Inside

|

The Long View Jyoti Rahman explores where this year's budget might take us

On June 10, Mr AMA Muhith submitted the third Awami League government's second budget. The budget has been much parsed and analysed in the weeks since. As such, there may not be much in this piece that is particularly novel. Nonetheless, a macro-economic analysis is attempted. We consider the growth and inflation outlook for 2010-11 (FY11) first, before exploring the medium-term macro-economic targets, paying particular attention to industrialisation, exports, domestic services industries, and investment. The macro-economic outlook for FY11 is achievable despite risks to agriculture and remittance. Into the medium term, the government's economic agenda is nested within an ambitious set of macro-economic projections. Resolving the energy crisis will be crucial to realising these projections. Macro-economic outlook for 2010-11 The 2009-10 budget was initially based on GDP growth of 5.5% in FY10. The expected growth rate was subsequently revised up to 6%. While the latest national accounts peg the year's growth rate provisionally at 5.54%, the 2010-11 budget still maintains a growth rate of 6% for FY10. If the budget is correct, the Bangladesh Bureau of Statistics will revise up the FY10 growth rate next year. As it happens, BBS has revised up GDP growth only three times (twice in pre-election years) in the past 15 years. And historically, our budgets have tended to be based on over-optimistic growth outlooks. That is, if history is any guide, the economy in FY10 will eventually be considered to have been weaker than government expectations. Will the government be proved too optimistic for FY11 too? Therefore, agricultural production presents a key risk to the growth outlook for FY11 -- on the one hand, the government may be too sanguine, on the other hand, various policy efforts taken thus far may present an upside to the ADB's forecasts. Turning to the expenditure side of the GDP, the budget assumes strength in consumption growth coming from surging remittance. The government expects remittances to grow by a whopping 22% in FY11, whereas the ADB expects remittance growth of only 12.5% next year. While remittance growth has far surpassed expectations in recent years, including during the global recession, there appears to be significant downside risks to the government's remittance outlook. At the onset of the global recession, exports were considered to be one channel through which Bangladesh could have been affected. Even though exports showed remarkable resilience when compared with a sharp decline in world trade during the worst of the global recession, delayed impact of the crisis was felt on our exporters in late 2009. Both the government and the ADB, however, see exports rebounding in FY11. To the extent that the global recession has been not as severe as feared -- the world economy shrank by 0.6% in 2009, against the IMF's April 2009 forecast of a contraction of 1.3% -- there may be some near-term upside to our exports. And if political stability can be maintained, there may well be some upside to the investment outlook, which will have positive spillovers across the economy. However, overshadowing all the uncertainties around farm production, remittance, export or investment is the continuing electricity and gas shortage, which may not only derail investment or industrial production, but can also hamper household consumption and create political instability.

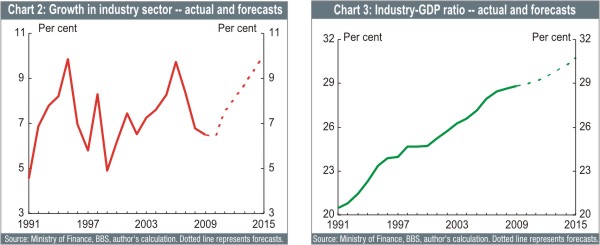

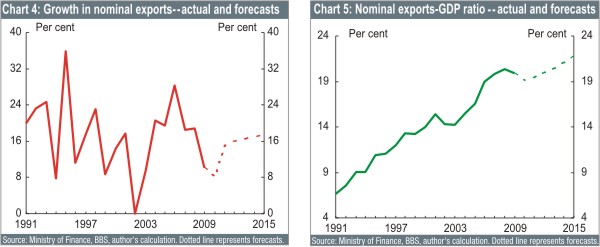

Medium-term macro-economic outlook According to the government's medium-term macroeconomic forecasts, with the growth rate accelerating to 8% by FY14, the economy will grow by 7.4% a year under the current government (between FY10 and FY15). This is far stronger than the IMF's forecast for the same period of 5.9% a year (a rate similar to what was achieved in the past decade). And the government's medium-term projections appear to be ambitious by historical standards too -- 7.4% a year is over a full percentage point faster than the strongest annual average over a 5-year stretch in our history (6.3% a year in the five years to FY08). Of course, ambitious doesn't necessarily mean unattainable. The IMF has typically underestimated the resilience of the Bangladeshi economy over the past decade, and it may well be far too gloomy on our medium-term prospect. Plus, the government projection is for an economic acceleration of 2-2½ percentage points over four years coming out of a cyclical trough -- we achieved a similar feat between FY02 and FY06. So the projected economic acceleration is certainly possible. But to assess whether it is likely, we need to unpack a few underlying stories regarding industrialisation, export, domestic services sector, and investment.

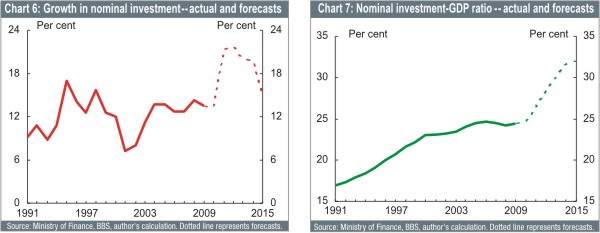

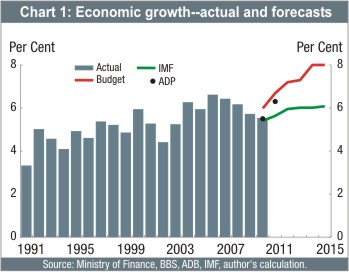

Export-led industrialisation vs domestic services growth The projected recovery in industrial growth is likely to be different from the previous bouts of industrial acceleration. The previous episodes were accompanied by export booms (Chart 4) that saw the exports-to-GDP ratio rise steadily (Chart 5). The projections are based on a far more modest outlook for our exports into the medium-term. And given the continued labour market slack and fiscal doldrums in the rich world that is our primary export destination, the modest projections are, by and large, prudent. The implication of an industrial rebound without an export boom is that the government expects domestic demand to pick up. In line with this, the government expects services sector -- particularly trade and housing -- to boom into the medium-term. Such medium-term projections could be well-founded. Sectors such as transport, storage, and communication, financial intermediations, and health and social works saw their growth accelerate by 2½ to 3 percentage points in the past decade. The use of information and communication technology has been credited with the better performances in these industries. Could the trade, property, and business services industries be next in line to get a boost from the digital revolution? These sectors amount to about a fifth of the economy. If they were to grow by 2½ percentage points faster, then overall GDP growth would rise by 1 percentage point a year. Investment Part of this boom is public investment, which is projected to rise to 6% of GDP. The annual development programme forms an important component of the promised public investment bonanza. While the conversation about ADP among our punditry is typically about its size or "best practice" project design, given the government's commitment to raising ADP, the attention should shift towards ensuring that right projects are implemented at the right time. In addition, the government reiterates its pledge to implement large investment projects in power and infrastructure sectors through PPP initiatives.

While the experience thus far with PPP is not much to speak of, even assuming the public investment projects fully online by FY15, private investment will still need to rise by over 6 percentage points of GDP over the FY10-FY15 period for the projection to hold. This is, again, unprecedented in recent decades. What are the constraints that have been inhibiting private investment from growing by the pace envisaged? And of these constraints, which ones should the government prioritise? One way to answer these questions is by using the growth diagnostics framework developed by Harvard's Dani Rodrik and colleagues. This framework systematically explores where small policy changes could make the greatest difference. One such analysis -- the first for Bangladesh as far as we are aware -- finds the following factors as significant breaks on investment: low levels of human capital; poor infrastructure; market failures specific to individual sectors; low levels of trade; corruption; and cumbersome regulations. From these constraints, the government should prioritise tackling infrastructure bottlenecks; opening new export markets, maintaining existing ones, and resisting protectionism; and reducing regulatory and bureaucratic burden on the private enterprises. The government's rhetoric is on the right tune on all these fronts. Whether it performs, however, remains to be seen. 1. See the S Ahamed's The Budget 2010-11: The Good, the Bad, and the Uncertain in this volume for a detailed review of the budget. Jyoti Rahman is an applied macro-economist and can be contacted at jyoti.rahman@drishtipat.org.

|

government and the ADB expect similar industry and service sector growth in FY11 (7.5% and 6.5% respectively) -- the stronger government projection is based on a brighter outlook for the agriculture sector than the ADB's 4.3%. By way of context, the budget argues that the agricultural sector is likely to have grown by 4.4% in FY10, much faster than the BBS provisional estimate of 3% -- this difference accounts for the government's refusal to accept the provisional national accounts in the budget.

government and the ADB expect similar industry and service sector growth in FY11 (7.5% and 6.5% respectively) -- the stronger government projection is based on a brighter outlook for the agriculture sector than the ADB's 4.3%. By way of context, the budget argues that the agricultural sector is likely to have grown by 4.4% in FY10, much faster than the BBS provisional estimate of 3% -- this difference accounts for the government's refusal to accept the provisional national accounts in the budget.