Inside

|

An Honest Budget Sadiq Ahmed offers his assessment

On the evening of June 10 after some 32 years abroad I had the opportunity to sit through and listen to the presentation of the national budget for the fiscal year 2010-11. The Bangladesh Chamber of Commerce had arranged this TV viewing and listening opportunity at the Sonargaon Hotel surrounded by a host of television and print media representatives. I was a part of the five invited panelists and the task was to listen to the budget speech by the honourable finance minister (FM) and then respond to questions from the media. The budget speech started in an innovative fashion that I much appreciated. The FM explained that he would depart from the conventional approach and not read the entire long speech that was already circulated in written form to the House. Instead, he said he would focus on the highlights and the main messages by using power point. Immediately my excitement went up. I always believe less is more and the main points tell a better story than long-winding speeches where the storyline and central messages get buried or lost in the maze of winding details. The first phase of the FM's presentation focused on the highlights of achievements of the past year and the key features of the coming year's budget. So far, so good. But I wish the rest of the budget presentation had proceeded in the same spirit rather than the detailed description that went on for a fairly long period, punctuated by a couple of longish breaks for prayers. The summary of FY 2010-11 budget is shown in Table 1 along with implementation of the last two year's budgets. The media representatives were twitching for their stories and headlines.

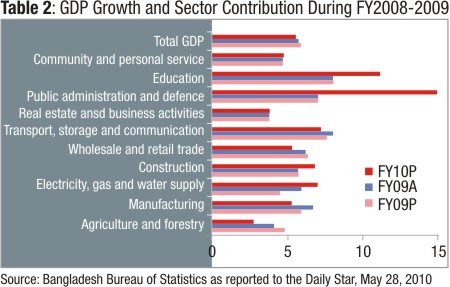

One key question thrown to the panel was: What's new in the budget? While my fellow panelists were thinking how to say something politically correct, I quickly jumped in by saying that I was struck by the focus of the budget on growth unlike previous years where the main emphasis was on social welfare. My first reaction listening to the FM was that this budget certainly can be dubbed as a budget for economic growth. I say this because of the emphasis on infrastructure, especially energy, the emphasis on raising the investment rate, the emphasis on exports, and the emphasis on manufacturing sector as the main source of additional growth and employment. Even in agriculture, the budget de-emphasises subsidies in favour of rural infrastructure, technology, and research and extension. I think these are the right things to emphasise. The growth target in the budget, 6.7% for FY10-11, is ambitious but achievable. In this regard, I wished the FM was gracious enough to accept the 5.54% growth rate for FY09-10 that was estimated by the Bangladesh Bureau of Statistics (BBS), rather than project a 6% growth rate which may not have a solid basis (see Table 2). I do not think we need to be embarrassed by the 5.54% growth rate, which is quite While remittances are buoyant and have boosted domestic demand and public expenditure is also somewhat higher than last year, it is unlikely to have a supported a 6% growth in the face of the serious downturn in the expansion of exports and agriculture. Of course, I will celebrate if the BBS is wrong and there is new evidence to support the higher growth expected by the FM. But as a starting point I would suggest we stay with the BBS estimates, which is the only institutional basis for estimating the economic growth rate at the present time, until new results are found. In addition to the focus on growth in the budget, I am pleased to see emphasis on a number of structural reforms: expanding coverage of the medium-term budgetary framework; revitalising the Public-Private Partnership (PPP) initiative; intention to decentralise budget to lower levels of government (provided it is well done); efforts, albeit limited, to revitalise tax collection through focus on modernising the Value Added Tax system (VAT). I commend the government for maintaining macro-economic stability, which has been a hallmark of economic management in Bangladesh and is the primary reason for a favourable international credit rating. Importantly, I also commend the government for preserving overall sound expenditure priorities. The focus on safety nets, health and education, energy, agriculture and transport in expenditure allocations are indeed the right priorities in today's Bangladesh. We should indeed celebrate these strengths, provided we also remain vigilant about the challenges. And there are quite a few. In the first place, we keep on decrying the low level of development spending and quickly celebrate the increases. Last year's budget does show a hefty increase in development spending (46% according to revised budget data but most likely to be 35% increase), even though overall levels are low (around 4% of GDP). And the next budget programs a similarly large increase. A priori, this is a positive development, especially because the level of our development spending is far below what is needed. However, we cannot simply stop here and celebrate. An even more pertinent question is: Where has this money gone? This is a particularly important question given all the concerns about poor procurement policies, inadequate monitoring and follow up on where the money goes, and very little review of the results or outcomes of these spending. This absence of a monitoring and evaluation framework (M&E) is a serious weakness of our national budget, where the main focus is on money mobilised and spent rather than what are the key objectives and targets set in the budget and to what extent these objectives and targets were achieved. The move towards an outcome or results oriented-budget ought to be a key long-term objective. To this end, I recommend as a start a good review of the spending efficacy of resources devoted to agriculture. If the increase in agriculture value-added has remained at a mere 2.8% despite the huge amount of subsidies and interest free loans thrown in, there is a clear need to think through the rationale for these spending levels and instead ask what really motivates farmers and can this money be better spent. Similar questions should also be asked for other major public programs. A second question where more thought needs to go is how the sectoral growth targets would be achieved, especially for agriculture and manufacturing. I have already touched on the subject of agriculture. The only other point I will like to add is the role of agriculture pricing policy. We seem to shy away from this question in public policy debate. I suggest that this needs to be intensely debated at the public forum including at the political level. The policy question to ask is: Would Bangladesh be better off by letting its farmers enjoy the market prices of outputs and inputs and instead focus the budgetary allocation for agriculture on rural infrastructure including farm-to-market roads, rural power, rural irrigation, and storage facilities. Evidence from China suggests that such public spending have high rates of return relative to input subsidies. Regarding the manufacturing sector, it is sad that even after 40 years of independence we have really not tackled the issue of how to spur the true potential of the manufacturing sector. Between 1970 and 2010, the share of the manufacturing sector in total GDP has marginally increased from 11% to 17% while the employment share has increased from 8% to 11%. The government's plan is to raise these shares to 40% and 25% respectively by 2021 (in the next 10 years). I do not doubt that these are achievable targets. But what is missing is a strategy for achieving them. The budget for FY10-11 is similarly vague. The emphasis on infrastructure is well taken. If well implemented, the availability of power and better transport services will reduce production cost and can be a major impetus for expansion of manufacturing and services sectors. But this is not enough; the government needs to push reforms in a number of other areas as well to improve the incentive structure for spurring the growth of labour-intensive manufacturing. This will be some combination of reducing cost of doing business through reducing regulatory barriers, improving incentives by reducing tariff and non-tariff barriers to international trade and competition, reforms of the financial sector to promote long-term financial institutions and capital markets while also reducing the financial intermediation spread, and streamlining the tax regime to remove the biases against manufacturing and longer-gestation investments. Additionally, efforts are needed to attract direct foreign investments that are a key source of technology transfer. The budget pays lip service to small and medium enterprises. It naively assumes that throwing some financing will spur the sector's dynamism. This is not just a shortcoming of the budget but a major gap in national knowledge.

To my understanding the country lacks a comprehensive database on SMEs that can inform us about the number, size, product-mix, employment, value-added, constraints, etc. In the absence of this knowledge and the lack of a baseline, throwing money at SMEs is like dropping bank notes from helicopters. It is almost impossible to say where money is going and what is being achieved. We have a tendency to jump on bandwagons without thinking what outcomes we are securing. Unfortunately the promotion of the SMEs has become a flavour of the month without much idea of what we are really supporting. I for one am a great believer that SMEs are a critical factor in any industrialisation strategy for Bangladesh and deserve the highest policy priority. But any serious effort to help this key sector must start with establishment of a quick and competent database on SMES, a strong analysis of the structure of SMEs and chief constraints based on local and international knowledge, a road map of where the SME sector should go in the next 5-10 years, and an articulation of what policies and strategies will allow that road map to be achieved. Clearly, therefore, there is quite a bit of work to be done to implement the ambitious growth target for the next year and over the longer-term. The overall macro-economic framework, as I noted earlier, is a strength for Bangladesh over a long period of time. This budget similarly does a good job to preserve macro-economic stability by achieving a low level of fiscal deficit this year and targeting a low level of fiscal deficit for the next year. Additionally, like this ongoing fiscal year the budget for the next year emphasises domestic resource mobilisation. Starting from very low levels, this year the budget succeeded in raising the tax to GDP ratio by 0.6% of GDP (from 8.2% of GDP in FY09 to 8.8% of GDP in FY10) and hopes to raise the tax rate by another 0.5% of GDP in FY11. The strategy adopted is to streamline the VAT and strengthen income tax collection through a number of measures. This is laudable, but falls short of expectations especially in the area of reform of income taxation. Furthermore, the budget does not deliver much in rationalising the import duty regime. Pending detailed analysis, there is even a risk that the proposed trade tax measures might raise the effective rates of protection for domestic production as against exports. If correct, this incentive regime goes against the stated objective of promoting labour-intensive, export oriented manufacturing. The government had good intentions and as a first step it established two task forces, one on value-added taxes and the other on tariff. The objectives were to rationalise these major taxes, raise productivity of value-added tax and ensure the consistency of tariff duties with production and export incentives. Unfortunately, the announced budget fell far short of implementing these recommendations and we see this as a major missed opportunity. It appears unfortunately that national politics got the better of good intentions from the finance ministry. One other aspect of the macro-economic policy is the consistency of monetary and fiscal policy to achieve inter-related targets of economic growth, balance of payments stability and inflation control. Usually, the convention is to focus fiscal policy on economic growth, exchange rate and trade policy on balance of payments, and monetary policy on inflation control. This co-ordination seems to be emerging as a problem for macroeconomic management in Bangladesh. While fiscal policy seems reasonably well focused on economic growth, it is not obvious what the direction of monetary policy is. Inflationary pressure has been increasing in Bangladesh in an environment of global depression and relatively lower growth of commodity prices. Food prices in Bangladesh have been relatively stable in FY09-10, yet the inflation rate has accelerated to 8.8%.

Since fiscal deficit is relatively under control over the past two years, the indications are that inflationary pressures might be emerging from faster than desirable expansion of domestic liquidity. Indeed, data shows that broad money (M2) has been expanding at over 21% per annum. With GDP growth at below 6% per annum, even if one allows for an income elasticity of money that exceeds one, the rate of liquidity growth does seem be on the high side and a priori appears to be a key factor for spurring higher inflation. So, when the FM sets a goal of reducing inflation down to 6.5% for FY10-11, as chair of the monetary board he will be well advised to ask that the conduct of monetary policy be made consistent with the budget targets for inflation. Finally, the overall budgetary management will benefit from some early thinking on a number of downside risk factors that could compromise macroeconomic stability unless managed well. First, there is a need to comprehensively deal with the matter of off-budget contingent liabilities that have been piling up for a while. I do not have the latest estimates but the last time I saw the data, these liabilities were estimated at a hefty 10% of GDP. These are mostly the unsettled obligation of public enterprises including the petroleum corporations and the nationalised commercial banks. Secondly, the growing pension obligations of the government budget need to be managed in an orderly fashion. Several advanced countries are facing huge problems on this count. While Bangladesh is at a relatively early stage on this problem, lessons can be learnt from international experiences, including how to devise creative financing options for a growing pensions liability. Finally, the inefficient and expensive power expansion program forced on Bangladesh by years of inaction and mismanagement needs to be carefully monitored and factored in to estimate the huge implicit subsidies from these expensive power generation facilities. It is very unlikely that the budget can easily absorb this large subsidy. The proper balance between pass-through to consumers and budget subsidy needs to be worked out in the context of prudent burden management and the time path for phasing in the pass through needs to be worked out upfront. How do I conclude my views on the FY10 national budget? I do not hesitate to say that this is an honest budget by an impeccably honest finance minister and well deserves our support in helping its implementation.

But lots of work needs to be done, as I have elaborated above, and some mid-way corrections in the budget might be needed. Of particular importance is the need to debate and discuss incentive policies for spurring growth in agriculture and manufacturing and for raising private investment. In this regard some flexibility in changing tax policies might become necessary, or at the least a willingness to tackle these changes in the next budget. Finally, steps need to be taken to move towards a results or outcome-oriented budget, where budget is not just judged on the basis of numbers going up or down but on the basis for targets and results being achieved. Sadiq Ahmed is Vice Chairman of the Policy Research Institute of Bangladesh.

|

respectable by international standards given the global crisis. Exports have barely grown in Bangladesh in FY09-10 that has dampened manufacturing growth. Agricultural value-added is estimated at 2.8% in this past year, which is respectable but not spectacular and much less than that achieved in FY09-10.

respectable by international standards given the global crisis. Exports have barely grown in Bangladesh in FY09-10 that has dampened manufacturing growth. Agricultural value-added is estimated at 2.8% in this past year, which is respectable but not spectacular and much less than that achieved in FY09-10.