Inside

|

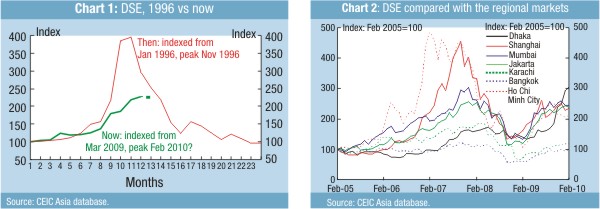

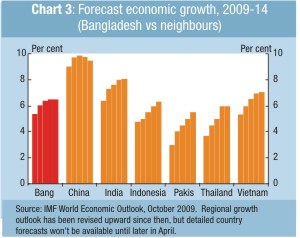

The Share Market Bubble? Jyoti Rahman warns that there might be trouble afoot in our capital markets After bringing uncomfortable memories of 1996 to many minds over the last few months, the bull run in Dhaka Stock Exchange (DSE) seems to be in abeyance, at least for now. At the time of writing, DSE had fallen by about 1 per cent since the end of February. While there have been reports of angry reactions of retail investors expecting sharp price rises, a modest price correction is a preferable outcome than continuing froth in the market eventually ending in a more severe bust. Of course, such a bust is still very much possible. We are by no means out of the woods yet. But with luck, we will have avoided a collapse. Either way, focus should now turn to factors that fuel these episodes, and what, if any, can policy do to avoid them. How does the recent stock market boom compare with that of 1996? Chart 1 explores this. In this chart, the horizontal axis shows number of months since the beginning of the bull run, while the vertical axis shows the DSE indexed to that beginning. Back then, DSE started rising from January 1996. In November 1996 (that is, 11th month of the run), DSE peaked at 395 per cent of its January value. Now, the market is indexed to March 2009, when the global asset markets reached the post global financial crisis trough. Since then, DSE had risen by nearly 125 per cent by February 2010 (that is, the 12th month of the bull run). Chart 2 compares DSE with other regional markets. While DSE's performance was relatively modest compared to those of our neighbours for much of the past half decade, DSE far outpaced other regional markets in the closing months of 2009. Both these charts show that while the recent bull run may have had the hallmark of bubble in its acceleration, the price rises have not been as stratospheric as those witnessed in 1996, or what Ho Chi Minh City experienced in 2006 or Shanghai went through in 2007. There are two reasons why Bangladeshi stocks might be attractive for global investors seeking emerging market bargains. First, with only a small proportion of stocks held by foreigners, Bangladesh remains a hidden opportunity for international investors. And second, Bangladesh weathered the global financial crisis relatively well, with respectable growth expected in the next half decade (Chart 3). Regional growth outlook has been revised upward since then, but detailed country forecasts won't be available until later in April.

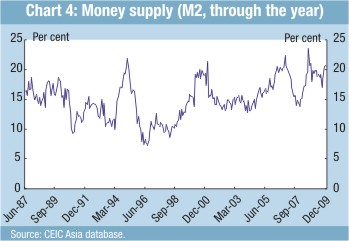

Industry level price-earning ratios can provide further insight. All else equal, a high price-earning ratio means the stock has a high growth potential. But if price-earning ratio rises very quickly in the absence of any new information, then that might point to a bubble. Four industries -- cement, information technology, services and real estate, and textiles -- have seen price-earning ratio sky-rocket during the bull run. There are anecdotes of an emerging housing boom that might be driving the real estate stocks. A housing boom, along with the expectation of an infrastructure boom in the coming period, may be driving the cement stocks. Over the past decade, per capita cement consumption has trebled, further buoying the sector's medium-term outlook. One can argue that various "Digital Bangladesh" initiatives may well have been boosting IT stocks. And textiles may have benefitted from the resilience shown by the export sector. But these positive outlooks notwithstanding, stories of price-earning ratios reaching 70 or Considering various factors, one major market commentary optimistically noted last November: "The relative resilience of the other issues in the marketplace is encouraging and DSE 5,000 from the current level of 4,169 seems a realisable target by mid-2010." DSE crossed 5,500 in February, and was still around then at the time of writing. Returning to 5,000 by middle of the year would require a correction of 9 per cent or so over the next quarter -- a modest adjustment all things considered. If we are lucky, we will avoid a bust this time round. But unless a range of regulatory, monetary, supply-side and socio-cultural issues are addressed, we will soon see another frothing episode. And we may not be lucky next time. Are there regulatory failures here? Have there been insider trading and other such efforts to drive up the market to unrealistic heights? The Security and Exchange Commission is the agency in charge of regulating, and preventing illicit manipulation of, the share market. The SEC has taken steps to calm the market -- for example, conditions for margin loans have been tightened. However, it is vitally important that the SEC is seen as a credible and competent institution. And that credibility has been tarnished recently when this technocratic institution has been used to achieve partisan political ends in the DSE election. While restoring the credibility of the SEC is crucial, there may well be other factors at play here. Mansur and Haque (2009) eloquently point to the excess liquidity that may be fuelling up an asset price bubble: Obviously when there is a lot of liquidity in the system, and money being fungible, there is no way to prevent people from borrowing on one account (for the officially stated purpose of trading, housing, agriculture and other uses) and investing in the stock market. As surging flood water cannot be contained by a putting a small/weak dam downstream and water simply bypasses or overwhelms/washes away the barrier, money keeps pouring into the stock market ignoring the SEC signals lured by quick capital gains. While much has been made of the strong remittance flows during the global recession, it is not clear whether we understand why remittance held up in 2009. Similarly, we may not fully appreciate the unintended consequence of the strong remittance inflows. Strong remittance inflow underpins capital inflow into the country that is putting upward pressure on taka. If the taka is allowed to appreciate, it may hurt the manufacturing sector (exports-oriented or imports-competing) in a classic "Dutch disease" manner. But by pegging taka to the dollar, and thus allowing it to depreciate against the Indian rupee, the Bangladesh Bank may be inadvertently fuelling food price inflation. And the dollar peg at an undervalued rate means the central bank is accumulating foreign reserves. Unless the surplus reserve is "sterilised" by the central bank selling instruments, money supply will rise. Money supply has been rising at an annual rate of around 20 per cent for the past year and a half -- the longest period of that rate of growth in the past quarter century (Chart 4). If there is excess liquidity in the economy, the impact should be visible in the goods market as well as the asset market. Indeed, non-food inflation has jumped to 6.5 per cent in the year to January, compared with a rate of 3.7 per cent six months earlier.

If excess liquidity is the problem, then is a tightening in monetary condition -- through a modest appreciation of taka or more direct measures -- the only solution? Not necessarily, at least as far as the asset market is concerned. The underlying problem in the Bangladeshi asset market might be that there are not enough instruments for people with savings to invest in. Perhaps, instead of borrowing overseas in foreign currency to fund infrastructure projects like the Padma bridge, the government could issue infrastructure bonds. And given high borrowing rates faced by businesses, perhaps the time is right for a corporate bond market in Bangladesh. The lack of instruments to invest in ultimately points to a deeper problem Bangladesh faces: a relatively low invest-to-GDP ratio. Private investment accounts for less than 20 per cent of Bangladesh's GDP. It is difficult to envisage sustained 7-8 per cent economic growth unless investment rises relative to GDP. Rahman and Yusuf (2009) argue that infrastructure bottleneck and regulatory burden are the binding constraints on investment and economic growth in Bangladesh. Until these supply-side constraints are addressed, any rise in savings (such as through a remittance boom) is likely to drive up goods and asset inflation instead of adding to the economy's productive capacity. And finally, there are socio-cultural factors that have caused asset bubbles and financial crises around the world over the past eight centuries. As a bitter investor or one such bubble is alleged to have said: More money has been lost because of four words than at the point of a gun. Those words are: This time is different. Whether it is in tulip during 17th century Holland, American houses a few years ago, or the DSE, such bubbles seldom end well, particularly if the investors run up debts to fund their investment. The data are not available to judge whether the retail investors being hurt by the market correction are highly leveraged or not. And social scientists are only beginning to appreciate the herd mentality that drives these manic episodes that end in panics. Perhaps it is unrealistic to expect our policymakers to grapple with socio-cultural issues that bedevil authorities in advanced capitalist economies. But we can definitely aim for better regulatory, monetary, and supply-side policies. 1. The data used in this piece are as of March 24, 2010. Artwork: LARRY LIMNIDIS Jyoti Rahman is an applied macroeconomist and is a member of Drishtipat Writers' Collective. He can be reached at dpwriters@drishtipat.org.

|

higher suggest nothing but "irrational exuberance."

higher suggest nothing but "irrational exuberance." The problem is compounded by two additional factors. First, the 2009 budget's provision to "recycle black money" released a large amount of cash into the economy that went into the stock market. Second, merchant banks and merchant banking divisions of non-bank financial institutions have become among the most active members of DSE.

The problem is compounded by two additional factors. First, the 2009 budget's provision to "recycle black money" released a large amount of cash into the economy that went into the stock market. Second, merchant banks and merchant banking divisions of non-bank financial institutions have become among the most active members of DSE.