Inside

|

Meeting the Major Targets Fahmida Khatun runs the budget numbers

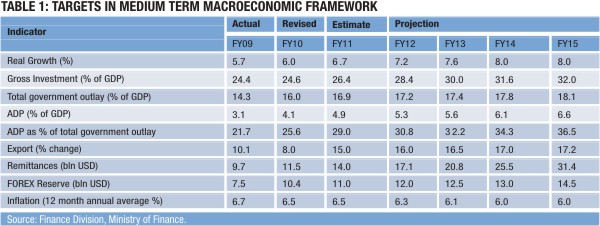

The budget for the fiscal year 2010-11 (FY11) has been prepared in a setting where the macro-economic situation of the country is faced with challenges that need to be addressed in this fiscal year with utmost priority. These challenges include stimulating the investment scenario through prompt supply of energy and power, recovering from the lagged impact of global financial crisis through stimulating the external sector, and dampening the creeping inflationary pressure, which is feared to increase the cost of living of the common people with fixed income. Apart from these immediate tasks, we are posed with meeting up of several other requirements that are relevant for all time to come if we are to achieve economic stability in the medium- and long-run. Some of the important ones are enhancement of capacity to deliver and implement policy decisions, achievement of food and energy security, alleviation of poverty through creation of employment and strengthening the social safety net programs and improvement of economic governance. The new budget will be implemented during the first year of two mid-term planning processes: the sixth Five Year Plan (FY2011-15) and of the Perspective Plan (FY2010-21), where these goals are spelt out as national priorities. Though many economies around the globe experienced significant slow down during the last two years due to global financial crisis, the economy of Bangladesh fared well, with a reasonably good GDP growth rate hovering around 6%, which, though lower compared to the previous years, is still impressive compared to the global growth statistics. The figure has, however, been an issue of discussion, as it has been revised upward in the budget speech to 6% from 5.5% as estimated by the Bangladesh Bureau of Statistics. The Ministry of Finance identified crops, manufacturing, and import duty to be the major drivers of such higher growth. One of the reasons for resilient growth even during the financial crisis is the inherent strength of the economy, which lies with its agriculture and external sectors. The bumper agricultural production has not only helped reduce food prices, it has contributed to improvement in the purchasing power of the common people and to poverty reduction and employment creation as it is a labour intensive sector. The vibrant external sector supported by strong export growth, particularly of the ready-made garments (RMG) and the robust flow of remittances, have also made it possible for the economy to progress at a steady rate as opposed to the slow or even negative growth in the larger economies. However, the export sector has experienced sluggish growth during first half of FY10 due to the lagged impact of the global meltdown, and remittances have to be watched carefully in view of the reduction in the outward flow of workers from Bangladesh in recent times. Macro-economic targets The increased growth of GDP in FY2011 is expected to be possible through a 4-5% growth of the agriculture sector, 7.5% growth of the industrial sector and 6.5% growth of the service sector. The MTMF also projects exports to grow by 15%, remittance by 14%, foreign exchange reserve by 11%, gross investment by 26.4%, and inflation by 6.5%. In view of the good performance of the agriculture sector for the last two consecutive years, it is expected that the sector could meet up its growth targets provided policy support continues and no major natural disaster occurs. Total allocation for agriculture and allied sectors that is for crop, livestock, fisheries, forestry, land, and water resources is Taka 11,409 crore, which is 6% higher than the revised budget of FY10 and 27.5% higher than the original budget of FY10. Revised budget of FY10 went up due to increase in the amount of subsidy for the agriculture The amount of agricultural subsidy is Taka 4,000 crore, which is 11.1% higher than the allocation in the original budget of FY10 and 19.2% lower than the revised budget of FY10. Given the importance of the sector as a source of food security, employment generation, higher GDP growth, and poverty reduction, the sector should be provided with more allocation if needed. Also in view of the volatility of prices of fertiliser and other inputs in the international market, there may be a requirement for upward revision of the subsidy in the sector. The sustainability of the growth of the agriculture sector is also dependent on the diversification within the sector, which currently relies mostly on crops. Investment has traditionally been low in Bangladesh, and is still far below the required level of 35-40% of GDP in order to achieve a GDP growth of 8-10%. Ironically, our savings are not totally invested, and there is a gap of around 8% between savings and investment rates. Additionally, the quality of investment is also critical, as enhanced investment is expected to make significant impact on the economy in terms of higher growth. Though the share of private investment stands at about 80% of total investment in Bangladesh, it constitutes only 19% of GDP. Such low level of private investment, which has been mainly due to lack of infrastructure and power and enabling environment, is unable to attract foreign investment and bring about overall economic development of the country. Increased momentum in investment in power and infrastructure is a critical component for enhancing industrial growth to the targeted level, which has been featured as the most important factor for achieving GDP growth. An estimate by the Centre for Policy Dialogue (CPD) indicates that in order to achieve the targeted GDP growth as spelt out in the MTMF, the average annual growth of electricity generation should be in the range of 12.5-14.5%. The power and energy sector received about 61.5% higher allocation (Taka 6,115 crore) in the budget of FY11 than the revised budget of FY10. The allocation for power and energy sector in the ADP is about 15.8% (Taka 6,075 crore) of total allocation. Though the budget puts highest emphasis on the power sector, allocation for this sector has been kept low compared to the requirement since the government expects investment in power and energy sector both from private and foreign sources. Therefore, the financing of the energy sector remains to be a crucial issue to be scrutinised through regular follow ups. It may be noted here that in the ADP of FY11 the power and energy sector received approval for 99 projects under which setting up of two peaking power plants with a capacity of 970 megawatts produce an additional 1,000-1,500 megawatts of electricity in FY11. While the initiatives to establish quick rental or peaking plants are the immediate measures to ease the electricity crisis in the short run, the government has to make quick decisions on gas and coal based generation of electricity given the huge fiscal burden on the government due to costly electricity of quick rentals and peaking plants.

Inflation: Achievement of the inflation target, which is projected to decline during the FY11-15 in the MTMF will depend on both global and domestic factors. Global commodity prices have experienced volatility since 2004-05 due to loss of production of major crops in some of the important food producing countries and diversion of foodgrains for ethanol in a number of developed countries including the US and the EU. The situation has eased during the second half of 2008 in the face of global financial crisis which contributed to a sharp decline in the aggregate demand in the developed and developing countries. Bumper foodgrain production coupled with falling global prices led inflation rate in Bangladesh to fall since September 2008. After a short spell of respite in terms of lower inflation and prices, the country has again started to feel the pinch of high inflation, which has already sneaked into the day-to-day lives of common people. Though domestic production, particularly of rice, is essential for output stability and food security inflation is determined to a large extent by international prices since the country has to depend on several essential commodities. The inflationary pressure is also partly due to the exchange rate management mechanism of the central bank to keep the value of the taka stable against US dollar and push the foreign exchange reserves upward. Ironically, the exporters are being benefited by the measures of the central bank, but the wages of the workers in the export sector remains constant and the standard of living of workers has been deteriorating day by day. Therefore, monetary policy has to be crafted in a manner which would address the imbalances among various macro-economic factors and contribute towards economic growth and poverty alleviation. Expenditure and Revenue Efforts Low expenditure capacity by the government is due to inefficiency in ADP implementation. The size of the ADP has been revolving around 3-5% of GDP during the last ten years, which is not sufficient to meet the huge investment demand of the country. Low public investment also contributes to low private investment, which in turn discourages foreign investment. The allocation for ADP in FY11 is 4.9% of GDP or Taka 38,500 crore, which is 26.3% higher than original ADP of FY10 and 35.1% higher than revised ADP of FY10. One positive initiative has been the inclusion of 13 new ministries under the medium-term budgetary framework (MTBF), which have to report on the implementation status of projects in the respective ministries. However, the performance of MTBF ministries in terms of implementation has been below satisfactory level. An important feature of ADP projects is that most of the projects are carry-over projects. In the budget of FY11 a total of 910 projects are listed in the ADP, of which only 94 are new, 148 are carry-over projects, 432 are to be completed in FY11, and 330 projects will be continued beyond FY11. Number of carry over projects is highest in the education sector (33%) followed by power sector (29.1%). The failure to complete projects within stipulated period could increase the costs of the project and tell upon the quality of expenditures. The quality of expenditures erodes due to a number of factors including among others, ill planned and politically motivated programs, and discontinuity of projects with the change of governments, which result in wastage of resources. The finance minister has time and again pointed out several measures to improve the ADP implementation which include monitoring of major projects under critical path method, special and intensive monitoring of projects in 10 ministries, improving efficiency of project directors etc. The government has made amendments in the public procurement act (PPA) and public procurement rules (PPR) to facilitate ADP implementation. During the presentations of the interim reports to the parliament on macro-economic performance (which were presented in January and June of this year) by the finance minister, an account of a detailed review of progress of ADP implementation would be useful in monitoring the progress of ADP implementation. Also prioritisation of projects should be made on the basis of the initiation period and sectoral importance.

Budget deficit and resource mobilisation: The imbalance between expenditure and revenue is a perennial phenomenon, which leads the government to borrow both from domestic or foreign sources. The budget deficit has been below 5% during the previous years. In FY2011 budget deficit is projected to be 5%, the major part of which will be financed by resources from domestic sources (66.2%) and the rest (33.8%) from the external sources. Though the need for deficit financing arises from the inadequacy in mobilising resources, actual deficit has mostly been lower than the projected rate due to the inability to spend on projects. In the revised budget of FY10 deficit was estimated at 4.5% compared to 5% projected in the original budget of FY10. Revenue mobilisation has been a success story during the first ten months of FY10 when NBR collected about 77% of the revenue target registering a growth rate of 17.16%, which is higher than the targeted growth of 16.13% for the FY10. The sources for such high growth are the increase in income tax and value added tax (VAT) at local stage which grew by 20.83% and 25.60% respectively. Traditionally, the tax structure of Bangladesh is such that it has to reply on indirect tax for revenue generation, which is discriminatory in nature. A slow move towards increasing the income tax is being observed recently. The proportion of income tax is targeted at 22.6% and of VAT by 29.2% in FY11. In an effort to improve the revenue scenario revenue tax-GDP and revenue-GDP ratio have been targeted to be to 9.3% and 11.6% respectively in FY11 as opposed to 8.8% and 11.5% respectively in FY10. Though tax-GDP ratio has risen from 5% in the early 1980s, it is still very low compared to even the neighbouring countries. Such conservative effort in resource utilisation and limited success in revenue earnings do not bode well for the economic development, and do not allow provision of adequate funds for employment generation and social safety net programmes for the poor. Expenditures on account of public investment are desirable, but not the increase in non-development expenditure, because development through such measures is not sustainable. Similarly, for a sustainable and inclusive development social safety net programs have to be operated through a redistributive policy by increasing collection of tax and distributing that among the poorer section of the people. Additionally, the long-term vision for resource mobilisation should aim to be less dependent on expensive and conditional foreign aid. There is a conscious effort to expand the tax net and realisation of taxes, which is evident from various reform measures and policies proposed in the budget. The improvement in the revenue scenario is contingent upon motivated and efficient human resources, and modern, transparent and accountable tax management system. Concluding remarks The budget in fact guides and manages the economy, since through the budget document the government can collect taxes from the citizens of the country, and plan expenditures for various development programs, which is why the budget can have impact on the growth and the lives of people. The national budget is also about the long-term vision of sustained growth, which can, in fact, be attained through budgetary allocations and policy incentives. The first budget (FY10) of the ruling Awami League during its current tenure did spell out a number of medium- and long-term objectives, some of which looked forward as far as 2021 and most of which were in line with the promises of its election manifesto. Those visions have been repeated in the budget of FY11 through the announcement of a host of promises such as job creation, increase in social safety net allocations, and reduction of regional inequality to achieve balanced growth, agricultural development, achieving power generation targets towards industrialisation, and improvement in infrastructure for the creation of Digital Bangladesh.

Various sectoral policies have been devised in the budget document to achieve those objectives. While the attainment of various objectives is essential for accelerated growth, it should also be realised by policy makers that numbers do not matter to common people. What is important to them is the delivery of services in terms of health, education, employment, and income. This can be delivered through political commitment, which will not only plan but also implement a budget towards delivering on the annual goals and achieving long-term objectives of eradication of poverty and establishment of social justice in the country. Dr. Fahmida Khatun is an economist at the Centre for Policy Dialogue (CPD). |

sector. However, the share of the agriculture and allied sectors in total expenditure has decreased to 8.6% in the proposed budget of FY11 compared to 9.7% in the revised budget of FY10.

sector. However, the share of the agriculture and allied sectors in total expenditure has decreased to 8.6% in the proposed budget of FY11 compared to 9.7% in the revised budget of FY10.