Inside

|

No Pain, No Gain M.Tamim charts out a strategy for energy security GAS was first discovered in Chattak field in 1959. Although the first drilling in Bangladesh At the height of oil use, gas was not considered a valuable item at that time. It was treated as a by-product of oil production and was considered more as a nuisance than of any value. As a result, the best commercial use at that time was its household use. The first household connection was given by Titas in Dhaka in 1968. After the 1973 Arab oil embargo, the commercial value of gas rose rapidly. Oil became very expensive and Bangladesh switched most of its power plants, steel/re-rolling mills and other industries from oil to gas during 1980-85 period. There was a big jump in gas use during the same period compared to the previous one and a half decade. Since then gas use has been increasing between 5% and 10% per annum. Sixties was the golden era of gas discovery in Bangladesh. Shell Pakistan discovered five major gas fields in Bangladesh including Titas and Habiganj. Eighty five percent of Petrobangla production today comes out of these fields. Shell handed over these fields to Bangladesh for a mere 4 million pounds sterling in 1975. That is the legacy of "old gas" of Petrobangla for which it pays a next to nothing amount of Tk. 7.8/Mcf (thousand cubic feet). The replacement cost of the same gas from a green field ("new gas") today would be no less than Tk. 70/Mcf at the wellhead. It is more likely to be Tk. 100/Mcf. The average buying price of IOC gas is Tk. 100/Mcf including the free gas of Petrobangla. The weighted average selling price of Petrobangla is Tk. 140/Mcf now. As IOCs produce fifty percent of the total production today, even with the almost no cost "old gas," Petrobangla is losing money. It has no money to reinvest in the industry let alone make profit. Adding processing, transporting, distributing cost plus other overheads, it needs to sell the gas at Tk. 200/Mcf at least. Under this prevailing situation, if the commercial framework of business (market price?) is not fixed, Bangladesh's primary energy problem will not be resolved. No company -- local or foreign, will be able to sell a product below the cost. In a situation where the gas supply and demand gap is widening every day (presently the supply shortage is in the range of 250 MMcfd), one must look back how we arrived here because it is affecting power production, industrial growth, and the overall economy. It all started in 1998 when Unocal discovered Bibiyana gas field. At that time, Bangladesh could not use the gas because there was not enough market. It was a short-term excess or surplus. As a result, all IOCs essentially stopped looking for any more gas except the minimum work obligation of the contract to hold the most prospective acreage. They gave up most of the risky areas. The PSC says that if a commercial discovery is made, Petrobangla will have the first right of refusal and if they cannot buy the gas, the IOCs can sell it to any local third party as the second alternative. The third option is to export in the form of LNG. That was never viable for 4 tcf gas situated far away from the shore. As a result, the company proposed a pipeline export to India, that was not included in the PSC contract, for a quick return on investment. This created the expected commotion and while vigorously debating the proposal, Bangladesh went out of its way to increase the usage. During the same time a gas utilisation committee (2002) suggested that IOCs should be allowed to export their share of gas from new discovery only. This was concluded from a demand analysis that showed that while short-term surplus prevailed at that time, there would be supply shortage from as early as 2010 if new gas discovery was not made. The complete idleness of the IOCs was alarming. The export suggestion was more a market signal to invigorate exploration than actual reality as Bangladesh could always exercise its first right of refusal to buy the gas.

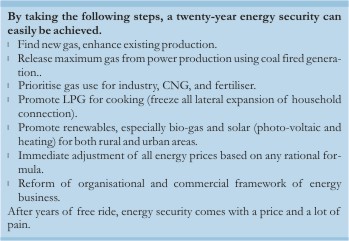

The present power crisis is very much coupled with the gas crisis. Eighty five percent of the power generation is gas-based. Over the years, press and general public have made much noise about lack of generation units. Ironically, today there is 600MW stranded generation that cannot produce power due to lack of gas supply. Unfortunately, adding more power plants will not solve the problem. The solution to the problem lies in ensuring primary energy. Despite various claim of Bangladesh floating on oil and gas, one need to drill to find them. Oil and gas does not come out like ground water -- one cannot drill anywhere and find gas. It requires lot of surveys, indirect measurements, and experienced interpretations to get a better underground picture, and yet great uncertainty remains in its operation. Unless one sees the gas coming out of a wellhead, the chance of finding it is always attached with a probability. Reserves of any sort (proven, probable, or possible) has some sort of proof of hydrocarbon existence attached to them, whereas resources are completely unknown possibility based on regional geology and some survey data. So far in Bangladesh, it is estimated that the highest resource potential with a five percent probability is about 64 tcf and with a fifty percent probability is about 32 tcf. The country's proven plus probable reserves are about 13 tcf with a yearly consumption of 0.6 tcf now. The yearly US consumption is 22 tcf, the proven gas reserves of Qatar are about 130 tcf and USSR has supposed reserves of over 1,000 tcf. One can now check the individual perception of "floating on gas" with these facts. The same survey says that there is a ninety five percent chance of finding 8 tcf additional gas. This does not include most of offshore that has not been surveyed yet. Realistically, extensive The question that needs to be asked is how the country is going to meet its primary energy requirement to produce power. Provided, another 15 tcf gas is found, will it be wise to use that gas to feed another power plant, especially when there is a vast reserve of coal? Thirty six countries produce more than 25% of their power from coal including China (78%), India (70%), and US (50%). Coal was also the fastest growing fuel in 2007 (2.7%). Moreover clean coal technology is becoming less expensive by the day. Gas use must be prioritised. The economic multiplier of gas use is highest in its industrial use. CNG use has two-fold effects. The primary benefit is environmental and the secondary but equally important benefit is import replacement of liquid fuel. Care must be taken so that government realises maximum economic rent from both uses. In this respect, the country does not have too many options but to develop coal for power production. The nuclear option can also be explored, but the cost has gone beyond the capacity of this country. Renewable energy policy now allows the government to embark on large-scale projects with incentives that can play a good supplementary role. There are several barriers to achieve the coveted energy security everyone is talking about. The biggest is the mind-set and the next is the money. A 1,000MW coal-fired power plant requires one billion dollar, a 1,500MW nuclear power plant requires 4 to 6 billion dollars, one tcf of new gas will require a billion dollars for exploration and development. Tk 2.5/kWhr electricity rate is the cheapest in the world because of the heavy subsidy at one dollar gas for electricity production in this country. Coal-based (local or imported), imported gas based (LNG or Myanmar pipeline), Indian or Nepal power -- none will be cheap. The days of cheap power are over. Anything less than Tk 4/kWhr is not commercially viable in today's global energy market. Energy, even gas is not a local product any more. The regional price of gas is anywhere between Tk. 300/Mcf (Reliance India new discovery) to Tk 500/Mcf (Myanmar gas to Thailand and China). Unfortunately, there is no quick solution to the country's present suffering. All mistakes and indecisions have a price to pay.

While major emphasis must be given for long-term energy security, the immediate relief remains in demand management (both gas and power) and production enhancement from existing gas fields. Bapex is incapable of achieving the kind of intervention required to quickly increase gas production at this moment. Third party contracts must be handed over to specialised companies that would require use of advanced technology and large investment. Any dilemma or indecision will aggravate the present crisis even more. All sort of inefficient use of both power and gas must be terminated strong handedly. All pilferage and system loss must be minimised to get by before the mid- and long-term solutions kick in. In the meantime, two imported coal-based 500MW power plants should be set up -- one in Chittagong and the other one in Khulna. A proposal by India to sell 200MW from Tripura must be negotiated immediately. For energy security, fuel and source diversity is absolutely essential. Bapex alone cannot solve the immediate gas exploration requirement of the country. Due to the generous allotment of fund and gas price adjustment by the last caretaker government that approved a seven year self-reliance target, Bapex is fully tied up with all their manpower and equipment for the next three years. Moreover, no country in the world has been successful relying only on national oil companies. The negligence of Bapex for years have been a cardinal offense, but to discard the IOCs in future will be a big mistake. For optimum and reliable supply of energy, both local and international investment is required. The risk and the amount of investment is enormous. All gas exploration embargoes must be lifted. A quick decision in favour of offshore exploration is also warranted. In the meantime, businesses and industries are suffering. There are some short-term solutions for them. Until new gas is discovered or enhanced production is ensured, new or stranded businesses can look into starting production using imported LPG to replace gas. The same equipment can be used for both sources. The merchant power plant policy approved by the last government may play a role in providing reliable electricity to private business. It allows any company to produce and sell power to any bulk customer at any price negotiated between them. Government will neither supply the raw material nor buy the final product. Both these options have one catch. Electricity and gas are going to cost more than the government subsidised supply. For reliability, the business in the country will have to adjust to this higher price of energy. Obviously, the price disparity creates unfair competition, especially for local market. On the other hand, these solutions can be attractive to many export-oriented industries whose energy cost is only 3-8% of their total product cost. For the massive investment done by the private sector in the last decade, it is almost impossible for the state subsidiaries to cater to the need for reliable energy at their present state of commercial or organisational status. Single buyer model for both power and gas must be replaced by a multiple buyer/supplier model. Merchant plants with mutual understanding of all the parties can be a good starting point where relationship between proper price and reliability can be demonstrated. Our business cannot run on subsidised energy any more. There is massive scope of efficiency improvement in both management and technical operation that can be only achieved through gradual adjustment of energy price. M. Tamim is a Professor of BUET. |

started in the early 1900s, the major thrust was given after the discovery of Sui gas field in the then West Pakistan. Commercial use of gas commenced in 1962, with the establishment of Chattak cement factory.

started in the early 1900s, the major thrust was given after the discovery of Sui gas field in the then West Pakistan. Commercial use of gas commenced in 1962, with the establishment of Chattak cement factory.  Apart from uncontrolled and unplanned expansion of gas use, no other decision was taken in the ten years since 1998 to find new gas field despite written warning. The result is the leanest decade of gas discovery in the history of Bangladesh. Only 0.5 tcf Bangura field was discovered from a known structure and after all these talks, Unocal had to sit on their investment for nine years before Bibiyana came into production in March 2007. The indecision also affected Bapex. No attempt was made to activate them either. The prediction of the 2002 Gas Utilisation Committee has come into effect couple of years early due to unexpected and uncontrolled growth of captive power and CNG sector.

Apart from uncontrolled and unplanned expansion of gas use, no other decision was taken in the ten years since 1998 to find new gas field despite written warning. The result is the leanest decade of gas discovery in the history of Bangladesh. Only 0.5 tcf Bangura field was discovered from a known structure and after all these talks, Unocal had to sit on their investment for nine years before Bibiyana came into production in March 2007. The indecision also affected Bapex. No attempt was made to activate them either. The prediction of the 2002 Gas Utilisation Committee has come into effect couple of years early due to unexpected and uncontrolled growth of captive power and CNG sector.  drilling may produce up to 15 tcf additional gas onshore and shallow offshore, based on current data. All these estimations and probabilities are a function of time that is subject to last updated data.

drilling may produce up to 15 tcf additional gas onshore and shallow offshore, based on current data. All these estimations and probabilities are a function of time that is subject to last updated data.