| Post Campus

The 2012 Nobel Prize in Economics

Asrar Chowdhury

Photos: Internet

Although popularly known as the Nobel Prize in Economics, it was not included in Alfred Nobel's original will. The Royal Bank of Sweden initiated this prize in 1968 to celebrate its 300th anniversary that year. The prize has been awarded as the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” since 2006. The first Nobel Prize in Economics was awarded in 1969 to Ragnar Frisch and Jan Tinbergen for their contributions in the field of Econometrics. Since then, the prize has been awarded each year by The Royal Bank of Sweden in the same spirit as the original Nobel Prizes.

|

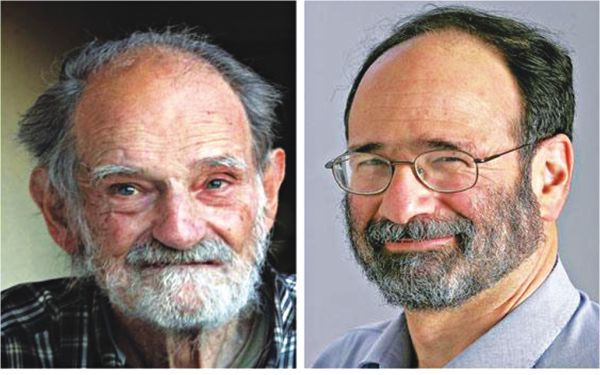

Lloyd Shapley and Alvin Roth- Winners of the 2012 Nobel Prize in Economics. |

From 1969-2012, the Nobel Prize in Economics has been awarded to 70 researchers inside and outside the field of mainstream Economics who have contributed to the broadening of the boundaries of the Economics Discipline. Citizens of the USA have won the highest number of Nobel Prizes in Economics- forty till 2012. This is no surprise. It is an outcome of US investments in higher education and research; and also a flexible immigration policy to attract creative minds from the rest of the world.

This year's Nobel Prize in Economics has been awarded to Lloyd Shapley of the University of California, Los Angeles (UCLA), and Alvin Roth of Harvard University. They have been acknowledged for their contributions to the 'theory of stable allocations and practice of market design'.

Traditionally, Economics has studied resource allocations in markets where prices act as signals to consumers and producers. Based on market prices, when demand made by consumers and output produced by suppliers equal each other, efficiency is achieved. None of the two groups in the market has an incentive to change. Markets are then in equilibrium. Although this neoclassical microeconomics is taught as a standard principle in textbooks, the real world is more complex. Prices may not be a good indicator for resource allocation. Think about the examples where many schools are not allowed to charge tuition fees on legal grounds or in the case of human organ transplants, money payments are ruled out on ethical and moral grounds. Yet, resource allocations have to be made in these market transactions. This is a question that has puzzled Economists ever since they found out perfect competition does not exist in reality. To answer this question, a new branch within mainstream Economics started to emerge from the 1950s and the 1960s. Today, this branch is known as 'matching markets' and/or 'market design' The 2012 Nobel Prize in Economics has acknowledged the contributions of two of its greatest exponents- Lloyd Shapley and Alvin Roth.

| |

|

| |

Lloyd Shapley- 2012 Nobel Prize Winner in Economics. |

Lloyd Shapley was a pioneer in laying the theoretical foundations of 'market design' in the 1950s and the 1960s mainly through his collaboration with David Gale. The two asked a simple question 'how can demand and supply be matched in markets where there are ethical and legal complications'? They tried to find a matching combination that is stable where no individual sees gains from further trade. This joint collaboration is now known as the Gale-Shapley Algorithm that is based on cooperative Game Theory where individuals seek to find ways to cooperate.

In the early 1980s, Alvin Roth studied the market for newly qualified doctors in the USA. World War II created a scarcity for medical students- many of whom joined the war. This scarcity existed in the USA in remaining decades. Hospitals were forced to offer internships earlier and earlier to medical students- sometimes several years before graduation. The consequence was: a match was made before medical students could fruitfully provide evidence of their skills and qualifications. In his 1984 classic paper 'National resident matching program', also based on Game Theory, Roth studied the Gale-Shapley algorithm showing it applied to real-life situations.

Lloyd Shapely did his PhD at Princeton in 1953. Princeton was where it was all happening in the 1940s and the 1950s. In 1944 John von Neumann and Oskar Morgenstern laid the foundations of a wonderful branch in applied mathematics that they termed Game Theory. In 1950- in his PhD DissertationJohn Nash cemented the problem that had been puzzling Economists since the middle of the 19th Century- how do individuals reach an equilibrium when decisions are inter-related to each other? That same year, Nash's PhD supervisor and a mathematician in his own right Albert Tucker introduced the famous Prisoners' Dilemma that shows while trying to make matches that are in the best interest of individuals, an economic system reaches a bad equilibrium that is sub-optimal. Microeconomics used to term this as market failure, but failed to provide a meaningful analysis.

Since the birth of the Game Theory Revolution in the 1940s and the 1950s, Economicsand Microeconomics in particularhas experienced a much needed re-birth. The masterly contributions of Lloyd Shapley and Alvin Roth and other Game Theorists has shown, Economics has “genuinely made the world a better place” as Stephanie Flanders, Economics Editor of the BBC rightly appreciated. Another Game Theory Nobel Prize in Economics- albeit in disguise- proves Economics is more than just a 'Dismal Science' as Thomas Carlyle, the 19th Century Scottish satirist remarked. Another Game Theory Nobel Prize in Economics also begs to ask the question- when a similar revolution will emerge in the classrooms of universities in Bangladesh.

(The author teaches economic theory at Jahangirnagar University and North South University.)

|