Inside

|

On agflation Jyoti Rahman looks behind local inflation woes to global trends

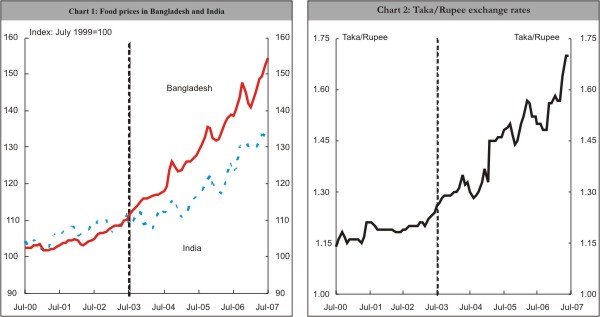

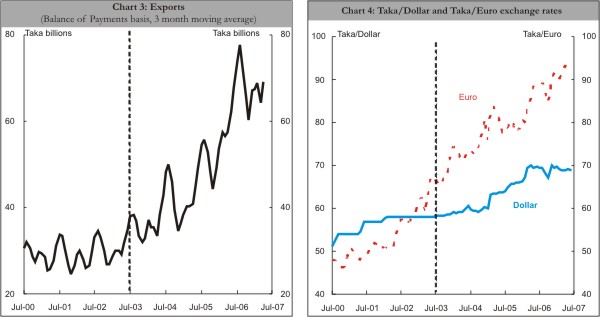

Let's start with the global reasons. There are three reasons behind the global agflation. First, concerns about the effects of climate change have resulted in a rapid rise in the demand for bio-fuel whose production relies on corn. This has led to rises in the price of corn and its substitutes like wheat and other grains. Second, rapidly rising prosperity in poorer countries, particularly India and China, are raising global demand for food products, and are thus fuelling price rises. Thirdly, as grain prices rise, so do those of other food products -- there is less land for growing vegetables and the poultry industry itself depends on grain. Agflation in India has strong implications for us as our food market is quite strongly linked with that of our neighbour. One would expect food prices in Bangladesh to move in concert with those of India. This indeed was the case until 2003, as Chart 1 shows.2 The chart also shows that food prices in Bangladesh started rising in 2003-04, about a year before Indian prices. Chart 2 shows how the taka has depreciated against the Indian rupee since 2003. One Indian rupee cost 1.20 taka in late 2002. In mid-2007 the rate was 1.70 taka per rupee. That is, whatever cost 1 rupee in late 2002 now costs 50 paisa more in Bangladesh. Now a story can be told. As the taka started depreciating against the rupee, Indian imports became more expensive in Bangladesh. So, even before Indian food prices started to rise, our prices were taking off. Of course, once Indian prices started rising, the continued depreciation made matters worse.

If the depreciating taka is the problem, then is an appreciation the solution? Any appreciation of the taka could hurt exports, a sector that has done relatively well in recent years (Chart 3). Exports may have become more competitive internationally by the depreciation of taka against the euro and the US dollar over the past few years (Chart 4).

However, the exports sector depends heavily on imported intermediate machineries, and a weak taka makes them expensive. Further, exports really started taking off in 2004, after taka started depreciating against the euro but before its fall against the dollar. Compared with a weak taka, potentially a much more important reason why the exports have done better is strong growth enjoyed by the developed economies since 2004. This strong growth has resulted in consumers in those countries demanding more of our exports.3 Structural changes within our garments sector --a move towards knitwear -- have also helped exports. Since rupee is the primary import currency, especially for food essentials, any depreciation against rupee has major inflationary impacts, but little competitiveness gain for our exports. If the rupee exchange rate were to stabilise at say 1.50 taka/rupee, then the taka would appreciate a bit against both US dollar and euro. Policymakers need to evaluate how much such an appreciation would hurt exports and balance that against the gain in terms of lower import -- and thus food -- prices. In addition to any exchange rate policy, there are, of course, a range of microeconomic factors that need to be addressed in stabilising food prices. Much has been made of the collusive behaviours by business syndicates and hoarders, and the impact of the anti-corruption drive on business confidence. In this regard, it is important to think about the underlying economics of our food market. As an essential, food, particularly rice and other grains, are relatively price inelastic -- that is, a large rise in prices lead to only modest fall in demand. In addition, given the scales involved in operating a food imports business in Bangladesh, the wholesale market for food is likely to be dominated by a few large players. This means that faced with falling supply, the natural market response would be to raise prices -- this is not immoral behaviour by any businessman, rather, it is what economic theory suggests a profit maximising businessman would do. Of course this hurts the consumer. To safe guard consumers' welfare, it is important to create an independent competition watchdog. However, the exact composition and mandate of such an agency, and the way it will work with other agencies such as the Anti-Corruption Commission or the tax authorities require careful consideration. In addition to an agency to enforce competition policy, there are other avenues that our policy makers should pursue. Sharp rises in prices following (or in anticipation of) a fall in supply can be somewhat mitigated against by better provision of information. For example, the lack of reliable data about the magnitude of our large informal food trade with India makes it harder for the market to adjust. A commodities future exchange would help traders to smooth out the impact supply shocks. The restoration of the food stock buffer system that was built up over the 1980s and 1990s, but run down in the current decade, should also be a priority. And finally, more investment in improving agricultural productivity is needed. But most of these policies will yield benefit only in the medium-term, whereas rising food prices is a clear and present danger. The authorities would do well to remember that price controls and command economy have not worked anywhere, and treating economic problems as law and order issues will not help. It appears that macroeconomic policies are the only realistic options left to our policymakers in the short term.

A lot has been written lately on the recent discussions between our policymakers and the pundits from the IMF. Media reports suggest that the Bangladesh Bank is signalling an accommodative monetary stance -- contra IMF advice -- going forward.4 The expansionary monetary policy that is being reported is likely to lead to further depreciation of the taka against the rupee. If stemming agflation is the objective, it is hard to see how this is going to help. In the long term, improving agricultural productivity is the only way to stop spiralling food prices. In the medium term, we need to build institutions such as a competition watchdog or commodities future exchange. But in the short term, an appreciation of the taka against the Indian rupee is likely to be the best option to combat agflation. ------------------------------------------------------------------ 1. The Economist, The agonies of agflation, August 25, 2007. ------------------------------------------------------------------ This article has benefited from discussions at: Unheard Voices (http:// www.drishtipat.org/blog/), Addafication (http:// addafication.com/) and In the middle of nowhere (http://rumiahmed. Wordpress.com/). ------------------------------------------------------------------ Jyoti Rahman is a macroeconomist and a member of the Drishtipat Writers' Collective.

|

R

R