase of 10 percent from 2006 and 82 percent growth since 2002. India topped the list with an inflow of $27 billion in 2007, followed by Bangladesh ($6.56 billion), Pakistan ($5.99 billion), Sri Lanka ($2.7 billion) and Nepal ($1.7 billion). In the South Asia region, the cumulative average growth rate of remittances over the last five years is highest in Nepal (20.7 percent), followed by Bangladesh (18.1 percent), Sri Lanka (15.6 percent), India (11.4 percent) and Pakistan (11 percent). However, as per the World Bank classification, India and Sri Lanka are the Lower Middle Income Countries (LMCs) and Bangladesh, Nepal and Pakistan fall in the lower income group. Out of 49 low-income countries (LIC), Bangladesh ranked first in terms of inward remittances inflow, followed by Pakistan and Vietnam (Table 1).

While remittance is not the only source of development in a country, it does play a significant role. Almost all countries -- low, medium and high income -- target workers' remittances. The geo-political scenario also influences international labour mobility, and thereby remittance. The recipient country's economic situation and its relationships with wealthier countries matter. What also matters is the way these remittances are utilised in the home country. Imported workers pose competition in the local employment market. From a host country's perspective, foreign exchange is going out because foreign workers will be remitting money to their home countries. The concept of "brain drain" through migration is not a major issue for developing countries anymore, because it has been observed that their contributions to GDP may be offset more favourably by inward remittances and favourable effects on remittance and investment. Hence, it is of utmost importance that the government should work with foreign governments and form partnerships to increase worker mobility and remittance. Bangladesh Scenario

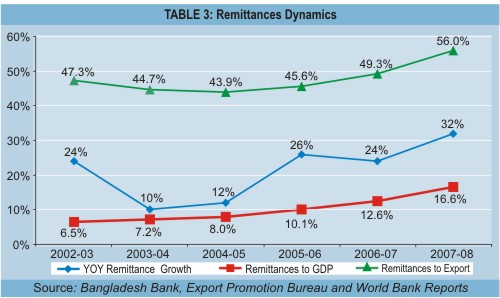

As globalisation expands, the flow of remittances is likely to increase, since movements of people will accelerate. Globalisation leads to ease of communication, availability of training, attraction towards tourism, etc. There is some relationship between remittances and human resource development. Most developed countries, to fill in the resource gaps and with the shift in income to an upper level, are outsourcing talents as well as blue-collar jobs from overseas, primarily from developing counties. Given the global outlook, if Bangladesh can maintain a cumulative average growth rate of 22 percent in remittance inflow, which is the growth trend for the last three years, it should be able to generate $30 billion remittance income by 2015. For achieving this $30 billion, Bangladesh has to improve its current share of 3 percent and capture more than 5 percent share of the remittance inflow. Now, what should be the destination model? What challenges are lying ahead, and how to overcome them? Bangladesh has made remarkable progress in terms of growth of remittance inflow. According to Bangladesh Bank data, the total remittance inflow in FY2007-08 was $7.98 billion, which represents year-to-year growth of 32 percent, 16.6 percent of country's GDP and 56 percent of total exports. During the first two months of the present fiscal, Bangladesh received $1.5 billion in remittances. To sustain the current growth trend (Table 3), Bangladesh needs to address the following issues immediately.

Up-skilling the Workers and Competitive Salary Up-skilling requires effort. Many policy analysts have been talking of setting up polytechnics and vocational training institutes for this, though we already have many. Therefore, instead of setting up new technical training institutes, it would be far more cost effective and quicker to shore-up the extensive network of polytechnics and vocational training institutes. Revised curricula relevant to the needs of local industry and of foreign labour markets may be adopted in these institutions; the trainers may be retrained, and successful trainees may be offered internationally recognised certifications. Experts have been talking of engaging the MFIs/NGOs also in this effort. The skill mix of the workers should be changed so that more up-skilled workers can get jobs that pay higher than average. Bangladesh will, thereby, be able to increase per capita remittances and also improve its brand image in the developed economies. Up-skilled workers can find alternate opportunities during their stay overseas, reducing the chances of becoming unemployed, which creates social issues both in foreign and home countries. While low-skilled labourers are not in a position to bargain, up-skilled workers can expect more competitive compensation. Continuous scanning of demand-supply situation and compensation scale in the international labour market are crucial. Encourage Participation of Women in the Migration Pool Instead of taking any positive actions, the Bangladesh government banned women migration in 1998, which continued till 2005. While women are playing a significant role in the country's export earnings, we cannot ignore the immense potential of remittance earnings, which is being wasted by lack of participation of women in the migration pool. New Destinations

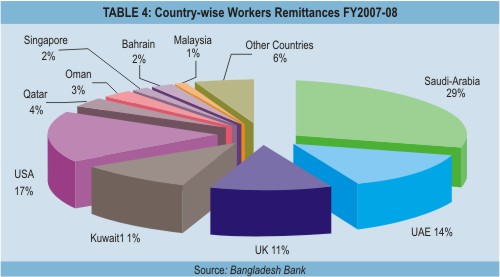

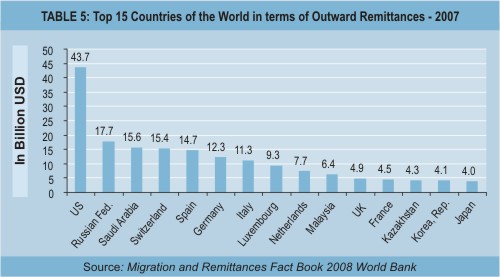

Total remittance outflow of the world in 2007 was $238 billion, out of which high income OECD countries contributed the lion's share of $159 billion, or 67 percent of total world outflow (Table 5). Out of the 27 high income OECD countries Bangladesh receives a reasonable amount of remittances from US, UK, Germany and Japan. But if we look at Bangladesh's share of remittances from those countries we can see that it received only 2.5 percent of total outward remittances of the US. The shares from Germany and Japan are very insignificant, 0.2 percent and 0.3 percent respectively. However, Bangladesh has a reasonable share of 18.5 percent of outward remittances from UK. The government needs more analytical support to identify the economies that are expected to go through a phase of upturn or downturn. Remittance flows will depend on the economic cycle of the importing countries. Economic downturns in the home country may also encourage workers to move abroad. Upturns also draw attention from competing labour exporting countries. For example, the Gulf Cooperation Council (GCC) countries are currently experiencing an economic boom due to high commodity (fuel) prices, which is resulting in an increasing demand for migrant labour. The GCC countries have among the highest number of migrants as a share of population in the world: 78 percent in Qatar, 71 percent in the UAE, 62 percent in Kuwait, 41 percent in Bahrain, 26 percent in Saudi Arabia, and 24 percent in Oman. Hence, we need to improve our relationship with the Gulf countries. The government should act to bring more benefits to the workers by increasing job related training and language skills for manpower export in the right countries. Foreign missions can play an important role here. The commercial and economic divisions should closely work with the labour division in our foreign missions.

Currently, countries like Malaysia, South Korea, and other East Asian countries offer opportunities. Reconstruction work in Russia may open up new avenues. Bangladeshi construction workers have found jobs in new markets like Romania, Brunei, etc. The large construction and services firms of Bangladesh should look for more contracts in the destination countries and thereby engage more Bangladesh workers, like the Indian construction firms did during Kuwait reconstruction after the Iraq attack. Relationship with Employing Countries Scope for employment also needs to be explored in other countries where demographic patterns indicate shortage of young local entrants in the labour market. This is likely to include South Korea, Japan, and many western European countries. Role of Foreign Missions Whether the missions were able to ensure ease of entry, safety, security, well-being, respect of our workers, whether our workers are paid at par in the foreign market and are aware of their rights, should be the focus of our foreign missions. Incentives may be offered to the missions for ensuring highest remittance through official channels. Bangladesh missions abroad should play an active role in mobilising labour between Bangladesh and the destination. This is a crucial issue because better performance by our foreign missions means increased remittance flows to Bangladesh. Post 9/11, movement of workers was affected in several parts of the world. If foreign countries feel threatened due to agitation and other chaos, say for the case of Kuwait, this will not bring any good for us. The government's foreign policy and role of foreign missions in establishing positive diplomatic relationships with host countries are vital to boost inward remittances. Building top-level relationship between the ruling regimes is the key for achieving the goal. Efficient Banking and Investment Services Focus on Labour Export to Wealthier Economies Discussions should also take place to reduce the cost of outward remittance in the host countries. The worker remittance should be viewed as a relatively stable source of foreign exchange. While Foreign Direct Investment (FDI) is driven by fiscal policy of a particular government, remittances are not so much fiscal incentive driven. It continues to flow even during bad times, when FDI or portfolio investment or official flow plunges in the event of financial crisis/meltdown. Hence, worker remittance is viewed as one of the most stable and more definite sources of foreign exchange. Free Movement of Labour under WTO

Manpower export should be considered as an industry in Bangladesh, and the government should focus on building an end-to-end network to facilitate smooth and safe migration, not just for blue-collar wage earners but also for white-collar jobs in the international markets. Capacity enhancement of the relevant government agencies should be addressed. This requires participation of overseas recruiting agencies, prospective employers, the Bangladesh consulates, host country regulatory bodies and Overseas Bangladeshi Community Group. Possible Ways of Increasing Alternative Distribution

Channels Over the years, Bangladesh Bank has taken various measures, like allowing floating exchange rates in current account, fixing time limit for remittance transfer, allowing expansion of exchange houses and correspondent banks, and encouraging banks, which facilitated the growth of remittances inflow. However, we have a long way to go in terms of automation and build up of technological infrastructures. At present, 48 banks are operating in Bangladesh and have about 4,500 branches all over the country. This is not enough to serve over 150 million people. Moreover, most of the private banks do not want to open branches in villages because of low profit potential. Hence, it is important to explore alternative channels. Recently, we have seen that many private banks have formed partnership with Bangladesh Post Office, which has more than 10,000 branches, to reach the remote corners of the country. MFIs can play a significant role as alternative distribution channels of inward remittances in Bangladesh because of their presence even in the in the remote parts of the country. The MFIs/NGOs can leverage their existing branch infrastructure, local knowledge of the client base, loyalty and confidence of potential client base, and in-depth knowledge of the locations. In return, MFIs can also enhance their existing client base and cross-sell micro-finance products. Very recently, we have seen much debate in newspapers regarding initiating mobile phone banking. Although this should be subject to various regulations, it also opens another new horizon of alternative distribution medium. The telecom companies have more than a thousand customer services centres, which can be utilised for broader coverage and faster delivery of inward remittances. Usage of Remittances for Domestic Development

For Bangladesh, worker remittance is working as a protection against increased international oil prices and is contributing to the development finance. The economic effects of remittance are significant. In Bangladesh, inflows from remittance are either invested or consumed. In either case, it is good for the economy. If the remittance is invested it contributes to the GDP growth, if it is consumed it favours multiplier effect in the economy through spending. In a developing economy like ours, remittance can increase both savings and investment. Remittances can be used for investment purposes in Bangladesh. As a unique solution, securitisation of future flows of remittance would generate bulk proceeds of foreign exchange to be invested in major projects in Bangladesh. In the social sector, education and health get benefited because of schools and hospitals being constructed from remittance inflows. Also, the foreign currency received through worker remittance is spent to import basic inputs of production that are not available in Bangladesh. To hedge against the episodic nature of FDI and portfolio investment, which increase during economic growth but decrease with economic downturn, the government should focus on remittances, which are less volatile and would hopefully continue to increase. While we do encourage FDI and portfolio investment by foreign investors in the real sector and capital markets respectively, we need facilitation of portfolio investment in Bangladesh by wage earners abroad as this would also be important in channeling of remittances into uses promoting development.

In Bangladesh, inward remittance is the second biggest source of foreign exchange after exports. On the other hand, if we consider "net receipts," remittance will be higher than export receipts. Remittances are the source of savings and investment for a household and a mode of wealth accumulation, all of which serve to build a "safety net" for a household. Bangladesh, to a great extent, was able to sustain the global shock of oil and food price hike mostly because of robust inflow of remittances. Remittances will continue to be the driving force of the economy. In short, to achieve a $30 billion share from the world remittance market, Bangladesh should explore new destinations, upgrade workers' skill sets, search for more hassle-free and efficient distribution channels, come up with new savings instruments, channel and facilitate wage-earners investments into the productive sector of the economy, encourage participation of women in the migration pool, take active measures to ensure worker safety, build up a well-framed manpower industry, and, lastly, but most importantly, promote Brand Bangladesh to the rest of the world. Photos: Tanvir Ahmed/ Driknews Mamun Rashid is a Banker and Economic Analyst. The writer is grateful to Ambassador Farooq Sobhan from Bangladesh Enterprise Institute, Allah Malik Kazemi from Bangladesh Bank, and Dr. Fahmida Khatun from Centre for Policy Dialogue for their guidance and intellectual support in writing this article. |