Inside

|

Is the Bull Market Sustainable?

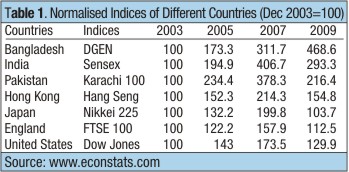

Ahsan Mansur questions whether the stock market is over-valued and what the consequences might be The Dhaka Stock Exchange (DSE) is one of the best performing stock markets in the world in recent years. During the 4-year period since January 2006, the DSE general index has increased by more than four-fold to more than 5,800 in recent weeks. The DSE gained further momentum with the Grameen Phone IPO in November 2009. Along with the price index, the market capitalisation has also increased rapidly, from $3.4 billion in January 2006 to $34.2 billion today. The strong market performance also attracted an increasing number of small investors to the market, with the number of new Beneficiary Owners' (BO) accounts surging to high levels. All these positive developments have opened up the potential for the stock market to become a real alternative to mobilise funds for investment, moving away from the traditional dependence on the banking system. However, while welcoming these developments, we also observe a number of disturbing phenomena, which, if unattended, may seriously undermine the sustainability of this positive trend. Significance of Healthy Stock Market The banking sector, which dominates the financial sector in Bangladesh, has served the economy very well, and its coverage is broadly comparable with other developing countries. However, equity markets which generally serve as the second most important pillar of the financial sector, have significantly lagged behind in Bangladesh. The recent increase in investor interest in the Bangladesh capital market, as reflected in terms of market capitalisation and turnover, has significantly changed this situation; the capital market is gaining its position as a sizable source of investment financing after the banking sector, which is a welcome development.

Market developments and sustainability depend on market fundamentals, and the fundamental strength of the market essentially comes from financial strength of the listed enterprises. Strong regulatory environment created and maintained by the regulatory bodies (like the SEC) and participation of institutional investors and professional market analysts help orderly market operations. The problem comes when market prices overshoot fundamentals in a big way, transactions become speculative, and market becomes unstable in terms of prices, turnover, and volatility. Such developments are not new in Bangladesh; we experienced it in the boom and bust of 1996 (see box). The global landscape is also littered with such boom and bust episodes, the recent ones being: the crash of the US stock markets in 2000 (NASDAQ tumbling from 5,100 to less than 1,600); Japanese stock market crash of 1989 with Nikkei tumbling from 31,000 to less than 10,000; the crash of GCC (Saudi Arabia, UAE, Kuwait, and Qatar in particular) stock markets in 2005; and more recently the crash of Chinese stock markets in 2007. We must keep in mind that a sharp rise in stock prices does not necessarily mean formation of a bubble. Sometimes stock prices may rise sharply across the board when some things change fundamentally in the economy or in the economic outlook, as happened in the case of Spanish and Irish stock markets on the eve of their joining the EU. Several East European (former Soviet Bloc) countries also experienced surges in their stock markets because of their anticipated integration with the EU. Furthermore, no two bubble episodes are exactly the same across countries or across time. Each episode had its own features and unique background.

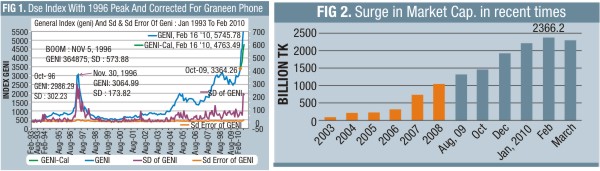

What Worries Us? The common characteristics that are generally associated with a stock market bubble episode are also visible in several ways in Bangladesh today. Some of these characteristics include: exuberant demand manifested through weak correlation between economic values and prices, high price volatility, acceleration in margin lending for stock market investment, narrow market leadership, structural weaknesses like weak, and sometimes inconsistent signals from the regulatory regimes. Existence of exuberant demand has been quite visible during the August-February period, although a bit tempered by some regulatory measures in recent weeks. Record high levels of market turnover and new records of the DSE general index week after week are certainly pointing to market exuberance. Only time can tell whether the exuberant market conditions are/were irrational or not. The DSE index grew by 98 per cent during this period from 2,941 in August 2009 to more than 5,800 in February 2010. Even after correcting for the error in the index, which was made by the DSE at the time Grameen Phone IPO was launched due to its inappropriate/ incorrect reflection on the index at its launching date, the increase was in excess of 4,700 or 60 per cent (Figure 1). It is certainly difficult to rationalise this surge, coming on the back of a steady increase in the index since April 2004, in terms of economic fundamentals.

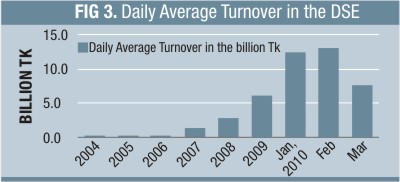

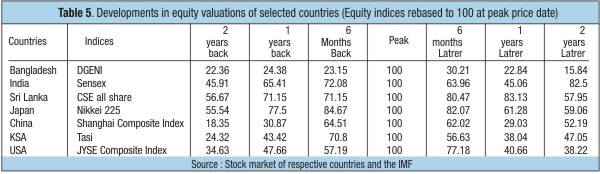

Reflecting the increase in the price index, market capitalisation (total market value) of all companies listed in the DSE increased to Tk 2,366 billion (equivalent to $34.2 billion) at its recent peak in February, compared with Tk. 1,307 billion ($18.9 billion) in August 2009. To put this increase in market capitalisation in proper perspective, DSE market capitalisation was only Tk 97 billion ($1.7 billion) in December 2003, immediately before the beginning of the current bull-run (Figure 2). Stock market activity in terms of turnover, which measures the total amount of sales of all stocks during a day, also recorded a remarkable upward trend. The daily average turnover increased from only Tk. 140 million in December 2003 to Tk. 12 billion in January 2010 and further to Tk 13.2 billion in February (Figure 3): A 100-fold (10,000%) increase in a six-year period! The surge is certainly impressive, but also a matter of concern. The increase in market turnover happened in an environment where supply of stocks, as reflected through the number of listed companies, remained almost unchanged except for the launching of the Grameen Phone IPO in November 2009. The pressures in stock prices and the rapid increase in turnover are obviously coming from the demand side. An army of new retail investors armed with fresh funds, is primarily responsible for this price pressure and market turnover. The number of new Beneficiary Owners' (BO) accounts increased by 115,000 in January from 58,000 in December 2009. In February, the number of new BO accounts increased further by 180,000. To put the increase in proper perspective, during the 1996 episode, the total number of small/retail investors was reported to be 25,000, one-seventh of the additions to BO accounts in the month of February!

New investors have been pouring in huge amounts of money into the stock market through these BO accounts. About 10,000 new investors, bringing on average Tk 100,000 (an assumption) would add Tk 10,000,000 into the market every day when the market is open. Foreign investors on the other hand, are rapidly withdrawing from the capital market in order to realise their capital gains, as happened during the 1996 episode (Table 2). Domestic institutional investors like mutual funds are also reported to be following their foreign counterparts, in some cases holding more than 90 per cent of their assets in cash, waiting for a market correction before coming back to the market. However, the portfolio size of institutional investors in Bangladesh, at well below 2 per cent of the market capitalisation despite impressive gains of recent years, is still very small and thus could not have played the kind of stabilising role that institutional investors like mutual funds could have played (see Table 3). The strong demand from the retail investors, not matched by a corresponding increase in supply of stocks, has caused the price earnings (P/E) ratio to rise beyond rational levels in many cases. The P/E ratio, defined as the ratio of price per share to the annual earnings per share, is a widely used and time-tested indicator to measure share valuation. In simple terms, the P/E ratio can be interpreted as "the number of years of earnings to pay back purchase price," ignoring the time value of money. It is also true that a high P/E ratio may also imply higher growth potential for a company's share, justifying higher investor interest to hold that share in their portfolio. The high P/E ratio for Bangladesh market may accordingly reflect, at least in part, a higher growth potential for the Bangladesh economy. These considerations notwithstanding, P/E ratios of many non-bank DSE listed companies have become overvalued. The weighted average market P/E ratio has risen to almost 30 in recent weeks from 17.5 in August 2009, meaning it will take 30 years on average for an average share to give back (through dividends) its purchase price to the investor. It is widely known that some companies that are not even properly managed are being traded at P/E ratios well above 75! The example of Grameen Phone (GP) is also worth mentioning. The company was listed in the DSE only 5 months ago, and its Tk. 10 shares (face value) are currently trading at Tk. 340 and rising further! The day after GP announced a Tk 6 dividend per share, newspapers and press releases issued loudly announced that as a 60 per cent cash dividend. The next day, GP shares jumped by 8 per cent. In reality, the amount of dividend at current market value (of more than Tk. 340) was less than 2 per cent, but an illusion was created that it was 60 per cent. By announcing a dividend of Tk. 6, GP has de facto got more than Tk. 24 increase in its share price. At P/E ratio of more than 135, is it not insane to invest in the company? I agree that GP is the largest listed company at the DSE, and is a fairly well managed one with significant growth potential. However, its track record of profitability is not that good and more importantly, with the coming of Bharti Airtel in Bangladesh (with Warid), it will be facing much tougher competition in the domestic telecom market in the coming years. Certainly not a good outlook for justifying a P/E ratio of more than 135! What Role can the Policy-Makers Play? These were right moves and the market started to respond to such actions: the DSE index declined from its peak of 5,828.4 on February 17 to a low of 5,338 on March 15; daily market turnover also slowed down from a high of Tk. 13.2 billion in February to Tk. 8 billion in March (Figure 3); and the DSE index became range bound moving within a relatively moderate band of 5,300-5,800. However, as some demonstrators started agitating against the market correction, in a surprise move the SEC eased the margin lending condition by increasing the equity-to-debt limit 1:1.5 on March 15. Yielding to pressures from demonstrating investors definitely sent a wrong signal to the market. The stock price development is also a manifestation of the general inflationary trend visible across the economy. As the economy has been passing through a liquidity overhang in recent months, inflationary pressures are building up all across the economy: general inflation as measured by the consumer price index (CPI) increased to 9 per cent in January from a low of 2.25 per cent in June 2009; real estate prices are all time high; land prices are high across the country; and the surge in the stock price index is the topic of discussion in this paper. With broad money (M2) expanding by more than 20 per cent last fiscal year and once again this year, fueled by inflow of worker remittances, there is enough liquidity to create the general inflationary environment. The budgetary provision to allow whitening of undisclosed money through investment in the stock market and real estate has also contributed to the asset market inflation in Bangladesh. Increased investment by commercial banks, and bank lending for investment in stocks, lured by high return on such investments, have also greatly contributed to the high market valuation and volatility. It is widely reported that a sizable part of the increased bank profitability is attributable to the gains from such investments. Measures should be taken by Bangladesh Bank to minimize the exposure of banks to the stock market in order to safeguard depositors' interest. Increasing supply of stocks would surely help meet the growing market demand for stocks. Recently introduced book building method (BBM) for new IPOs is certainly a positive development and should encourage private corporations to consider floating of IPOs as part of their expansion program, since IPO pricing under the BBM would reflect issuer and investors expectations. This new method would also allow institutional investors to carry out due diligence since they would have to take up shares at prices they bid in the bidding process. High price earnings ratios would certainly be a big incentive for established companies to consider public floating of their shares. While we do not believe that bringing loss-making public entities to the stock market should be the right solution, if the government can bring the profitable enterprises to the market with scope for management change, that would help increase supply of quality stock. Mutual Funds (MFs) can also play an important role in institutionalisation of capital markets of Bangladesh by increasing supply of professionally managed funds, providing liquidity, reducing the scope for market manipulation, and increasing institutional investor market depth. Although the MF sector has gained some momentum in Bangladesh, the size of MF industry in Bangladesh at less than 1 per cent of GDP and less than 2 per cent of market capitalisation is very small. In contrast, the size of the thriving MF industry in India is 12.5 per cent of GDP. Certainly the MF industry has a long way to go from its current state of infancy. The strong interest among the private sector investors and sponsors to launch new MFs, as reflected in the pipeline of about Tk. 40 billion (0.65% of GDP), if allowed to materialise in a phased manner, will be a positive move toward institutionalization of the capital market in Bangladesh. A broader and deeper MF industry should be able to play an important role in price discovery and valuations, and reduce scope for market manipulation. Concluding Observations The investment guru Warren Buffet has rightly characterized stock market frenzy in the following manner in 2000: "The line separating investment and speculation is never bright and clear ... becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money." It is thus imperative on the part of policy-makers to send clear warning signals highlighting the heightened risks in order to protect ordinary investors. Today's stock market is not as immature as it was in 1996. Nevertheless, when we see small investors erecting road blocks and burning tires whenever stock prices come down marginally, we have to believe that this market is being driven by mob frenzy. When the great scientist Sir Isaac Newton lost a bundle with the bursting of the South Sea Bubble, he observed that: "I can calculate the movements of stars, but not the madness of men." If the madness in Bangladesh stock market continues for a few more months, the bubble would become much bigger and it would explode like it did in 1996. We may still have time, but the policy-makers would have to act now and in a concerted manner. The Stock Market Debacle of 1996

A snapshot of the 1996 debacle: The newly-elected government of that time, initially misinterpreted this formation of the stock market bubble as fundamental strength of the economy and a manifestation of people's confidence in the new government. However, policy-makers' enthusiasm was short-lived and was soon replaced by concerns about the demise of the bubble and the impending market crash. When the market index more than doubled in one month to 3,000 in October 1996, efforts were made to stabilise the market, but it was too little and too late. As the bubble burst in November 1996, the DSE general index collapsed to its post-peak lowest level of 957 in April 1997, stabilising at about the same level where it was some 10 months back (see Fig 1). By the end of April 1997, the DSE price index plunged by almost 70 per cent from its peak of November 1996. During this bubble period only few traders and market manipulators who had knowledge and inside information gained, while general investors paid heavily. The bear market that started with the busting of the bubble lasted for seven years, the DSE general index rarely crossing the 1,000-point mark during this period. The market started a recovery from April 2004, when it was somewhat under priced with the average price-earnings ratio at about 10. Foreign investors repatriated massively:

The 1996 bubble was very short-lived: The reasons behind the bubble and the debacle of 1996:

Ahsan H. Mansur is Executive Director, Policy Research Institute.

|

|