Inside

|

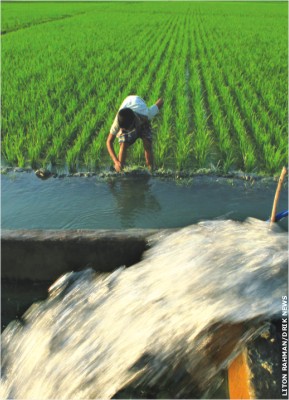

The dilemmas of rural finance Akbar Ali Khan examines the financial perils faced by small and medium farmers Rural finance in developing countries is characterised by what Partha Dasgupta describes in "An Enquiry Into Well-being and Destitution" as an irony and a tragedy. The irony is that credit is readily available for rich people who can save and may not require it, whereas it is beyond the reach of the poor who are in desperate need. The tragedy is that the imperfect markets for credit nurture poverty through a process of ruthless exploitation. Thanks to the dramatic expansion of micro-credit to the poor (about 6 percent of total credit from institutional sources at the moment), the intensity of this tragedy in Bangladesh has diminished, but the irony has assumed a new shape. The extreme rich and extreme poor in Bangladesh have much better access to credit than those who lie in-between. This is the irony of what the World Bank describes as the "the peril of the missing middle."

A survey shows that roughly 25 percent farmers owning land up to 0.5 acres have no access to credit. The corresponding figures of farmers owning 2.5 to 5 acres and of farmers with holdings in the range of 5 to 7.5 acres are, respectively, 34 and 40 percent. By contrast, only 17 percent of large farmers, owning more than 7.5 acres, did not get credit. During 2003-06, 52 percent micro and small enterprises had no access to credit from formal sources. Another private sector enterprise survey shows that 16 percent of enterprises with one employee were dissatisfied with access to finance, while the analogous figure for enterprises with four employees was about 32 percent. this figure declined to about 8 percent for enterprises with more than ten employees. in statistical terms, the "missing middle" refers to lack of credit for about one million small and medium enterprises (out of 6.8 million enterprises), and about 4.3 million small and medium size farmers (out of 12.5 million farmers). Apart from the peril of the missing middle, an analysis of the rural finance scenario in Bangladesh suggests the following disquieting trends: Flow of resources from rural to urban areas: The banking institutions in Bangladesh function as a conduit for transferring money from rural areas to urban areas. In 2005, for every taka deposited in a rural bank branch, only 57 paisa was lent in rural areas and the rest was siphoned to urban areas. This happened in both state-owned and private banks. Acute shortage of loans for rural finance: Total bank loans in the rural sector in 2005 was Tk. 310 billion, while the unmet requirement for the missing middle, according to an estimate of World Bank is Tk. 483 billion. Drag on economic growth: Two vital sectors of the economy are stifled by lack of credit facilities. Agriculture contributes about 18 percent of GDP, while the share of micro, small, and medium non-farm enterprises in GDP is estimated at approximately 17 percent of GDP. Two potentially dynamic sectors that constitute more than one-third of GDP are hamstrung by serious credit constraints. Making the poor poorer: Lack of credit for MSM enterprises and farmers compounds the problems of the poor who live mostly in rural areas. For example, about 40 percent income of the poorest ten percent of the population originates in rural non-farm sectors. About 2.14 million marginal farmers' households have no access to credit. The roots of inadequacy of agricultural credit may be traced to the following: Insolvency of state-owned agricultural banks: Two state-owned agricultural banks, Bangladesh Krishi Bank (BKB) and Rajshahi Krishi Unnayana Bank (Rakub) provided 65 percent of all bank loans in the agriculture sector in 2005-2006. However, these two major players in agricultural credit are deeply insolvent. The total losses of BKB are estimated at Tk. 51-61 billion while its total loans stand at 65.6 billion. Rakub's total losses are likely to be in the range of Tk. 12-16 billion whereas its total loans are approximately Tk. 21 billion. Both these institutions are entirely dependent on central bank refinance facilities for their liquidity. These banks do not have the capacity to sustain current level of operations. Declining flow from NCBs: The share of NCBs in agricultural credit has fallen from 31 percent in 1993-94 to 21 percent in 2005-06. However, the decline in NCBs' share in rural finance was less precipitate. It fell from 55 percent in 2000 to 46 percent in 2005. This decline may be attributed to ever-increasing default rate and mounting losses in rural finance. Unwillingness of private banks to expand rural finance: Owing to high transaction costs in selection of borrowers, high supervision costs, and regulatory practices that discriminate against collateral-free loans, private commercial banks try to evade rural finance despite prodding from the Central Bank. High transaction cost: Many potential borrowers in rural areas avoid institutional credit. When asked why they did not approach institutional sources for credit, 40 percent cited high transaction costs. According to one estimate, transaction cost for the landless is 42.9 percent, whereas it stood at 14.4 percent for farmers with less than .05 acres. Lack of institutional mechanism to cope with natural disasters: There is no effective market-based insurance for protecting the farmers and entrepreneurs against catastrophic disasters like floods and cyclones. The problem is further aggravated by forgiveness of agricultural credit in the wake of natural disasters. Usually, such debt-forgiveness is mandatory for state-owned financial institutions. These institutions are not, however, fully compensated for such concessions. Though government decisions on debt forgiveness are not binding for private institutions, they create an unhealthy environment for private banks and NGOs that find it extremely difficult to recover their dues from the same class of re treated differently by state-owned banks. Borrowers who are treated differently by state-owned banks. Low interest rates: Amartya Sen has described the policies that ultimately harm the poor though they were designed to help them as "friendly fire." Though the source of such fire is the generosity of the government, it ultimately harms the supposed beneficiaries. The low interest rate discourages the participation of commercial banks in agricultural credit. On the other hand, if subsidy is not provided by the state to specialised agricultural banks, they will continue to default on loans from Bangladesh Bank. Given this scenario of agricultural credit, the government has the following options: The main perils of "business as usual" are as follows: Threat to Central Bank: Total borrowings by BKB and Rakub from the Central Bank were estimated at approximately Tk. 49 billion in 2005. Without fresh loans from the Central Bank, BKB and Rakub are likely to be illiquid. These bad debts pose a serious challenge to the financial viability of the Central Bank. Incapacity of agricultural banks to meet increased demands: This will make the poor poorer and impede economic growth. Unsustainability of BKB and Rakub: Because of mounting losses and high default, the status Quo cannot be sustained. The possibility of a major dislocation in the sector cannot be ruled out. Escalation of the cost of reforms: Delay will contribute to escalation of the cost of restructuring the two state-owned agricultural banks. One-shot re-capitalisation of specialised krishi banks The main drawbacks of this proposal are: (1) Additional capital infused by the government will evaporate if the present trend of bad debts continues. Re-capitalisation without governance reform will be counter-productive. (2) Full re-capitalisation is needed for repayment of loans from Bangladesh Bank and for meeting the obligations to depositors. This will not provide enough resources for expanding loans to agriculture and non-farm rural sector. Privatisation of agricultural banks and increased role of NGOs The main disadvantages of this proposal are: (1) Because of high transaction and supervision costs, privatised agricultural banks (which will have all the functions of commercial banks) are likely to reduce the volume of rural finance and concentrate on more profitable activities. (2) NGOs in Bangladesh have turned out to be ineffective in agricultural credit. The driving forces of NGOs are women members who constitute about 97 percent of borrowers in NGOs. Most of the borrowers of agricultural credit are men. (3) The privatisation of agricultural banks will be a time-consuming process. This will also involve huge expenditure, as all the bad debts of these institutions will have to be accepted as liabilities of the government. The outcome of this process is uncertain. Phased reform program Performance-based re-capitalisa-tion: Re-capitalisation will be linked to performance otherwise the purpose of such exercise will be frustrated. Re-capitalisation must be adequate to protect the interests of depositors. In the alternative, restrictions should be placed on new deposits.

Governance reforms: The governance reforms that are badly needed are: (1) Reform of the enabling environment for rural finance by reviewing rules on provisioning requirements. (2) Reforming and implementing a new legal framework for secured transactions. (3) Development of new products and lending technologies for rural finance. (4) Better internal control and appropriate management information system. (5) More effective reward and punishment system for employees, etc. Strategy for coping with natural disasters: This would include: (1) Formulation of a national policy spelling out the coping strategy in the event of natural disaster, and the creation of fund for the relief of the victims of natural disasters. (2) Removing the legal and regulatory obstacles to the development of index-based weather insurance and provision of assistance from the government to interested institutions for development of index-based insurance products. Realistic interest rate policy: Either the state-owned banks should be allowed to charge interest on the basis of actual cost, or adequate subsidy should be provided in the budget for keeping the interest rate artificially low. It is very easy to formulate a strategy for reforms; it is not, however, easy to implement them. It will require lot of resources and technical assistance, and the capacity to withstand the pressures of what Mancur Olson describes as "distributional coalitions." What is needed most is the political will to sustain reforms during a protracted period. The political leaders must remember that the rewards of reforms to rural finance will be much higher than the costs in the long run. A vibrant and sustainable rural finance will open new frontiers of development in the country as a whole. |

The "missing middle" in the credit market encompasses micro, small, and medium enterprises, and small and medium farmers. The share of agricultural credit in total bank loans in Bangladesh has plummeted from 9 percent in 1982-83 to 3 percent in 2005-06. The net flow (new disbursement minus recovery) of agricultural credit in Bangladesh was negative in five out of ten years during the period 1996-97 to 2005-06.

The "missing middle" in the credit market encompasses micro, small, and medium enterprises, and small and medium farmers. The share of agricultural credit in total bank loans in Bangladesh has plummeted from 9 percent in 1982-83 to 3 percent in 2005-06. The net flow (new disbursement minus recovery) of agricultural credit in Bangladesh was negative in five out of ten years during the period 1996-97 to 2005-06.