Inside

|

The Good, the Bad, and the Uncertain Syeed Ahamed puts the budget under a microscope

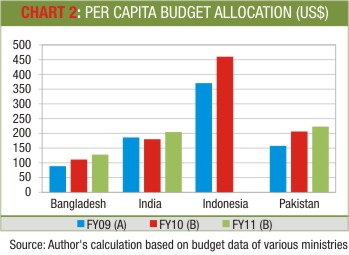

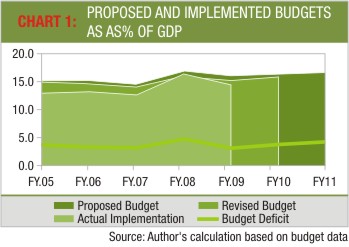

Typically an optimist will say the glass is half-full and the pessimist, half-empty. But when it comes to national budget, an optimist sees the vacant potentials, calls the budget inadequate; and the pessimist sees the implementation barriers and thus calls the budget oversized. Only a realist would say both sides have a point. In the abundance of optimistic and pessimistic post-budget reactions, my two favourite realist comments come from the opposition and from the government. An opposition BNP-leader has precisely labelled this year's budget as inadequate in terms of people's need, and highly ambitious in terms of implementation capacity. The finance minister also echoed this confused sentiment by admitting the implementation challenges while advocating the need for a bigger budget. Every coin has two sides and a budget has three -- the good, the bad, and the uncertain. The budget for fiscal year 2010-11 (FY2011) has encouraged us with a number of initiatives such as crop insurance, investment fund, and with its increased focus on gender-balance. At the same time, we were disappointed with some crouching schemes in hidden texts -- which were not explicitly announced in the budget speech but were made available through government orders -- such as the black money provisioning. Then there were subjective cases which can appear good in intention and face value, but might disappoint us at the end if not implemented correctly. The Good With Tk. 2,328 crore set aside in the budget for FY2011, fuel and energy sector recorded the largest (61.5%) increase in budget expenditure over its revised budget of FY2010. Transport and communication also registered 29.1% growth while expenditure for local government and rural development is set to grow by 18.9% in FY2011. Budget allocation for public service also registered 38.4% growth, whereas increase in expenditure for the new scale caused the budget for pay and allowances to grow by 19.5% in FY2011. But exactly how big is this year's big budget? To bring some perspectives, chart 1 takes into account our GDP and past budget performances to assess the size of this year's budget. On an average, budget target during FY2005 to FY2009 has been 15.8% of GDP. But as chart 1 shows, typically a budget gets slashed by 5% during its revision and only 85 to 90% of the original target is achieved at the end. Hence, implemented budget during FY2005 to FY2009 have been only 14% of GDP. The total size of this year's budget is aimed to be 16.9% of GDP -- i.e. 3 % of GDP higher than traditional achievements. By any estimation, this is indeed a big budget. To finance this 16.1% increase in total budget expenditure (over last year's revised budget), a matching 16.8% increase in revenue earnings has also been targeted. However, to cater to this big earning-big expending expansionary plan, the finance minister's focus was more on the expansion of tax net than on increase in tax rate. The essential ambition The finance minister has argued that such a big budget is a necessity given the size of the population. Chart 2 thus looks at the per capita budget expenditure and compares them with other budgets in the Asian region. In terms of per capita budget expenditure, Bangladesh is way behind India, Indonesia, and Pakistan, and suddenly our budget looks so inadequate. However, this budget aims to considerably increase Bangladesh's per capita budget expenditure from around 90 dollars spent in F2009 to 129 dollars in FY2011. Pakistan's per capita development outlay in FY2009 was 33 dollars, whereas India's was 80 dollars. In their respective budgets, Pakistan and India aim increase the per capita development outlay to 54 dollars and 97 dollars in FY2011. Bangladesh with a huge population compared to its smaller economy, is also set to gradually increase its per capita public investment. Bangladesh's per capita development (including non-ADP development) expenditure was less than 22 dollars in FY2009. The budget for FY2011 aims to increase that per capita development expenditure to 42 dollars. The budget also aims to revive the declining trend of annual development program. As chart 2 shows, the actual implementation of ADP in terms of GDP has been witnessing a chronic downfall since FY2000. Actual ADP as percentage of GDP fell from 6.5% in FY2000 to only 3.2% in FY2009. The target ADP (Tk. 38,500 crore) for FY2011 is not only high in nominal terms, it will also be higher in terms of GDP even after 85% of this target ADP is implemented by FY2011. So yes, this is an ambitious budget. Ambition is an integral part of any development plan and not necessarily a bad thing. More importantly, this big budget seeks to remain progressive as it aims to tax the richer people with high tax on luxury items, while offering rural subsidies and poverty reduction programs. Considering our ever-increasing economic inequality and the tendency of our policy makers to disregard the growth-inequality nexus, this budget looks more pro-poor. The Bad During the first nine months (July-March) of FY2010, the government could only implement 47.6% of its revised ADP (i.e. 44.5% of the original ADP) for FY2010. Apparently, government had to carry over many of these unimplemented projects from last year into this year's ADP. Hence, some have criticised this year's budget as a continuation of preceding year's budget. As Chart 4 shows, only 9% of ADP allocation for FY2011 is for new projects. Some 222 projects that were supposed to get implemented by last year have been carried over to this year's budget -- which contributed more than one quarter (26%) of the new ADP for FY2011. Rescheduling of promises was also seen in major budget schemes. Tk. 2,500 crore unutilised allocation from last year's budget -- for the much talked about public private partnership (PPP) scheme -- has been carried over to this year's budget. The government could only finalise the legal frameworks for this scheme in its first year and failed to utilise any allocation. Similar fate is predicted for another new initiative called Agriculture Insurance. Under this scheme, the government will provide the small- and medium-earning farmers with crop price support during natural disasters. Since it would take a year to finalise its guideline, we hope to put that scheme in our good-book in the upcoming year. Deficit financing In addition to 26% ADP that was carried over from last year, some 214 projects worth 44% of the total ADP allocation are scheduled to get implemented by this fiscal year. Since concluding projects register faster expenditure, implementation of this year's total budget outlay shouldn't be hard. However, that possibility of a better implementation may lead us to a higher fiscal deficit. Everything comes at a price and implementation of big budget comes at the risk of a big deficit. Financing of this deficit will remain a major problem for this year's budget. The overall budget deficit is expected to be Tk. 39,323 crore -- i.e. 5% of GDP. With some projected grants, the deficit is expected to be around 4.4 % of the GDP. Even that can be a trouble too if revenue earnings fail to show some magic. The revised revenue earning figure for FY2010 exceeds the expectation, registering an 18.8% growth over the actual earnings in FY2009. Achieving another 16.9% growth over the top of last year's high benchmark may become difficult. On the other hand, the projected 36.7% increase in overall domestic borrowing and whopping 81% increase in bank borrowing over last year's revised budget may crowd out the private sector credit flow. Both might affect growth in the long run. Financing of a big budget's deficit may also trigger inflation by influencing the money supply. The Uncertain While the government continues to follow medium term macro-economic and budgetary frameworks, both adapted from PRSP, the proposed perspective plan will essentially follow Awami League's pre-election "Vision 2021." This is supposed to be a welcome move. In a true democratic system, political parties set a nation's annual, medium-term or longer-term perspective plans according to their own ideological preferences. Hence, the economy of United States took a certain trajectory under Republicans, and changed its route when Democrats came to power. However, their strict system of checks and balance makes it difficult for a political party to totally scrap a legitimate scheme undertaken by its predecessors. In contrast, legitimate programs and reforms in Bangladesh's winner-take-all system are regularly abandoned just because they emanated from a different regime (Regulatory Reform Commission being the last instance). Notwithstanding this, the medium-term plans such as FYP were never scrapped in their entirety by the successive political regimes. Even PRSP survived a few successive political and non-political regimes. But lack of political ownership was a major criticism against plans such as PRSP. Now that the political ownership is set to prevail, can our development plans avoid the regular political abandonment every time a new party comes to power?

Art of desperate compromises When the black-money recycling scheme was offered again last year, the finance minister admitted that he ideologically opposed such scheme but had to keep it for another year as "politics is the highest art of compromise." The minister can be thanked for scrapping that scheme this year -- though not in its entirety. To a certain extent some of the schemes appear as fine-tuned art of desperate compromises. The government has created a fund titled Bangladesh Infrastructure Finance Fund (BIFF) for financing physical infrastructures such as for power and energy. Apparently, one can invest in the bonds issued under the fund by paying 10% tax where the source of the income will not be questioned. It's a departure from earlier black money recycling schemes since it doesn't let a person whiten the money for his own use and the money remains invested in national infrastructures. But it's still hard to accept, not only for moral reasons, but also on economic terms. Black-money recycling remained a statistically proven unsuccessful scheme during the last decade and history just might repeat itself one more time. Rather, the government should keep its focus on external sources -- from Middle East to Far East -- for this equity fund.

Another desperate attempt is the quick-fix. Of Tk 6,115 crore for direct government spending for power and energy, most would be spent on establishing or renting power plants. The incompetent handling of power sector during the past decade has put us in such a desperate situation that the government is opting for some quick projects without tender to improve the situation in the shortest possible time. But such initiative needs to be handled with extreme care since transparency of leadership is preferred in democracy over the benevolence of leadership. Syeed Ahamed is a public policy analyst and writes for Drishtipat Writers' Collective.

|

moves on from the recovery stage for economic expansion. Bangladesh economy survived the second year of global recession with an estimated 5.5% GDP growth in FY2009-10. However, to continue the resistance of a delayed impact, Bangladesh needed to move on from the current consumption-led growth setting to investment-led growth scheme. To facilitate this transformation, the government is set to by far increase its investment in public infrastructures.

moves on from the recovery stage for economic expansion. Bangladesh economy survived the second year of global recession with an estimated 5.5% GDP growth in FY2009-10. However, to continue the resistance of a delayed impact, Bangladesh needed to move on from the current consumption-led growth setting to investment-led growth scheme. To facilitate this transformation, the government is set to by far increase its investment in public infrastructures.